BSE's CEO and MD, Ashish Chauhan on the Market, Startups, Leadership and Cricket

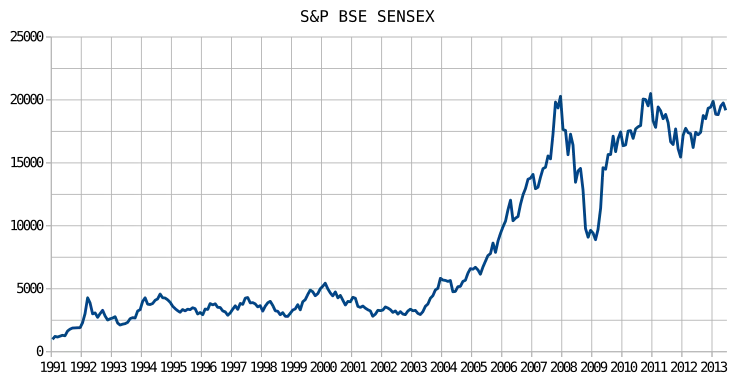

Dalal Street in Mumbai is home to the oldest stock exchange in the Asia. The Bombay Stock Exchange (BSE) was founded in 1875 and is one of the oldest stock exchanges in the world. However, it wasn't till the early 2000s that the BSE began to see its golden days. The below graph would give you a rough idea about the change that the BSE went through post 2000 -

Now a lot of the work that led to this growth was done post liberalization. Yesterday, we had the opportunity to speak with one of the people, who put in a lot of work that resulted in this growth. Ashish Chauhan was a part of the founding team that set up the National Stock Exchange. He also enjoyed a long stint with Reliance Industries, where he was instrumental in the growth of Reliance Telecommunications. He played many roles in the company, including managing the Mumbai Indians.

Now he is back at the BSE, as it's MD and CEO. Over a half an hour conversation with Ashish, we discussed a wide variety of topics, ranging from the way BSE has grown, the scope for startups with the recent launch of BSE SME, to tips on leadership from working with Dhirubhai Ambani and Sachin Tendulkar.

Read on as we engage with one of the country's most influential business leaders -

YS: How have you seen the BSE change since your first stint and now?

Ashish: The BSE is the oldest stock exchange in India; It started in 1875. It has grown phenomenally since then. Today we have a market cap of close to $1.3 billion. Today individuals can invest in stock, because we've made it accessible to the whole country with technology. However, this technology is fairly new. Before 1994, India had close to 20 different exchanges and all of them were floor based. It has it's own advantages. The dealers knew each other personally. However, a new India needed a new framework; we needed to bring in automation. So we set up a central stock exchange, the National Stock Exchange (NSE) in 1994 and the BSE was automated in 1995. Post the automation, the floors were converted to convention halls. The BSE has been automatic for the past 18 years now and this has significantly impacted its growth. Today currencies and interest rates trade in the BSE. To put things in perspective, on a good day today, we do about 3 to 4 lakh crore of trade; a good day back in 1994 would be about 200 - 300 crores. A lot of things have changed. Brokerages have come down, there have been regulatory reforms and now the entire nation can participate in trading on the BSE. Furthermore, the Indian market has become very safe and secure to transact in.

YS: What are some trends that you're noticing today in the stock market with respect to industries? How has this changed over time?

Ashish: 20 years ago, the stock markets were driven by industrial enterprises, as not many agricultural companies were listed. 20 years on, the IT industries contribute to a significant amount of trade on the stock market. Banks are another sector that a growing. But because of IT, we believe that new wealth will be created with newer technologies. But remember, the BSE will reflect the aspirations of the country.

YS: How has entrepreneurship affected the BSE?

Ashish: Tremendously. See, entrepreneurship was not so prevalent in the previous decade. But with people like Narayan Murthy coming into a totally unexplored industry, then, and making it big, made a lot of people sit up and take notice. Furthermore, with folks like Aziz Premji and the TATAs entering IT, which they were not usually associated with, made people realize opportunities that existed beyond the regular businesses. In the coming years, I believe that companies in healthcare, clean tech and other unconventional business will use market capital. Entrepreneurship is very prevalent now. Even recently, applied IT companies like JustDial, have shown that they can raise public money. With the newer technologies and newer business models coming into the foray, the BSE will serve as an ideal platform for them.

YS: What according to you are the challenges for companies to get listed today?

Ashish: The public platform will continue to be the medium which can raise the most amount of capital. Because there was a barrier to entry because of cost and other factors, we recently launched the BSE SME. Capital required for a new company to get listed is as less as 3 Cr INR and for an older company with about 2 years of profit can get listed for as less as 1 Cr INR. Furthermore, when the company is ready, it will automatically graduate to the BSE and it wouldn't need to go for a separate IPO. Getting listed comes with a lot of benefits. You will find newer partners and it will create wealth for you. As of now, we have listed 25 companies with another 12 in the pipeline. We're seeing great traction and it's very encouraging. We urge more companies to make use of the BSE SME.

YS: You've led many organizations successfully. What was your evolution as a leader like?

Ashish: If you work with great leaders, you also learn from them. It was a lot of learning at the feet of masters for me. I learned under the leaders like Suresh Nadkarni, IDBI Chairman in 1991, Dr R H Patil, first MD of NSE, Ravi Narain, second MD of NSE, Dhirubhai Ambani, Mukesh Ambani, Manoj Modi and several other notable leaders; I've been blessed with the opportunity to work with great leaders. You learn how decisions are made in tough situations, you learn how strategies are conducted; of course, there are your own experiences that count as well. The exposure that I got in IIM was very good for me. There is no magic bullet for instant leadership! You need to evolve every day and be humble enough to learn from all sources possible.

Also, it is very important to learn to work in teams. A team accepts a leader only if the leader brings value to it; most leaders have to earn their leadership. My bosses worked very hard and that's what we worked towards. Becoming a leader is one thing, but staying there is much harder. It is a lot of pressure and responsibility.

YS: What do you do other than work? At your level, can you have a personal side to life?

Ashish: My work has been my life. It has been so for the past many years. One thing that I learnt very early on is to do whatever is given to you wholeheartedly. Also, I've done a diverse set of jobs. I've been a part of a satellite launch, I've helped set up NIFTY, I've even managed a cricket team. This variety really keeps me going and when you enjoy what you do, work stops being work. I'm very passionate about my work.

Of course, I do have my personal life. I read a lot of books, I play (at least I used to) cricket pretty regularly and I have my friends circle whom I cherish meeting up with. But honestly, when you love your work, everything else falls into place.

YS: What were some of your key learnings from an offbeat job like managing the Mumbai Indians?

Ashish: You know, I always tell my children; learning to lose, is learning to live. And the only place you can give you 100% and still lose in an early age is sport. Sometimes, the other person is just better than you. Also, watching a 12th man have the same enthusiasm and vigor of someone on the field is an endearing sight. You need to have that child like enthusiasm about what you do. The day you stop having it, life becomes boring.

Also, seeing the game's greats like Sachin and Jayasuriya is a learning experience in itself. These guys are younger than me, but to watch them put aside their fame and fortune and wholeheartedly focus on just the game, is something we should all strive to work towards. Committing yourself to this moment is something that I've seen these guys do, and it has been a tremendous learning experience for me.

YS: You said that you're a voracious reader. What are some books you like and recommend?

Ashish: Reading is something that I've loved to do since a very young age. I studied in Gujarati medium till 12th class, and I used to read of lot of local books back then. When I learnt English, reading was the first habit that I picked up. I started with fiction and humor books like PG Wodehouse, but of course, now I read a lot more non fiction stuff. I love Nassim Nicholas Taleb's work with the Black Swan and Antifragile. I loved reading Against the Gods: A remarkable story of risk, by Peter L. Bernstein. Also, I think books like Future Shock and others by Alvin Toffler are phenomenal. Like I said, I read a lot.

YS: What are your goals for BSE today?

Ashish: I think boiling it down to one goal would be too simplistic. But the vision that we work towards is to bring back the BSE to it's preeminent days. Now that vision has many sub goals - we need to bring the best people on board. We need to stay abreast with developments in technology. We need to keep the operations of the BSE absolutely transparent. Once we're all clear about our roles and how it contributes to the overall vision, all we have to do is to put our heads down and work.

Stay tuned to YourStory for more interviews from the Industry leaders.