Digital will influence $30 billion of consumer spending on fashion online by 2020: BCG & Facebook report

This article is sponsored by Facebook.

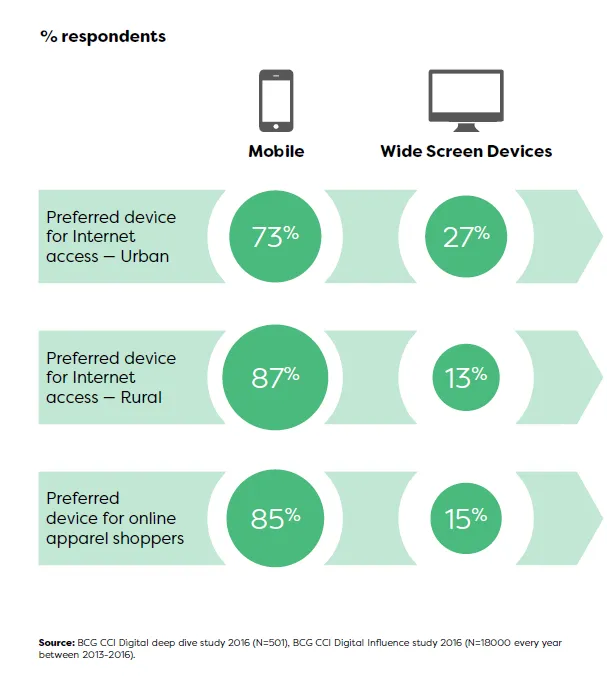

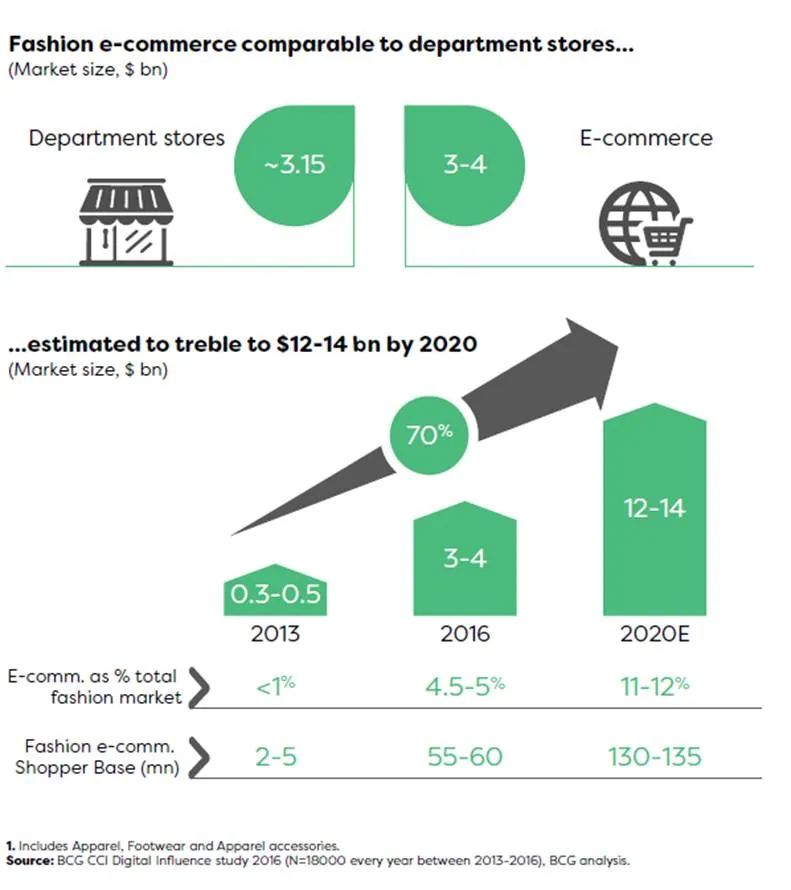

Over the next three years, the number of Indians buying fashion online is likely to double from 55-60 million today to 130-135 million by 2020. With nearly 1 in 2 users on Facebook and Instagram calling out ‘Fashion & Shopping’ as an interest, and 85 percent of millennials interested in Fashion on Facebook alone, this should come as no surprise. Digital influences – be it product discovery, peer influence, or exclusive offers – are playing a major part in this. It is expected that by 2020, 70 percent of people who go online will use the medium to shop, and fashion will be at the top of everyone’s list. The BCG-Facebook report ‘Fashion Forward 2020’ also reveals that Fashion is the category nearly 1 in 3 first-time shoppers start with, making it the gateway into the world of online shopping. Additionally, these consumers are mobile-first: 85 percent of online shoppers already prefer shopping on their mobile devices, a trend that is steadily going to rise.

These were some of the key findings of ‘Fashion Forward 2020’, an industry report brought out by Facebook and the Boston Consulting Group (BCG), which aims to understand how to harness the mobile revolution for fashion-based businesses. The report is essentially a comprehensive forecast of how the fashion consumer will shop in the near future, and what that means for Fashion businesses.

We look at some of the key findings:

- Digital footprint of Indians buying fashion online to increase to 87 percent

Today, mobile devices have emerged as the primary means of accessing the internet among 73 percent of urban users and 87 percent of rural users. These numbers are only likely to grow as increasing smartphone penetration continues to drive internet penetration.

- Digital will influence $30 billion worth of fashion spending in 2020

The Indian fashion industry is valued at ~$70 billion today, of which ~$7-9 billion is already digitally influenced. This figure is expected to grow ~4x to reach ~$30 billion by 2020, and will comprise 60-70 percent of the total branded apparel market.

- E-commerce will grow 4x to reach $12-14 billion by 2020

E-commerce already accounts for a significant 4-5 percent of the total fashion market, which is almost the same as the total department store sales. Online shopping, though, is likely to grow to $12-14 billion by 2020 and will account for 11-12 percent of the Indian fashion market. Nearly 40 percent of the growth in fashion e-commerce will be the result of the number of new shoppers doubling from 55-60 million today to 130-135 million by 2020; ~25 percent growth is likely to come from a higher share of existing shoppers.

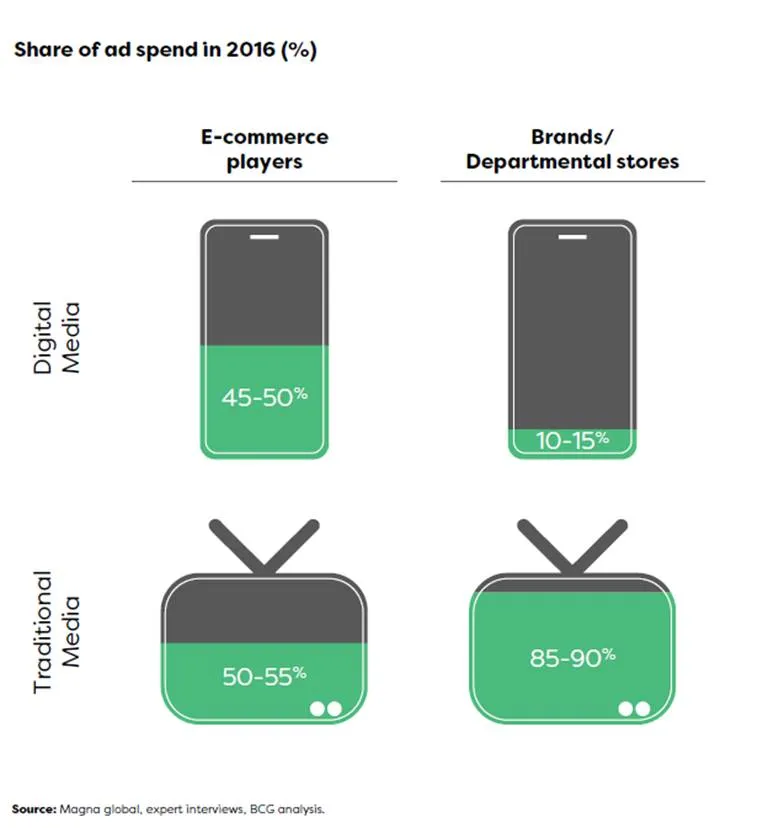

- Digital accounts for ~40 percent of urban internet users’ time spent with media, but only 10-15 percent of apparel brands' ad spends

With the exponential growth in user numbers that the report predicts, brands need to invest more in their digital platforms. Consumer behaviour also shows higher engagement on digital platforms, compared to traditional media.

- Look now! The Indian online shopper is changing

By 2020, the online shopper profile is likely to become more diverse and representative, with the entry of more women, semi-urban and rural shoppers and older people. Nearly 50 percent of the base will be women. Shoppers from Tier 2 cities or even beyond will account for more than half the base and shoppers over the age of 35 will account for nearly 37 percent of the online shopper base.

What this means for fashion e-tailers

While several Indian retailers already have an online presence, there is a need to up their digital engagement game. Several global companies have successfully engaged consumers across digital channels. Nike, for example, has built an entire digital community around running to heighten engagement.

Other companies have also used unconventional methods to draw in online consumers.

When Lenovo launched its A7000 smartphone in 2015, it floated a story about a movie (Mission A7000) based on a geek called Louis Santiago. Santiago, played by Hollywood star Johnny Depp, gets stranded in Istanbul after his leading lady ditches him for money. Faking News carried a story on how the censor board recommended a ban on mobile phones after watching Mission A7000, because they felt the lead character was misusing technology. A comic strip trailer doing the rounds on Twitter and other social media sites led many people to book a seat for the special screening, where they had the big reveal. Did it work? By July 2015, Lenovo had already sold 35,000 units of its A7000 phone, with registrations piling up for the next lot of online sales.

There is significant potential for Indian players to differentiate themselves through such novel means of digital consumer engagement.

Creating digital-enabled personalisation at an individual level will also boost engagement. Companies can build on digital data firepower to harness three key aspects of personalisation at an individual level. This includes

- Launching hyper-targeted campaigns based on customer profile to cross-sell and upsell

- Sending context-specific triggers based on location, customer preferences, and external information, and

- Identifying customers at risk of churn and rolling out targeted offers to maximise customer retention.

Fashion players need to build a data-driven product assortment and move from targeting segments to targeting individual consumers. Advanced analytics on the vast data available today will help sellers optimise the store assortment at an individual store level. Each store’s ideal assortment can be defined based on a deep knowledge of the store’s customers, their historical buying preferences and a data-driven prediction of their potential product preferences. Fashion leaders such as Macy’s are already leveraging these learnings across their stores. Online retailers can take this a step further and offer a tailored assortment to individual customers.

The Facebook advantage

Today, nearly 90 percent of e-commerce users in India are already on Facebook. With 184 million subscribers accessing Facebook each month (97 percent on a mobile device), the potential that this platform offers a business is staggering. Facebook Business has a range of offerings that helps you target your audience. This includes driving awareness of your fashion brands with impactful video, photo and carousel ads, delivering personalised offers and experiences; and tailoring the creative for mobile, all of which help to maximise attention and impact.

To get more insights, read the entire report with its findings and implications here.