SoftBank closes $93B, and it’s good news for India, not just Flipkart

India-born Rajeev Misra is leading the fund and will play a key role in all its transactions.

SoftBank Vision Fund has announced its first major close with over $93 billion of committed capital—a joint venture by SoftBank Group Corp (SBG) and the Public Investment Fund of the Kingdom of Saudi Arabia (PIF). Investors in the fund include the Mudabala Investment Company of the UAE, Sharp Corporation, and titans like Apple Inc., Foxconn Group, and Qualcomm Incorporated. The fund is targeting a total of $100 billion of committed capital, with a final close in six months.

India-born Rajeev Misra is leading the fund, which will be advised by wholly owned subsidiaries of SBG, collectively known as SB Investment Advisers. Misra will serve as the CEO of SB Investment Advisers and will be a member of the investment committee. He will play a key role in all fund transactions, supported by a highly experienced global team across offices in London, Tokyo, and San Carlos.

SoftBank’s strategies

SoftBank Vision Fund’s press statement has said that it will be SBG’s primary vehicle to realise its SoftBank2.0 vision, with preferred access to investments of $100 billion or more.

“SBG created the SoftBank Vision Fund as a result of its strongly held belief that the next stage of the Information Revolution is underway, and building the businesses that will make this possible will require unprecedented large-scale long-term investment. Additionally, the fund’s portfolio companies are expected to significantly benefit from SB’s global scale and operational expertise, as well as its ecosystem of group portfolio companies; this will thereby help them to accelerate their own growth profile,” it added.

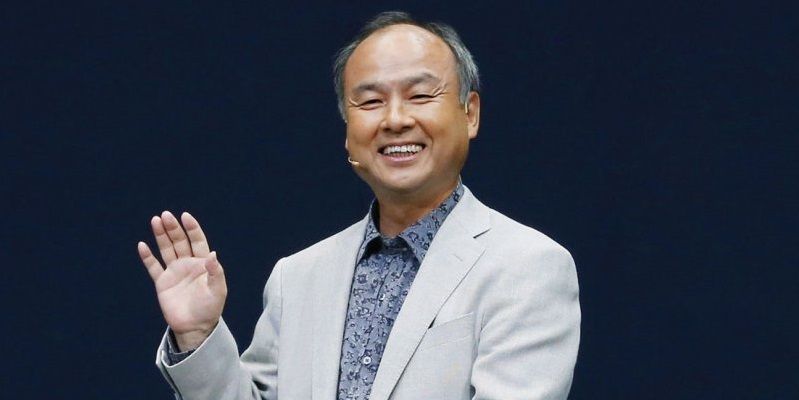

Masayoshi Son, Chairman and CEO of SoftBank Corp, said in the statement: “SoftBank has long made bold investments in transformative technologies and supported disruptive entrepreneurs. SoftBank Vision Fund is consistent with this strategy and will help build and grow businesses creating the foundational platforms of the next stage of the Information Revolution.”

The fund is expected to be active across sectors including IoT, AI, robotics, mobile applications and computing, communications infrastructure and telecoms, computational biology and other data-driven business models, cloud technologies and software, consumer internet businesses, and financial technology.

Saudi Arabia’s advantage

The deal was announced during US President Donald Trump’s maiden visit to Saudi Arabia. Despite the troubled diplomatic relations over the last few years, the Middle Eastern country has joined hands with the Japanese investor in an effort to build a portfolio with companies that will help enable the PIF’s role in supporting the Kingdom of Saudi Arabia’s Vision 2030 strategy to develop a diversified, knowledge-based economy.

HE Yasir Al Rumayyan, Managing Director, PIF, has said in the statement: “We are building a portfolio that is diversified across sectors, asset classes, and geographies, and expect the Vision Fund to act as a platform to access a range of exciting, emerging opportunities in the technology sector.”

The PIF will have the right to acquire certain investments already acquired (or agreed to be acquired) by the SoftBank Group.

Will India benefit?

More than a year ago, SoftBank had declared that it would invest $10 billion in India. Although its investees—online marketplace Snapdeal and real-estate platform Housing.com bombed—SoftBank is still keen on India. The Japanese investor—which has invested $900 million in Snapdeal—is now pushing for its sale to India’s e-commerce market leader Flipkart, which will give it stake in the Tiger Global-backed platform.

With the new fund focusing on fintech and cloud technology—two sectors which are growing fast in India —SoftBank's $10 billion is sure to go upwards in the country. In fact, fintech is moving beyond digital payments and credit lending to technological assistance for SMBs and kirana stores, and is expected to branch out in multiple dimensions. According to Signal Hill and iSPIRT, the Indian SaaS business is evolving from a horizontal to a vertical approach, thus increasing the lifetime value of the business. The time could not be better for attracting investment into startups in these sectors.

Hotel aggregator platform OYO Rooms reportedly raised $250 million round led by SoftBank recently. SoftBank’s other big bet, digital payments platform Paytm, in one of the biggest funding rounds from an individual investor, raised $1.4 billion from SoftBank last week. SoftBank has also invested $55 million in property buying platform Proptiger.

But another investee—grocery delivery platform Grofers—had shut down service in nine cities hardly two months after SoftBank put $120 million into the venture a year ago. Although cab aggregator platform Ola managed to raise $350 million (led by SoftBank) recently, it is still a long way from establishing an upper hand over US-based competitor Uber. According to its consolidated financial report for FY 2017, SoftBank has faced a combined loss of $1.4 billion in investments in Snapdeal and Ola. In February this year, SoftBank had written off $475 million from the same two players—its biggest investments in India till then.