Clovia

View Brand PublisherIndia’s online lingerie market

The new-age lingerie business is India is one area that has seen a fair bit of action over the last few years, and things seem to be shaping up quite interestingly in this space. The growth of the category, its relevance to the online medium (thanks to the privacy and the availability of options it offers) and its overall potential in the growing Indian consumer story has been catching investors’ fancy for quite some time. This year again, we decided to take a quick look at two major players who’ve been key contenders in the new-age lingerie space – Zivame and Clovia.

While Zivame started as a favourite with venture capitalists, changes in its management and model pivots has led to some upheavals. Clovia has been a somewhat consistent story with less funding than its competition.

We decided to dive deeper into the core fundamentals of the brand business and gauge how the two fared in FY 2017-18.

So what makes a brand business? What are the key KPIs that would decide strong fundamentals and hence a potential winner in the longer run? We believe these would include:

- Growth achieved in the previous year and the cost incurred in achieving that (or the profit achieved as a result of this growth)

- Inventory accumulated in making revenues (as it reflects a company’s ability to manage cash flows on a scale and avoid dead-inventory losses)

Growth Vs Costs

Zivame operates on a two-company model (a standard in all e-commerce businesses) with Actoserba Active Wholesale Pvt Ltd (“Actoserba”) and Mila Star Retail Pvt Ltd (“Mila Star”) (as mentioned in a 2017 article in The Economic Times). Clovia operates as a manufacturer/ brand through Purple Panda Fashions Pvt Ltd. Zivame has an approximate 1-2 year head-start over Purple Panda Fashions.

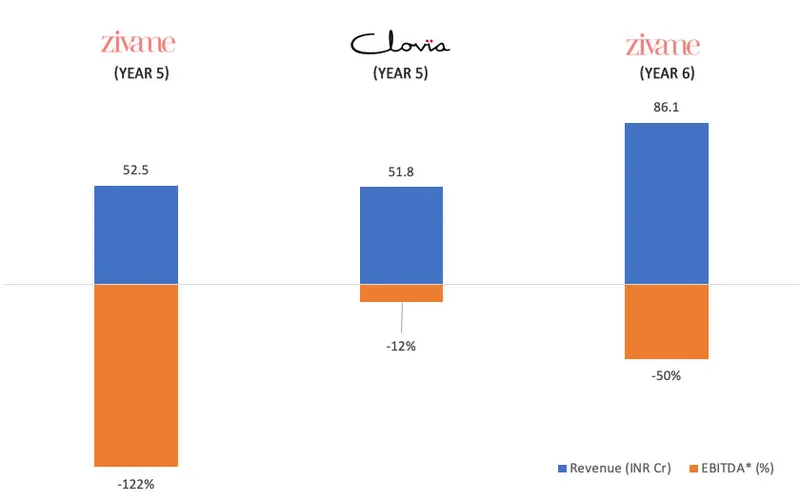

In 2018, Zivame made a revenue of Rs 86.6 crore, up from Rs ~53 crore the previous year, an impressive growth. In comparison, Clovia‘s revenue in 2018 was Rs 51.8 crore, up from Rs 38.6 crore the previous year.

Now, for calculating EBITDA, we decided to take the operational loss and subtracted all interest incomes (generated from interest income of VC funds held), finance costs (for debts etc.) and depreciation. This helps us understand the real cash the company is burning on the profit and loss level.

By this, the EBITDA (i.e. loss before tax without considering the depreciation and finance costs) for both companies associated with Zivame stands at Rs -43 crore (combined loss between the two Zivame companies), i.e. -50 percent. The same number for Clovia stands at Rs -6.32 crore i.e. -12 percent.

So the profit and loss of Clovia looks a lot closer to profitability compared to Zivame. The quality of capital looks a lot better for Zivame considering they made almost Rs 7 crore in interest income while Clovia bore a finance cost of almost Rs 1.1 crore. The same maps back to the funds raised by the former.

Inventory

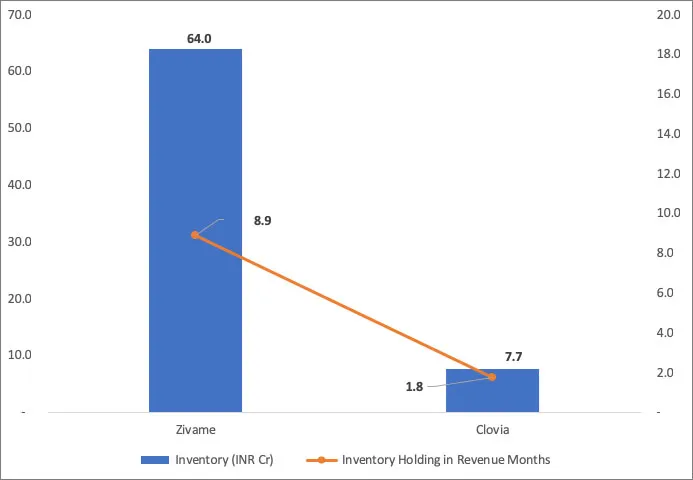

In Zivame’s P&L statement, the combined inventory held between the two Zivame companies amounted to a whopping Rs 64 crore, as per the ROC filings. That’s almost nine months of monthly sale value. Clovia held an inventory of Rs 7.8 crore, i.e. under two months of inventory on revenue terms.

To be fair, growth companies have a lot more revenue towards the latter part of the year, but even then, the inventory level for Zivame is a sign of worry for any brand business.

In Conclusion

So while 2018 saw a lot more sanity in competition and back-to-fundamentals, the consistency of Clovia is commendable. Zivame gaining speed is very heartening; at the same time, it does need to work on its inventory and cash burn. Nevertheless, the category continues to grow and in the end it is the consumer who emerges as a winner!

Disclaimer: All the analysis listed here is based on data picked up from ROC filings of the companies and information available in the public domain.