1550723198939.jpg)

Amazon Web Services

View Brand PublisherYourStory SMB Week: E-commerce market experts talk about how to build resilience in the business

In these trying times when the world is fighting to contain the spread of coronavirus (COVID-19), the ecommerce sector is among the worst hit. YourStory’s SMB week, powered by Amazon Web Services saw industry leaders come together on a WhatsApp chat to discuss how to build resilience in the business

In the last decade, e-commerce has transformed the way business is done in India. According to India Brand Equity Foundation, the Indian e-commerce market is expected to grow to USD 200 billion by 2026 from USD 38.5 billion as of 2017.

However, the recent threat of the pandemic coronavirus has put every business into bad shape and the e-commerce sector has too witnessed a major hit. The only plus side of the industry lies in the fact that it is able to deliver essential items like groceries, baby care products, medical items, including a few others.

The ecommerce entrepreneurs’ fear of reviving the business post the nationwide lockdown is increasing due to several factors with the biggest challenge lying in managing the cash flows, working capital, and liquidity management.

To help these enterprises power through these difficult circumstances, started “SMB week - Converse, Combat, Conquer”, a special, first-of-its-kind chat series, powered by Web Services (AWS). The chat series, which started on April 13, 2020, will go on till April 18, 2020.

On the fifth day of the series, leaders from the ecommerce sector came together to lend a guiding hand and provide guidance to the entrepreneurs on how they can navigate through these difficult times.

Insights on prioritising challenges

The interaction took off with the e-commerce sector entrepreneurs sharing insights on how they are prioritising various challenges in the business world. Yogesh Kabra, Founder, XYXX begins by sharing how COVID-19 has drastically impacted the business.,

“The economy has come to standstill. This phase isn’t like a recession in which sales would drop by 30-40 percent. Sales have dropped to zero for most businesses barring the essentials category and no business is prepared for zero sales. Zero sales means zero cash inflow while outflow for salary, rent etc are still the same. Therefore every business first has to fight the cash cycle imbalance,” he said.

These are unprecedented times, bringing with them unprecedented challenges, and therefore, calling for unprecedented solutions,” adds Hiren Shah, Founder and Chairman of Vertoz.

Sailing through this tough time, Naman Shah, Founder, added that as a procurement partner for various manufacturing industries. The priority has been to ensure safety and related products to reach the essential industries during this pandemic.

How to lighten the working capital cycles

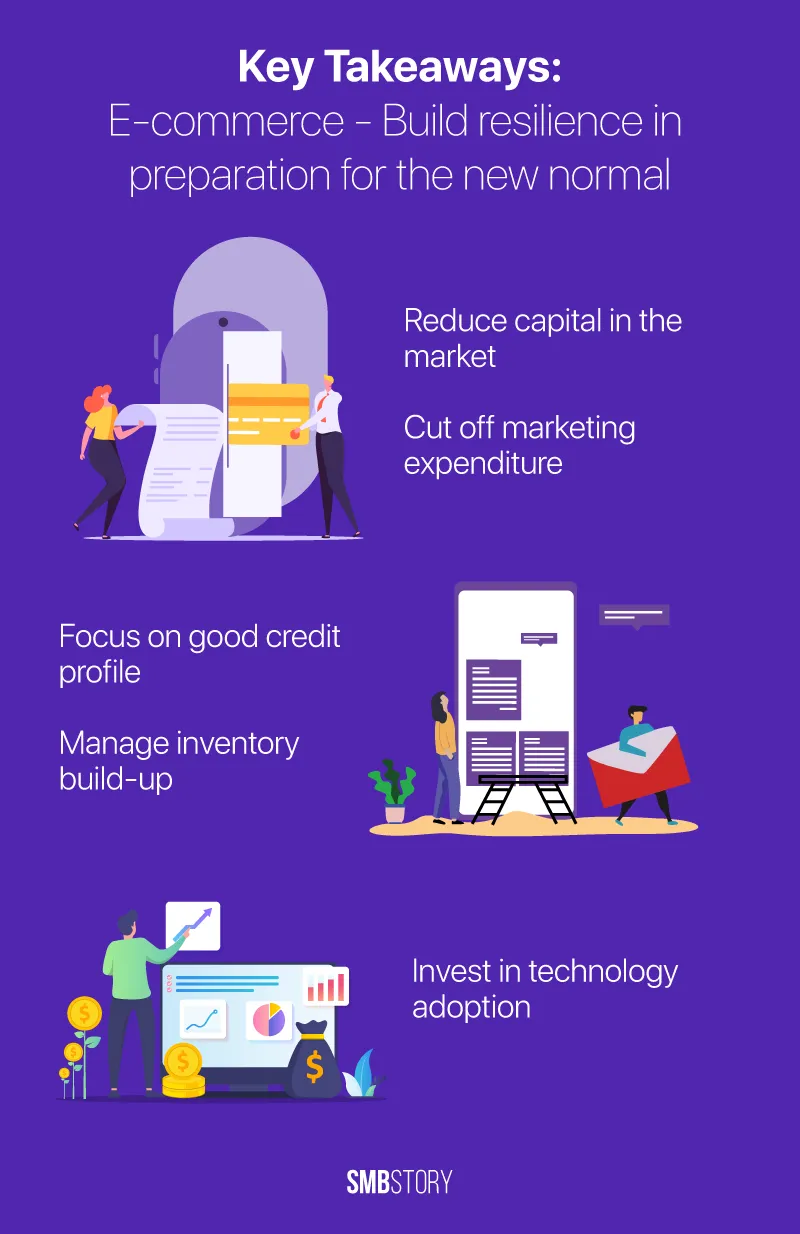

In a measure to reduce the capital in the market, Yogesh says that reduction of sales on credit should be the first step. Puneet Arora, CEO, AutoFurnish corroborates to the statement saying that businesses should maintain strict discipline on working capital, particularly around collecting receivables and managing inventory build-up.

Cutting the marketing expenditure and refraining from new hiring were also some of the key parameters suggested by the e-commerce sector experts to lighten the working capital. Also, they stressed on negotiating all the previous purchase orders, contracts etc. and may use credit cards to make the payment keeping the dues clear and on time.

On cash flow problems for the ecommerce that are funded, Abhineet Sawa, Founder of Snapmint added, “We are venture backed but survival instincts are critical. We are focusing on the good credit profile and reducing exposure into risky segments.”

Technological solutions helping SMBs to manage their liquidity effectively

Technological adoption is one of the finest ways for SMBs to adapt and manage their liquidity effectively. Cloud hosting not only saves money but also lets the entrepreneurs focus on the essential areas of the business which are otherwise taken care of by the outsourced resource or lay pending.

With the cloud and a good set of DevOps practices, IT maintenance and enhancement processes can also be leaner and more efficient. All of this has a beneficial impact on cash flows and on operational expenses. The cloud also provides “building block” components that can be used to deliver systems on a pay-as-you-go basis. A number of startups running on the AWS platform are using advanced AI & ML technologies to leverage various data sources and make faster, accurate decisions around creditworthiness, he adds.

The panellists couldn’t agree more on technological adoption for their businesses as they say that investing in automation and letting go of some aspects of the business that were manual is utmost required especially in these tiding times. This is a good time to focus on such initiatives so that when we grow again post lockdown - business is leaner.

Cloud-based technology adoption- how it can be a new normal

Technology plays a huge role in the growth of an e-commerce company as scaling is about efficiency and sustainability and with cloud-based solutions, the entrepreneurs can be assured of attaining the two factors.

“Cost, Scalability, accessibility, and simplicity are the four prime factors that SMBs will consider on top priority to plan a cloud migration. While any service or product delivered via the internet is considered a cloud solution, cloud solutions for small businesses largely focus on SaaS, or giving businesses access to ready-made software and services,” says Puneet Arora.

It also enables staff productivity as technology heavy lifting is done by the cloud platforms and staff/employees can focus towards more value-adding initiatives.

There are a few measures which entrepreneurs take during tough times, however, as the future of the online world depends upon the cloud-based technologies, for SMBs, this adoption could be a new normal soon.

How can AWS and its partners support SMBs

AWS helps customers around their work from home and business continuity requirements, helping customers adopt these solutions in a secure and cost-effective manner. It is also helping customers prepare for the future - to be ready with innovative and digital solutions to grab the opportunity when the market picks up.

Naman, who has also signed up AWS services says that they can help the business ecosystem to transform remote working and adoption of corporate net banking.

Key takeaways

Amazon Web Services (AWS) provides trusted, cloud-based solutions to meet the business needs of small and medium sized companies around the world. Whether you are running applications that share photos or you’re supporting the critical operations of your business, the AWS cloud provides rapid access to scalable, secure and low cost IT resources. For starting your digital journey you can reach out to us at https://aws.amazon.com/contact-us/

![[Funding roundup] Rakul Preet Singh invests in Wellbeing Nutrition; IndiaMART backs Truckhall](https://images.yourstory.com/cs/2/ba9e8080834311ec9e7e95cb06cf6856/Rakulfeaturefinal-1650281276479.png)

![[Funding alert] F2P mobile game studio LILA Games raises $10M in Series A led by Rainfall Ventures](https://images.yourstory.com/cs/2/ba9e8080834311ec9e7e95cb06cf6856/LILAfinal-1647414886475.png)