Indian Angel Network platform to invest Rs 1,500cr with its new fund over 4 years

The fund will support all the IAN deals as well as independently co-invest with other VCs. Together, IAN and the IAN Fund (plus co-investors), will invest approximately Rs 1,500 crore in around 160 companies over the next four years.

In the good news of the day, the Indian Angel Network (IAN) today announced a new global fund worth Rs 350 crore. The first close of Rs 175 crore, raised primarily from the domestic market, has industry stalwarts like Kris Gopalakrishnan, Co-founder, ex-CEO, Infosys, Sunil Munjal, Joint Managing Director, HERO Corp, and Dr Devi Shetty, Founder and Chairman, Narayan Hrudalaya, as part of its advisory committee.

The IAN said it was sector-agnostic, but the SEBI-registered early-stage venture fund will take a special interest to bolster early-stage startups in the healthcare and medical devices, SaaS, marketplaces, fintech, big data, AI, and hardware, supporting entrepreneurs with funds in the range of Rs 50 lakh to Rs 30 crore, co-investing with other VCs.

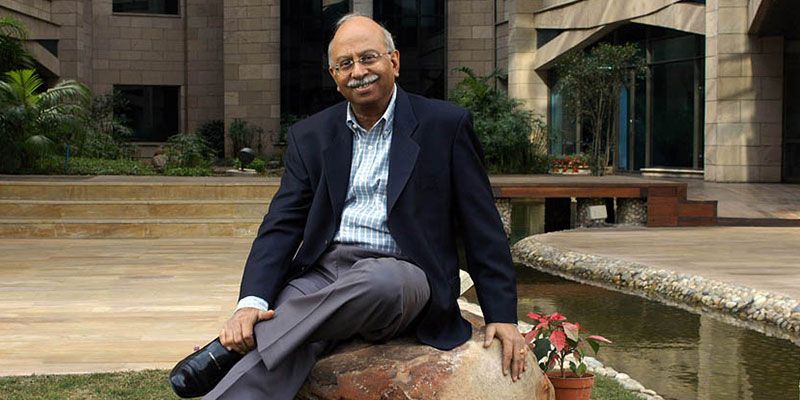

Speaking exclusively to YourStory, Saurabh Srivastava, Chairman and Co-founder of IAN, said, “With this fund, the aim at IAN is to create the country’s largest horizontal platform for early-stage investments. Our goal is to distribute the money as efficiently as possible to get innovators through the most challenging early stages of funding. I am confident that the fund will have a significant role in creating high-growth companies in our country.”

The fund will support all the IAN deals as well as independently co-invest with other VCs. Together, IAN and the IAN Fund (plus co-investors), will invest approximately Rs 1,500 crore in 160 odd companies over the next four years.

So, for example, if Rs 3-4 crore is raised by the startup in the first round, the fund will put in 20 percent, say Rs 70 lakh-80 lakh. In the second round, of say Rs 30 crore, the fund will put half of it, the other half being a VC fund. Thus, in the next 4-5 years, IAN will be doing Rs 600-plus crore of investment, the fund will be doing another Rs 400 crore to Rs 500 crore, and bringing an equivalent co-investment amount.

“Actually, in a 10-year period, the IAN platform will enable almost Rs 4,000 crore of money going into angel and early-stage startups,” says Srivastava, adding, “so, when you say good news, it is actually a very good news for the Indian startup space.”

In a conference call that included Srivastava along with Padmaja Ruparel, Co-founder & President at IAN, Ajai Chowdhry, Co-founder, HCL, Raman Roy, Chairman Nasscom, Founder QUATTRO, & Co-founder IAN, and Rakesh Rewari, ex-DMD, SIDBI, all the members were unanimous that the new fund will provide the much-needed runway for companies that are transitioning from early stage to reach their potential, thus plugging a huge gap.

The investment committee of the new fund includes the above members plus Harish Mehta, Founder, Onward Group, Co-founder, NASSCOM, Alok Mittal, ex-Canaan MD and entrepreneur, Co-founder IAN, and Rakesh Malhotra, entrepreneur, Founder, Luminous.

“At IAN, our next step is to create a conducive environment where companies have a potential to grow and do not face high mortality that is faced by companies post an angel round but pre the first round of financing,”

Raman Roy tells me: “That is a huge gap. If you study other economies where there is a robust ecosystem like in Israel or Singapore, as far as angel funding goes, there’s a lot of grants given by the government but beyond that getting a Series A or a Pre-Series A becomes a challenge. We are very excited to take up this challenge and plug this gap,” he adds.

IAN drives more than 40 percent IRR (Internal Rate of Return) on all the investments per year. Its around 450 members are senior corporate leaders and entrepreneurs, who have been there, done that, bringing in the much-needed mentoring and expertise that early-stage ventures need, besides money.

“At IAN, we have had a fortunate situation. Year-on-year, we have had exits in our companies and our investors have been able to get cash exits over the last three years continuously. So we have bucked the trend. This year, we are already at the third cash exit transaction for our investors. Thus, we are able to attract investors and negotiate well,” says Roy.

According to IAN, angel investments are on the rise, with a 20 percent increase in the number of active investors this year. Investors from China and APAC are also watching Indian startups keenly.

In 2016, Indian startups saw $4 billion in risk capital being deployed across 1,040 angel and VC/PE deals. According to YourStory Research, the disclosed funding announcements have shown a decreased value of 55 percent from the same period last year (2015) and a decrease of 20 percent from 2014. About $9 billion in VC/PE capital had been invested in 2015.

The number of deals in 2016, however, has increased by three percent over last year. On an average, four startup deals were announced every weekday throughout 2016. "After all, the year wasn’t only about the gloom and doom; funding hasn’t dried up, it just waned after last year’s exuberance," said the report.

A lot of exits for IAN comes from its vast network of members both within and outside India. Pointing out that the trajectory of IAN reflects that of the Indian startup space, Ruparel says that when they started out eight years ago, getting a deal funded would be very tough because the number of angel investors was few. “If we wanted a Rs 2-crore deal done, we would only have around 5-8 investors, so the size of the cheque was quite high for an individual investor,” she says.

“The number of deals we did were just two initially in the first year. Today, we are doing 40 deals a year.”

Interestingly, just to show how far the Indian startup ecosystem has come, Ruparel recalls an incident from eight years ago. “I was talking to a pretty well-known HNI and he said to me, ‘Tumhara investing toh samajh mein aa gaya ki return milega, lekin yeh religious part kya hai, tumhara angel ka.’” He may have mistaken angel to have a religious connotation, but if you ponder over it, starting up is slowly become the faith of many in India. A faith that the likes of IAN are glad to propagate.