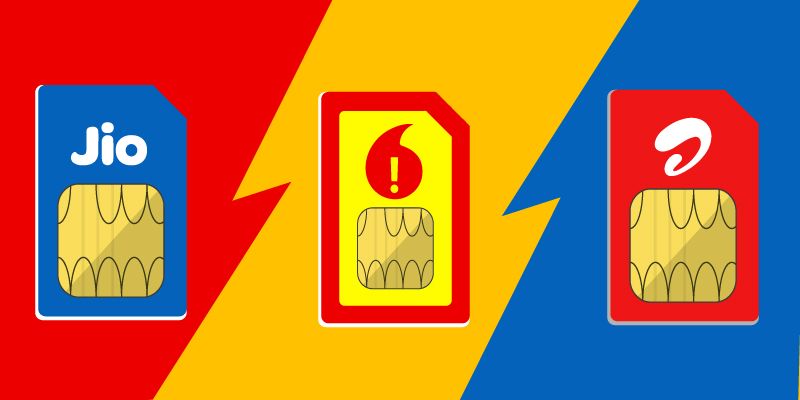

With Idea board approving merger with Vodafone, will it be more difficult now for Airtel to take on Reliance Jio?

The merged entity is now the largest telecom operator in India, with close to 400 million subscribers.

The board of Idea Cellular Ltd has approved the company's merger with Vodafone India Ltd to create the largest telecom company in the country with 390 million subscribers. The merger pushes Bharti Airtel, which has close to 303 million subscribers, to second place now. The merger is to be completed by the end of the next calendar year (2018) and must seek approval of existing creditors, shareholders, SEBI, and the telecom department.

The price war started by Reliance Industries with the launch of Jio has made the industry rethink business models and strategies. Telecom companies have a debt of more than Rs 3 lakh crore, and Jio, the latest entrant, is not making it any easier for them to maintain current prices. The average revenue per user in India is less than $1.50 or Rs 126. The Vodafone-Idea merger will now create synergies to take on Jio, and Airtel too will have to up its game.

A joint statement by the two companies highlighted the key aspects of the deal. Accordingly:

- Vodafone will combine its subsidiary Vodafone India (excluding its 42 percent stake in Indus Towers) with Idea, which is listed on the Indian stock exchange.

- Highly complementary combination will create India’s largest telecom operator, with the country’s widest mobile network and a strong commitment to delivering the Indian government’s ‘Digital India’ vision.

- Sustained investment by the combined entity will accelerate the pan-India expansion of wireless broadband services, using 4G/4G+/5G technologies, support the introduction of digital content and Internet of Things (IoT) services, and expand financial inclusion through mobile money services for the benefit of Indian consumers, businesses and society as a whole.

- It will be a merger of equals with joint control of the combined company by Vodafone and the Aditya Birla Group. This will be governed by a shareholders’ agreement.

- The merger ratio is consistent with the recommendations of the joint independent valuers. The implied enterprise value is Rs 828 billion ($12.4 billion) for Vodafone India and Rs 722 billion ($10.8 billion) for Idea, excluding its stake in Indus Towers, valuing Vodafone India at 6.4x EV/LTM EBITDA, and Idea excluding its stake in Indus Towers, at 6.3x EV/LTM EBITDA2. EV/LTM EBITA is arrived at after looking at the enterprise value of the company in relation to the last 12 months performance at the “gross” margin level.

- Substantial cost and capex synergies with an estimated net present value of approximately Rs 670 billion ($10 billion) after integration costs and spectrum liberalisation payments, with estimated run-rate savings of Rs 140 billion ($2.1 billion) on an annual basis by the fourth full year, post-completion.

- Vodafone will own 45.1 percent of the combined company after transferring a stake of 4.9 percent to the Aditya Birla Group for circa Rs 39 billion (circa $579 million) in cash concurrent with the completion of the merger. The Aditya Birla Group will then own 26.0 percent, and has the right to acquire more shares from Vodafone under an agreed mechanism, with a view to equalising the shareholdings over time.

- If Vodafone and the Aditya Birla Group’s shareholdings in the combined company are not equal after four years, Vodafone will sell down shares in the combined company to equalise its shareholding to that of the Aditya Birla Group over the following five-year period.

- Until equalisation is achieved, the voting rights of the additional shares held by Vodafone will be restricted, and votes will be exercised jointly under the terms of the shareholders’ agreement.

- Vodafone India will be deconsolidated by Vodafone on announcement, and reported as a joint venture post-closing, reducing Vodafone Group net debt by approximately Rs 552 billion ($8.2 billion) and lowering Vodafone Group leverage by around 0.3x Net Debt/EBITDA4. The transaction is expected to bump up Vodafone’s cash flow from the first full-year after completion.

- The transaction is expected to close during calendar year 2018, subject to customary approvals.

Which domain name would you choose for your website? Click here to tell us.

![[Startup Bharat] Y Combinator-backed BeWell Digital is enabling the digital transformation of radiologists](https://images.yourstory.com/cs/2/40d66ae0f37111eb854989d40ab39087/ImagesFrames31-1648033042143.png)