Why Nykaa’s IPO is a watershed moment for women entrepreneurs in India

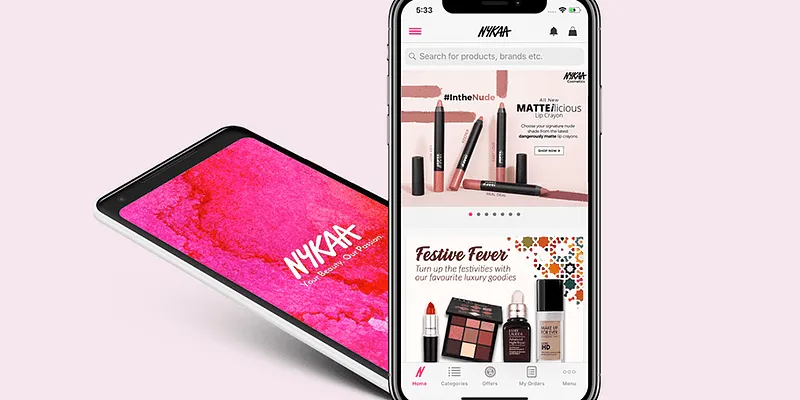

As omnichannel beauty retailer Nykaa heads for an IPO, Founder Falguni Nayar is raising the bar for women entrepreneurs and showing that women-led businesses are venture-fundable, profitable, and can create value.

The upcoming Nykaa IPO has put the spotlight firmly on Falguni Nayyar, who launched the online beauty startup in 2012. Today, as the omnichannel beauty retailer eyes the public markets, the banker-turned-entrepreneur is making history and raising the bar for women entrepreneurs.

Much like Anjali Sud, CEO of video solutions startup Vimeo, posing with her son before taking the company public or Bumble CEO Whitney Wolfe Herd (the youngest woman to take a company public) holding her son while ringing the NASDAQ opening bell did in 2020 and 2021, respectively.

But there’s more to the Nykaa IPO.

It certainly isn’t the first startup to go public this year. Zomato had a stellar opening in the market and several others, including insurance-tech platform PolicyBazaar and fintech major Paytm, are in the IPO line.

The Nykaa IPO will be ground-breaking for multiple reasons:

- It is the first woman-led startup heading for an IPO

- It is one of the few Indian women-founded startups to touch unicorn status

- It is one of the first profitable startups to be listed in the public markets

Also, it will be one of the few startups where the founder is expected to have much stronger control over the company compared to founders of other startups such as Paytm, PolicyBazaar, and Zomato. Falguni and her family own over 53 percent stake in Nykaa parent FSN E-commerce Ventures.

The IPO push

The Nykaa IPO bodes extremely well for India’s startup ecosystem – especially women entrepreneurs. It will draw more investor attention to women-led startups and attract many more women to tech entrepreneurship.

Funding for women-led businesses and startups has been comprehensively lower than that for men-led startups. According to YourStory Research data, women-led startups raised over five percent of the total funding, between 2018 and 2020.

“There is no doubt that the number of women-led startups that raise funding is limited and significantly lesser, but steps are being taken to change that. We, as a fund, have invested in a few women-led startups,” said Deepak Gupta, Founding Partner, WEH Ventures.

An IPO creates exits for investors, which in turn translates into more funds entering the startup ecosystem.

The reason the Nykaa IPO is of significant importance to women entrepreneurs is because it clears the path to an exit, which investors can get from a woman-led company.

When a woman-led startup heads towards an IPO, it opens up opportunities for more women founders to raise funds.

“Falguni’s journey is an inspiration to all women-led startups. Especially those in the business of beauty. The way she has built the business gives us all a sense of drive and purpose. It shows that women-led businesses are venture-fundable, profitable, and create value,” said Vineeta Singh, Co-founder and CEO, Sugar Cosmetics.

Falguni Nayar, Founder, Nykaa

Anup Jain, Managing Partner, Orios Ventures, agreed that Nykaa's IPO will be “an inspiration for women entrepreneur-led startups”.

“India has a rich history of corporate honchos who have led large MNCs in India and the world, and created many entrepreneurial success stories. This adds to the list. For investors, it is about their mandates in terms of sectors, stages, and looking for the best entrepreneurs. There is no bias or special focus basis on gender,” he said.

Margin for zero error

When Falguni founded Nykaa, the segment was new and beauty commerce or D2C weren’t as popular as they are today. In fact, the startup broke the myth that ecommerce and beauty retail do not work in India.

As a stock broker and investment banker, Falguni had come in contact with many people and businesses. She had been able to size up the market, translate business plans and projections, and understand the financial projections of a project. She had even done a lot of IPOs for businesses.

But taking your own business to an IPO is no mean feat.

“It requires skill, courage, grit, and determination, and so much more. When you’re a woman founder, there is no margin for error. The stakes are higher, you need to prove yourself every time with every move to get people to take you seriously,” said Sonya Hooja, Co-Founder, Imarticus Learning.

Like most entrepreneurs, Falguni was drawn into starting up on her own by the drive and passion she saw in the eyes of founders. In the nineties, entrepreneurs like Ronnie Screwvala would unveil grand plans of building a studio like Disney in India. Falguni would note the disbelief that usually greeted such plans.

In an earlier conversation with YourStory, she said: “I felt that there is a lot of early-stage value creation by entrepreneurs, and yet, there are several naysayers. It was the entrepreneur’s drive and belief that intrigued me, and it was something that I wanted for myself.”

Making the choice

Falguni had looked at many options, including a homestay, branding content, and more, before she zeroed in on beauty ecommerce. It was a space that Falguni felt she could experience the same zeal.

Cognisant of the space and its scope, she knew that there was “a positive future in India”, especially when she thought about how big the beauty space was in the US, Japan, and other countries.

The entrepreneur decided to start in an industry that “Tata and Ambani were not focused on”. “”They have deep pockets and I did not want to fight them. I wanted to ensure that I made a space for myself. I did believe in ecommerce, technology, and the power of being able to supply beauty all over India from a centralised location,” she said.

Cut to the present, when Nykaa has filed papers with SEBI to raise funds via an IPO that will comprise a fresh issue of shares of up to Rs 525 crore and an offer for sale of up to 4.3 crore shares by existing shareholders.

“Falguni has been able to build a strong and sustainable business, and that is a push towards one direction. The more women that are there pushing the bar, the more women get the ball rolling,” Vineeta said.

Liquidity, visibility, and scrutiny

Ankur Bansal, Co-Founder and Director BlackSoil, said Nykaa’s journey is very encouraging.

“The representation of women in leadership positions has been steadily rising. Falguni Nayar is one of the few women in India leading a tech startup. She has made Nykaa synonymous with online beauty in years and serves as an inspiration to all women entrepreneurs out there.

"It is widely known that women face extra scrutiny while raising funds. There are also multiple social and cultural biases that make the journey of a women entrepreneur difficult. We may be far from getting rid of these unconscious gender biases, but the Nykaa IPO signifies a huge step in the right direction,” he said.

Going down the IPO path isn’t easy; various regulator-defined steps lead to it. What is important is that as a startup gets listed, the focus moves from top-line to unit level profitability and delivering returns to investors without compromising on growth.

“Going public increases liquidity and visibility for a company, but it also brings in great deal of public and regulatory scrutiny. A startup needs to have the right systems and processes in place to handle the same,” Anup added.

Deepak said how startups fare in public markets will be decided only in the next year or so.

The fact that Nykaa is already profitable will stand it in good stead. In fact, just before the pandemic hit India, the beauty retailer claimed profitability for FY19 in December 2019. It reported a net profit of Rs 62 crore in FY21, as against a loss of Rs 16 crore in FY20.

This was accompanied by significant growth.

Nykaa attained unicorn status after raising funding of Rs 66.64 crore from existing investor Steadview Capital at a valuation of $1.2 billion. It focused on increasing its retail presence and the number of categories. It acquired D2C jewellery brand Pipa Bella in April 2021 and continued expansion in the offline segment.

It also launched NykaaNetwork, an interactive beauty forum where subscribers could chat with each other, and NykaaDesignStudio for apparel in designer and premium brands like Ritu Kumar and Masaba in 2018.

The beauty startup also launched NykaaMan, an ecommerce platform for men’s personal care products in hair care, skincare, wellness, and sports nutrition, among others.

Amid the lockdown, it started delivering essentials to over 14,000 pin codes across the country.

A step in the right direction

Ankur said a profitable unicorn like Nykaa hitting the road for an IPO definitely bolsters the Indian startup ecosystem.

“Given that Nykaa has been able to create value while being profitable, we can expect good traction from traditional investors who have been wary of loss-making companies going for IPO. For B2C businesses, Nykaa will serve as a benchmark on how going public can increase brand visibility and traction. Mature startups having successful IPOs will pave the way for early-stage ones being able to attract funding from multiple sets of investors,” he said.

Nykaa’s IPO is also a huge inspiration for women entrepreneurs. Vineeta said businesses that few understand will now be looked at closely.

She said, “There are lesser women in the investor side as well, so many decisions are made without understanding the woman consumer fully. It’s tough to explain to a man why there is a need for a certain kind of stay value in a makeup or a lipstick.”

And as Falguni said: “As a woman entrepreneur, I believe in Sheryl Sandberg’s statement that women actually want to lean in, as they are constrained by themselves. We do not want to go for it. I tell women to learn to dream – and then you will get where you want to get. There was no glass ceiling for me.”

Edited by Teja Lele

![[Startup Bharat] Y Combinator-backed BeWell Digital is enabling the digital transformation of radiologists](https://images.yourstory.com/cs/2/40d66ae0f37111eb854989d40ab39087/ImagesFrames31-1648033042143.png)