Swiggy vs Zomato: Foodtech in the spotlight again; it’s time for the battle of the biggies

With Swiggy and Zomato recently raising significant capital - $100 million and $200 million respectively – and with Uber and Ola entering the fray, the stage is set for Foodtech v 2.0.

Instant noodles or last night’s leftovers? What for? There’s no doubt that foodtech startups have transformed the way urban India eats. All you need to do is whip out your phone and order what you like from platforms like Swiggy, Zomato, or FreshMenu.

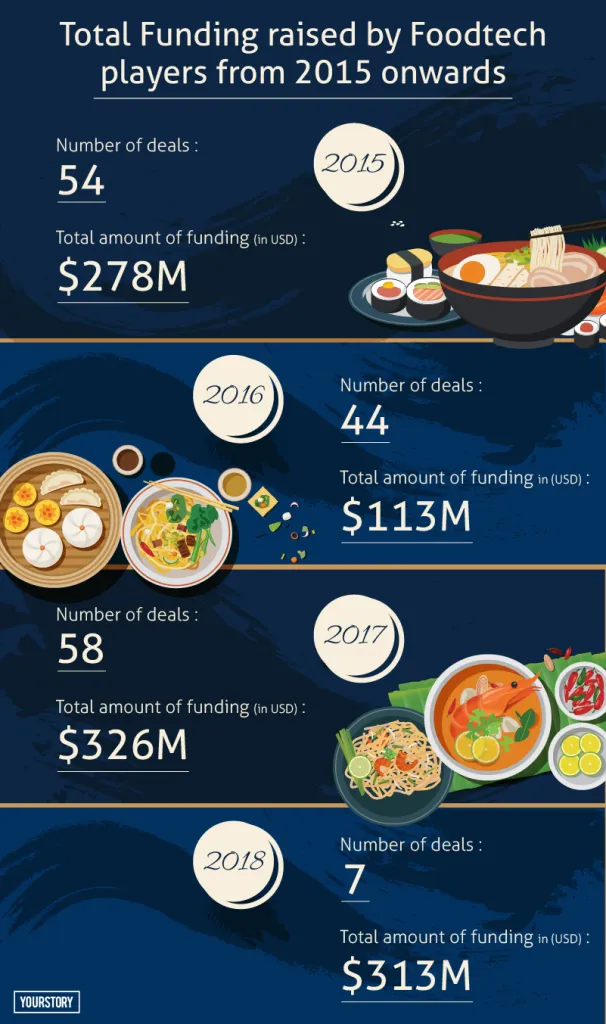

But the foodtech business in India, once the darling and then the pariah of the VC community, has – over the last few years – seen some serious highs and deep lows.

Foodtech startups were built on the foundation that roti, kapda aur makaan could never go out of demand, but over time many of them faced an early death. By 2016, several food startups - TinyOwl, Dazo, Spoonjoy, Eatlo, and EatOnGo - were out of the fray; this chill continued to the beginning of last year, with EatFresh and Yumist shutting shop. Only the big two – Swiggy and Zomato – survived successfully.

Sanjay Anandaram, noted early stage investor and startup mentor, believes online food businesses today are essentially focused on delivery, online kitchen, and a combination of both.

“While online kitchen businesses will raise money and continue to grow, the real battle and fight will be between players like Zomato and Swiggy,” Sanjay says.

Surviving one blood bath

However, these are the only players who survived the first stage. Investors and entrepreneurs burnt their fingers and realised that food was a tough business.

But what worked for Zomato and Swiggy? Sathish Meena, Senior Forecast Analyst, Forrester Research, says:

“If you look at it even now, the game is of the big players. The funding is coming only for the big guys. There is a market for food delivery and foodtech, but now that the money is being pumped deeply into one segment.”

But what helped the two players survive? What is it that they did differently? Was it only capital that aided their growth? Sriharsha Majety, Co-founder and CEO, Swiggy, began with one premise: “We aim to change the way India eats,”

When Swiggy first started operations in August 2014, its main proposition was to ensure that they delivered food from not only high-end restaurants, but also pocket-friendly joints and everything in between.

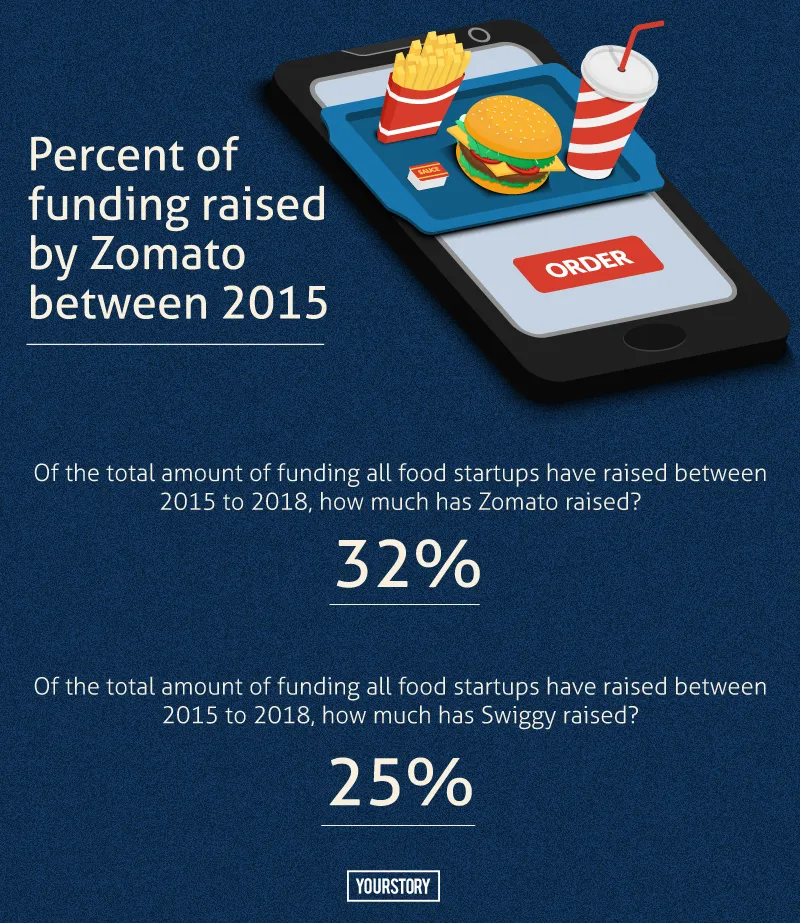

The next eight months saw Swiggy raise $2 million in funding from Accel and SAIF Partners. In May last year, Swiggy roped in media conglomerate Naspers and raised $80 million in a Series E round. Last week, it grabbed $100 million in Series F funding from Naspers and Meituan-Diaping, taking the total funding raised to over $255 million for a valuation of $650 million.

Meanwhile, Zomato, initially called Foodiebay in 2008, is one of the oldest surviving food businesses in India. In 2015, Zomato raised Series G funding. So far it has raised 10 funding rounds amounting to $443.8 million, and a valuation of $1.1 billion. It was in 2015 that Zomato ventured into the food-delivery space.

Around the same time, TinyOwl grew, faltered and retreated to just Mumbai. Rocket Internet-backed FoodPanda, which had gobbled up smaller players, was acquired by Delivery Hero earlier this year.

What did Swiggy and Zomato do differently?

For Swiggy and Zomato, that was just one more competitor. Swiggy at least had the first mover advantage and was miles ahead and Zomato had successfully survived. Even when late last year Ola forayed into the space by acquiring FoodPanda for $200 million, Swiggy and Zomato seem to hold the top spots.

Sriharsha, during the launch of Swiggy Access, a new vertical of their business, said:

“We do our basic service really well. We are boringly predictable. Our hope is there should be no touch points between a customer and us beyond them placing the order on the app and us handing over the food to them. It is a challenging business and we were able to get the basic service right through a mix of technology and operational excellence. One of the big contributors was having our own fleet. We had five riders when we started; we have crossed 20,000 riders now. We have India’s largest last-mile delivery fleet.”

A tough business but focusing helps

Deepinder Goyal, Co-founder and CEO, Zomato, earlier told YourStory that issues like changing rules, number of licenses required, high real-estate costs, and problems with training and retaining staff are issues that have traditionally plagued the food industry. They’re something tech can’t really solve.

The restaurant business involves high investments in space and equipment. Operating expenses are also high, with raw material contracts and staff — for every minute these aren’t utilised, they lose value and hit margins.

The only way to make money is to ensure a growing number of orders—that’s what Swiggy brings in.

Today, apart from the restaurant chains and bigger players, Swiggy also works with small restaurant owners, who form a big part of the unorganised restaurant business. For many small restaurants, Swiggy is the primary route through which orders flow in. Restaurant owners claim that they started out by paying 6 to 7 percent margins. Margins have increased to 10 percent, then to 15 and are now 20 percent.

Zomato, on the other hand, recently crossed the three million deliveries a month mark. This is in just two years since launching the meal delivery service. It has 25,000 restaurants on its platform in India, including 7,500 that are exclusively available only on Zomato.

It had revenue of Rs 333 crore in FY2017. While losses stood at Rs 389 crore last fiscal, they were grown from Rs 590 crore the year before.

“Entrepreneurial organisations keep pushing the envelope, and we want to think that we are one such organisation. Already, at Zomato what sets us apart is that we are a one stop for everything - discovering places, looking up restaurant information, ordering food, and booking tables - with more coming up,” Deepinder says.

Zomato is also focusing on increasing its repeat user rate by launching subscription products.

Both Zomato and Swiggy have also launched the cloud kitchen vertical, where the company provides the space and sets up a physical kitchen for participating restaurants that just have to get the food made and fulfil deliveries.

Cab aggregators enter the fray

Interestingly, while Zomato and Swiggy survived the bloodbath and the market settled last year, uberEATS launched operations in India. Since May, uberEATS has been pushing aggressively into the India market by acquiring delivery boys and adding more restaurant partners with each passing week.

Ola late last year said $200 million invested will be focused on creating more value and growing the business. Foodpanda currently claims to have 15,000 restaurant partners in across 100 cities in the country.

Both layers are late in the game. And yet they aren't contenders one can ignore. Bhavik Rathod, Head of uberEats India, says:

“It is a huge opportunity. The unorganised food delivery is still $80 billion. And one of the reasons it is so attractive is a problem - can you bring the cost of delivery down so low that the economics actually become super viable? Today with better technology it is easier to bring the cost of delivery lower with a sizeable business.”

He says in a business that generally has a low basket size, has perishable goods, and is done real time, it becomes very important that the delivery cost is significantly low.

Bhavik also believes that given Uber’s existing consumer base, it isn't going be difficult to acquire consumers.

uberEats is already present in different parts of the world is present in 200 cities globally and 10 in India. A restaurant owner in Mumbai, requesting anonymity, says: “It is Uber’s modus operandi; they wait to learn from everyone else. And build on it. They have the patience, but once they start growing they push aggressively with discounts and promos.”

However, the point of delivery has always been margins and marketing. Will uberEats and Ola be able to look at it deeper? Sathish believes discounting as a model doesn’t last long.

UberEATS started as UberFresh in 2014 in Los Angeles. At that time, the online food delivery market there had strong players like Postmates, Seamless, Sprig, GrubHub, and Caviar.

According to a Business Insider report, “When it started, it had only seven options for its lunch menu. It didn’t carry the restaurant’s entire menu like most of its competition did.”

Uber took a year to break into its competition’s space in the US, and they did it by being patient. Only time will tell whether they can wait in India too, where there are existing strong players.

Sanjay says: “uberEats and Ola are currently purely in the delivery game. The real online food business fight is between Zomato and Swiggy, who are getting into different verticals of the food business.”

Also, as mentioned earlier, the delivery business runs on consistency.

“uberEats and Ola are still small players in the food delivery game. Swiggy and Zomato have a bigger game. They have seen the market and have the advantage of understanding the space. Also the primary focus of Swiggy and Zomato is food, unlike for Ola and Uber,” Sathish explains.

Will foodtech be the next ecommerce?

According to RedSeer Consulting, the food delivery sector is set to hit $1.5 billion by the end of 2018 and touch $2.5-3.5 billion by 2021 in GMV terms. The sector, which valued at $750 million, is growing at a 15 percent quarter-on-quarter rate.

Most big investors like Softbank have looked deeply at sectors that they can take control over. This time around, things are different. Alibaba and Meituan-Diaping have entered the market.

“Softbank has always had the focus on the number one and two players in the market. Like they have a piece in the e-commerce pie. And now it looks like it is going to be the same case with foodtech,” Sathish says.

Interestingly, Softbank has indirectly already entered the fray. The Japanese conglomerate has a significant stake in Ola, which in turn has acquired Foodpanda. Also, Ant was looking to create an Indian version of Meituan with its funding in Zomato. However, with Meituan pumping funds into Swiggy, the battle is going to be interesting.

The question now is: will Softbank enter the fray with a significant investment in Swiggy? Speculative reports are already suggesting this.

“With so much capital pumped into the space it is highly unlikely that an investor will seriously look at a small or relatively new startup, because they will need to compete with Zomato and Swiggy,” Sanjay says.

The Indian foodtech market is currently big enough to accommodate four players, but most people believe that ultimately it will be a game for two strong players. And guess who almost everyone is betting on? Swiggy and Zomato!