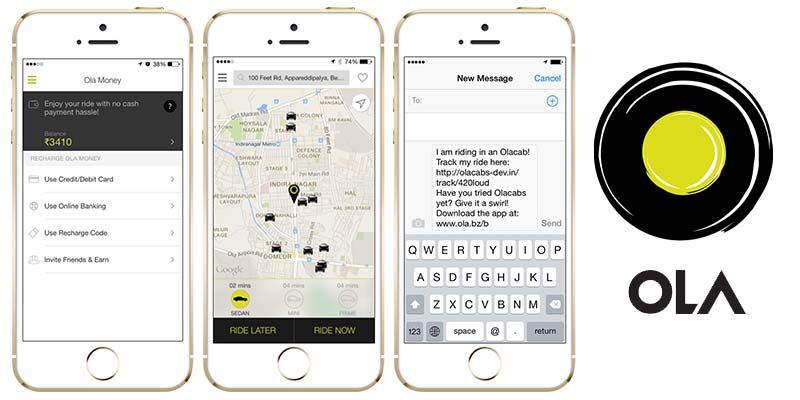

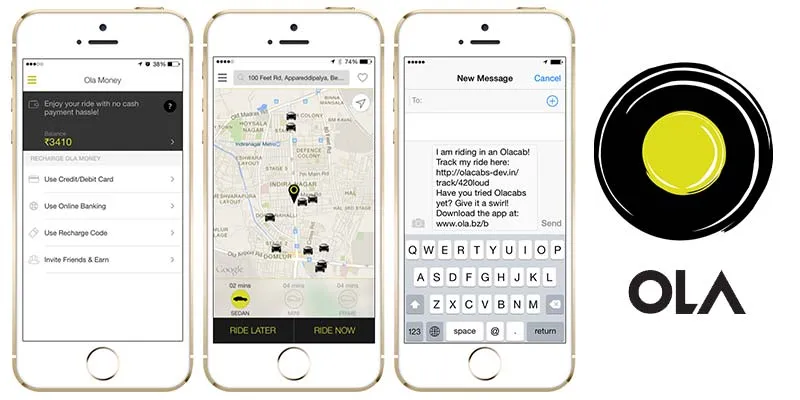

The new entry to the league of mobile wallets in India, Ola app

The latest entity to join the list of mobile wallets in India is Ola. The online cab booking service with 25,000+ cars across 15 cities aims to enable the cashless payments for its users. Paytm, Freecharge, Mobikwik and telecom providers among others have already launched mobile wallets and validated its success in the country. Adding to the convenience in payments for user, a mobile wallet keeps the user away from the hassle of carrying clumsy cards or processing the payments manually.

Ola’s prepaid wallet

Ola, today announced the launch of their in-app wallet feature enabling cash free rides for customers and a seamless payment experience. The wallet will allow customers to recharge their account through a credit / debit card or their online banking account right from the app. The available balance is automatically deducted from the customer’s wallet against the final fare after ride completion and a receipt is e-mailed, making it a fully cashless experience. The wallet will not only allow users to ride cashless, but also help them gift a ride or pre-pay for their loved ones!

How does it help?

To remove the hassle of paying in cash at the end of a ride, the mobile wallet from Ola enables users to recharge their account for a sum anywhere between Rs. 100 to Rs. 5000. The wallet completes the ‘entirely digital’ experience that Ola aims to provide - right from booking to tracking and now, cashless payments! Over 70% of Ola’s bookings come through the app today.

What’s there for early adopters?

In a bid to encourage more users to use the wallet, the company will double the amount of money added to the wallet by users. For e.g. if a user recharges their Ola wallet for Rs. 5000, he will get an equal cash-back of Rs. 5000 from Ola, taking the overall credit to Rs. 10000. The offer is valid on a user’s first recharge until October 31, 2014, for any amount between Rs. 300 and Rs. 5000. While the wallet is a huge step towards cashless payments, the company will continue to respect cash transactions as well.

Harsha Kumar, Head of Products at Ola commented,

"We are very excited about the possibilities that our mobile wallet offers and firmly believe that our customers will love this cash-free experience.”

Ola app makeover

Along with the wallet, the app also adds a number of other new features and has a new design and interface:

- Online payment via Ola wallet

- Security features - Know your driver, share ride details: The app enables customers to share their location with their loved ones while they are travelling in an Ola simply by forwarding an SMS with a unique link that will track the cab on a map in real-time as well as display details of the driver and the cab.

- Upfront details of ETA and rate card, ride time and fare estimator: The new update allows customers a single view of ETAs across categories. It also allows customers to compare fares by category as well as ask for a ride time and fare estimate by category viz. Mini, Sedan or Prime. This reduces the time to book a cab as well.

- Easy booking features – airport booking, enhanced search and favorites: Ola has enabled an option for customers to directly book cabs to the airport, something that was missing in previous versions due to differential pricing for airport travel. Apart from this, the app also offers a list of top pickup points for customers to select from quickly to book a cab, as well as mark their favorite places accurately for future pickups.

What's your take on the evolution of mobile wallets in India?