M&A activity up by 76% during Q1 2010: Venture Intelligence study

Wednesday April 07, 2010 , 2 min Read

During the first quarter of 2010, Indian companies were involved in a total of 134 M&A deals, a 76% increase when compared to the same period in 2009, according to a study by Venture Intelligence (http://www.ventureintelligence.in), a research service focused on private equity and M&A transaction activity in India. The deal activity remained largely on the same levels as Q4 ’09 (132 deals).

The median deal value during Q1 ’10 (for the 72 deals which had announced transaction values) was $25 million, higher than the median deal value of $10 million in Q1 ’09 and $21 million in Q4 ’10, the Venture Intelligence study found. In the largest deal during the period, listed telecom services provider Bharti Airtel Ltd. acquired Zain Africa, the African arm of Kuwaiti telecom group Zain, for $10.7 billion. This was followed by NMDC acquiring Ferrous Resources' Brazilian operations for $2.5 billion.

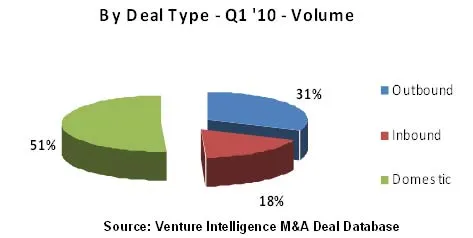

Over 50% of the deals in Q1 ’10 were outbound acquisitions, as against only 25% in Q1 ’09.

The most preferred destination for Indian acquirers was UK with ten of the 42 outbound targets in Q1 ’10 located in that country, followed by the USA (with 9 deals). The acquirers in seven of the 24 inbound deals were US-based companies, followed by French firms with five deals and Japanese firms with three deals.The IT & ITES and Manufacturing industries accounted for most number of acquisitions during Q1 ‘10 with a 19% and 18% share respectively. The activity in the IT & ITES industry remained largely on the same levels as Q1 ’09 while the share of manufacturing deals fell marginally (from 20%).

Top M&A Deals of H1 – 2009

About Venture Intelligence

Venture Intelligence, a division of Chennai-based TSJ Media Pvt. Ltd., is the leading source of information on private equity and M&A transactions in India. For more information, please visit http://www.ventureintelligence.in