Can Make in India inspire Indian entrepreneurs?

Vishal Krishna

Monday February 22, 2016 , 8 min Read

India has always had a rich history of manufacturing. Why, then, is the country beating the drum for a campaign launched in 2015 called Make in India? This has to be put in context of the 300 million jobs that the country has to create by 2030. Not everything can be left to startups and the IT industry.

They can, at best, absorb only 10 per cent of the total jobs. With mass migration from the rural side into Indian cities becoming a reality, the government knows that India needs several small manufacturing businesses to change the fortunes of the country.

Miles to go before we sleep

“The Make-in-India policy is a great initiative by the government. Especially in terms of getting company registrations, tax benefits and other factors. But we still need to see how this will convert into on-ground realities, and that’s where the power lies,” says Aditya Agarwal, Founder and CEO, ICE X Mobiles.

While there has been several initiatives and talks, there isn’t any clear documentation into what the policies will be or how they will help smaller businesses. Speaking in the same vein, Vibhav Joshi, Founder, Sattva Medtech, adds that there is uncertainty on how much benefits the startups in the manufacturing space can actually see.

Tarun Mehta, Founder, Ather Energy, says that there has been a positive shift towards Make in India in the past year and it is a good start. But we have a long way to go.

“The GST bill can make things a lot easier and smoother for the entire Make-in-India initiative. There are many stages and steps that you need to go through in terms of compliances, permissions, and complicated labour laws, and all of the paperwork needs to be reduced,” adds Tarun.

Citing an example, Tarun adds that it took them six to eight months to set up their manufacturing space. He adds that the time taken was for getting the licences and other permissions in place.

V Sumantran, advisor to Carlos Ghosn, Chairman of the $146-billion Renault-Nissan Alliance, takes a dig at why manufacturing in India is falling behind. “Businesses need to automate and make their factories smarter. But the process is slow because governments think this will result in job losses, which is untrue,” he says.

He warns that manufacturing has to be made aspirational or face the risk of managing a young and unemployed population.

Really making in India

Close to $63.4 billion of the import cost of the country is on electronics, machines, engines and pumps. To reduce this cost on the exchequer the government has asked many global companies to begin manufacturing in India. Its largest thrust area is health care and defence equipment.

More importantly the domestic market and consumers should appreciate goods manufactured locally. But Indian companies can never compete with cheap imports.

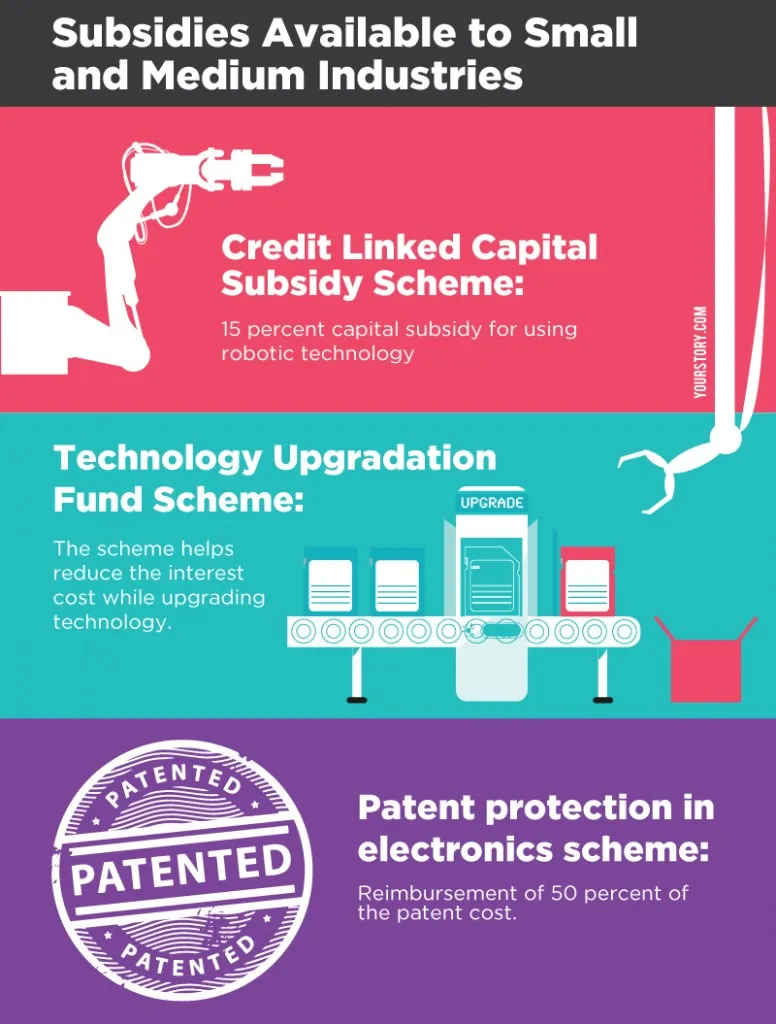

Even with several subsidies available, the Tier III and IV suppliers, entrepreneurs are yet to risk modern technology because they do not have the market access to scale up. It’s a price war that dominates the difference between one small business and the other. “If you look at the electronics segment, we have a lot of ground to catch up both in terms of technology and manufacturing setups,” adds Abhishek Latte, Founder, SenseGiz.

Will the focus shift to startups in the manufacturing setup?

Tarun adds that for the initial stage there will be push from the larger manufacturing brands, who will be benefiting from the Make-in-India initiative. “But they will need an ecosystem of suppliers around them,” he adds. Taking an example of the vehicle segment, Tarun says that they possibly need a base of close to 400 suppliers around them.

Currently the biggest problem that most manufacturing companies face is that none of the components are produced and manufactured in India. “In that sort of environment, Make-in-India becomes a moot point, because you can only assemble in India, especially if none of the main components are made here. Like in the case of mobile phones,” adds Tarun.

However, he adds that if the Make-in-India initiative is consistently built upon, the supplier base around the manufacturing setups too will grow. Abhishek believes that there needs to be a push from the government to support startups in the space. He adds that the larger companies today are driving the initiative. “With time, the local Indian companies like us too need to enter the fray, and there needs to be a clear path defined for that,” adds Abhishek.

While there have been MoUs signed by Xiaomi, One Plus, Foxconn (which promised to pump in $5 billion soon), Airbus and Boeing to manufacture and source in India, many are waiting to see if these will be large-scale factories that create a network of ancillary industries.

The airline industry has seen a fillip in local sourcing. Dynamatic Technologies, a Bengaluru-based component manufacturer for Airbus, has qualified as a Tier-I supplier for flap track beams, which is a wing component. “This is Make in India, because Airbus invested in getting us on track to become a global manufacturer,” says Udayant Malhotra, MD, Dynamatic Technologies.

For startups in the space, there are several nuances that go in, whether it is land permits, or compliance work like customs and land permits. “All of this takes up most of the time and energy, and if you’re a startup, the process is more time-consuming,” adds Aditya.

Also, we are yet to figure out how technology in the form of robotics and Computer Numerical Control (CNC) machines will be made available to entrepreneurs on a large scale. They cannot risk buying them because the return on investment (ROI) on these machines can happen only if they are recognised as an integral part the core supplier group of the Original Equipment Manufacturer (OEM).

“We need to have a clear picture on how we can work with accelerators or other companies to help build a strong manufacturing setup,” adds Vibhav of Sattva Medtech. There is talk on funding and setting up of accelerators, and evaluations will be made. However, Vibhav says that it isn’t clear on what basis and factors the evaluation will be made and who are the people who will be evaluating the setups?

“Soon, even e-commerce companies can source from factories, especially from apparel manufacturers and small tools manufacturers. GST can open up the market for such small businesses,” says Satish Meena, forecast analyst at Forrester Research.

Will Make in India solve the problem arising from rural to urban migration?

A McKinsey Global Institute report titled 'Urban Awakening' said that 590 million people will be living in Indian cities by 2030. India has 67 urban centres, with more than one million people. By 2030, these cities will be burdened with 10 times the population and people will be looking for jobs .

In the context of these developments manufacturing in the form of Make in India is extremely important. It is a call for the birth of new manufacturing heroes. It is to enable young blood to invest in manufacturing and supply to large-scale industries.

Will Make in India make young graduates aspire to work in manufacturing?

Make in India will struggle if employment in factories is not turned into an aspiration for the migrating and unskilled population. “You cannot blame low salaries alone because the revenues and the skill in small-scale business remain very low today,” says Mohandas Pai, MD of Aarin Capital.

He says that this is where there startups can play a vital role in re-skilling the population. Perhaps startups should take a dig at revamping the struggling Industrial Training Institutes (ITIs) across the country. At present, there are 12,000 ITIs across the country and they need to change their curriculum to provide 100 million jobs. Only 11 per cent of the total workforce of the 470 million is absorbed by manufacturing.

Manufacturing has stalled at 15 per cent of the GDP for the last five years. This is because of the slowing pace of investments from large firms. According to the International Labour Organisation only two per cent of India’s population is skilled.

The consensus

The National Skill Development Corporation says we need to up the total share of manufacturing jobs to 20 per cent of the total jobs by 2025. That would mean at least 60 million manufacturing jobs need to be generated by then. It’s a tough task at hand.

For Make in India to happen the small and medium manufacturing sector needs to be reinvigorated or even revamped. It cannot continue with the same set of industrial laws that were framed from lessons of the socialistic world.

Let the manufacturing industry be treated like the IT industry and we will succeed in creating the largest middle class in the world. That’s when Indian can be really called a successful democracy.

“There are several initiatives of the medtech manufacturing bases, especially in Telengana. However, we are yet to figure out a way to work with the bigger manufacturing bases,” adds Vibhav.