Google payments app Tez is not so 'tez' in impressing users

On Monday, Google launched its much-awaited UPI-based payments app, Google Tez.

The payment app will use NPCI’s (National Payments Corporation of India) Unified Payments Interface (UPI), allowing users to make payments, and send or receive money. The app is currently available only on Google Play Store and iOS App Store.

The UPI platform allows Tez users to make payments directly from one bank account to another across 55 banks.

Under the app’s ‘upcoming features’ are payments through debit and credit cards, and reminders for recurring bills such as DTH. Contemporaries include the BHIM (Bharat Interface for Money) app as well as Flipkart’s payment service PhonePe.

The app, built specifically for India, requires users to have an Indian bank account, and local phone number. The app offers language support for English, Hindi, Bengali, Gujarati, Kannada, Marathi, Tamil, and Telugu.

Speaking at the event, Caesar Sengupta, Vice President, Next Billion Users, was reported to have said,

“We did not start with a product built for another country and then localise it, we looked at what was unique about India and countries like India and built a product specially for it.”

Amazon and Facebook are also expected to foray into the Indian payments space, and launch their own payment apps on the UPI infrastructure.

Minister of Finance and Corporate Affairs, Arun Jaitley, who was present at the launch, reportedly said, “Tez by Google, and other ecosystems, will make a major change in the digital payments landscape in India.”

Transactions on the app are shown as simple conversations, and users can choose individuals from their contact list to pay to, or receive money from. A user can also transfer money using the account number and IFSC code of a beneficiary. Alternatively, money can also be sent to an individual’s UPI ID, or by scanning a QR code, or to a phone number registered on the app.

The Cash Mode

Tez also has a ‘cash mode’ for offline payments. Using the ‘Nearby’ API, a sender and receiver can use pay and receive options simultaneously to complete a transaction.

The app detects and shows users nearby trying to receive money with their name and number. The sender can then choose to pay a merchant by putting in the amount and UPI pin.

For the next billion?

Tez users faced certain bugs and technical issues on Day 1.

A key issue was linking bank accounts with Tez – many users said it took them multiple tries, and this was validated by user reviews as well. Several users also claimed to have faced problems while onboarding the app, and verifying phone numbers.

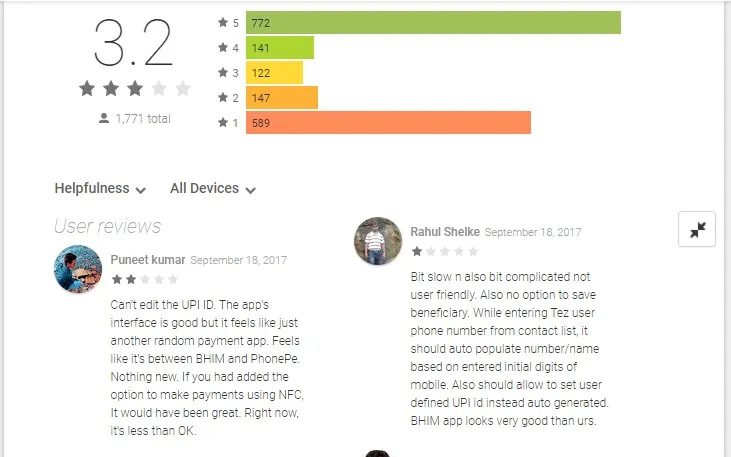

At the time of writing this article, the app was rated a mere 3.2 by users, with over a quarter giving it a one-star rating. After the launch, Twitterati expressed concerns on the UI and UX of the app.

Some also said the app was not really self-explanatory, and almost seems to push users to ‘discover’ the functionalities by themselves.

Others claimed that one needs a Gmail ID to set up an account with Tez, which essentially contradicts the idea of digital inclusion.

Just last month, Uber announced it has added UPI, among several other payment options.