BharatPe aims to build a $100M loan book and its secret sauce is India’s 50 million SMBs

While PayTM and PhonePe may already be dominating the digital payments market, BharatPe is writing its own success story by becoming a partner for India’s 50 million SMBs.

(From L-R) Shashvat and Ashneer, founders of BharatPe

Prerna Pharmacies’ Venkat Reddy has been running a small retail operation for the last 15 years in Rajajinagar, Bengaluru. His monthly revenue was around Rs 3 lakh a month, and last October, digital sales (through QR codes) made up only 40 percent of his business.

Another 10 percent of his business came from cards (credit and debit) while the rest happened through cash.

Eventually, in April 2019, Venkat ran into a problem — he had to pay off a debt of Rs 3.25 lakh that he had taken for his daughter’s college education.

While he could pay half of it using his savings, he urgently needed to raise the remaining amount. Desperate, he looked towards the banks, asking them to fund him on his invoices, but all banks wanted personal guarantees and collateral.

However, one evening, Venkat received a call from a executive, who said that the company could grant him a personal loan based on the cash flow of his pharma store.

In less than 48 hours, Rs 2 lakh was transferred to Venkat’s account and he was able to pay his unsecured debt promptly. This collateral-free loan solved Venkat’s worries.

As for BharatPe, it would be paid back on a daily basis, from every QR code transaction made in Venkat’s store, which amounted to Rs 2,200 per day. Even after paying BharatPe, Venkat would still have Rs 6,000 as daily earnings.

“I paid off my debt just before the pandemic. Now, business is booming because we are in the essentials list and our businesses did not suffer through the lockdown,” he tells YourStory.

And Venkat is not alone. Delhi-based startup BharatPe, founded in March 2018 by Ashneer Grover and Shashvat Nakrani, which claims to have reached more than four million businesses with its QR codes, is well on the way to using its underwriting business to change the story of SMB owners in India.

By April 2021, BharatPe expects to make more than $1 million in interest income while helping businesses be free from merchant discount rates, as well as save on monthly payments to SaaS or CRM companies or bookkeeping companies.

“The Indian SMB is hardwired to pay interest. But SMB owners need not pay additionally for the convenience of technology. Their gross margins are less than 15 percent. They want solutions that can put cash in their hands and not take it away from them,” Ashneer tells YourStory.

The early days

IIT alum Ashneer and Shashvat met in January 2018 at a technology event, and found themselves discussing how technology, data, and underwriting could come together as a full-stack solution for SMB owners in India.

In less than three months, the duo started up with their own capital and launched BharatPe. The idea was to be different from and , which were using closed-loop QR codes at the time, although UPI allowed them to be interoperable.

Ashneer Grover, Co-founder of BharatPe

“I remember trying to raise money in July 2018, and everyone would ask what I would get from going after a company with a $15 billion valuation and a company with a $10 billion valuation — PayTM and PhonePe respectively. I told them we were not a QR code company but I could only convince my family and friends, who put in Rs 1.92 crore to help us build the business. That helped us sign up more retailers, as we needed the data before we entered the lending business,” recalls Ashneer.

The duo, along with its eight-member team, soon signed their first thousand customers. Ashneer himself remembers signing up retailers in Galleria Market (Haryana) and Nehru Place (Delhi) to use digital payments with QR codes. He also told them that once they do 1,000 transactions using BharatPe’s QR code, the startup could lend them money to manage their business.

By January 2019, BharatPe had signed up more than 50,000 retailers, who were doing over 1,000 transactions per day using its QR codes. At the same time, PhonePe launched interoperable QR codes and was signing up SMBs fast.

In 2019, Shashvat moved to Bengaluru to build their southern operations and sign up many more SMBs. In April that year, the startup raised $15.5 million from Insight Partners, Sequoia, and BeeNext, which it used to expand its SMB base.

It also began to expand to lending.

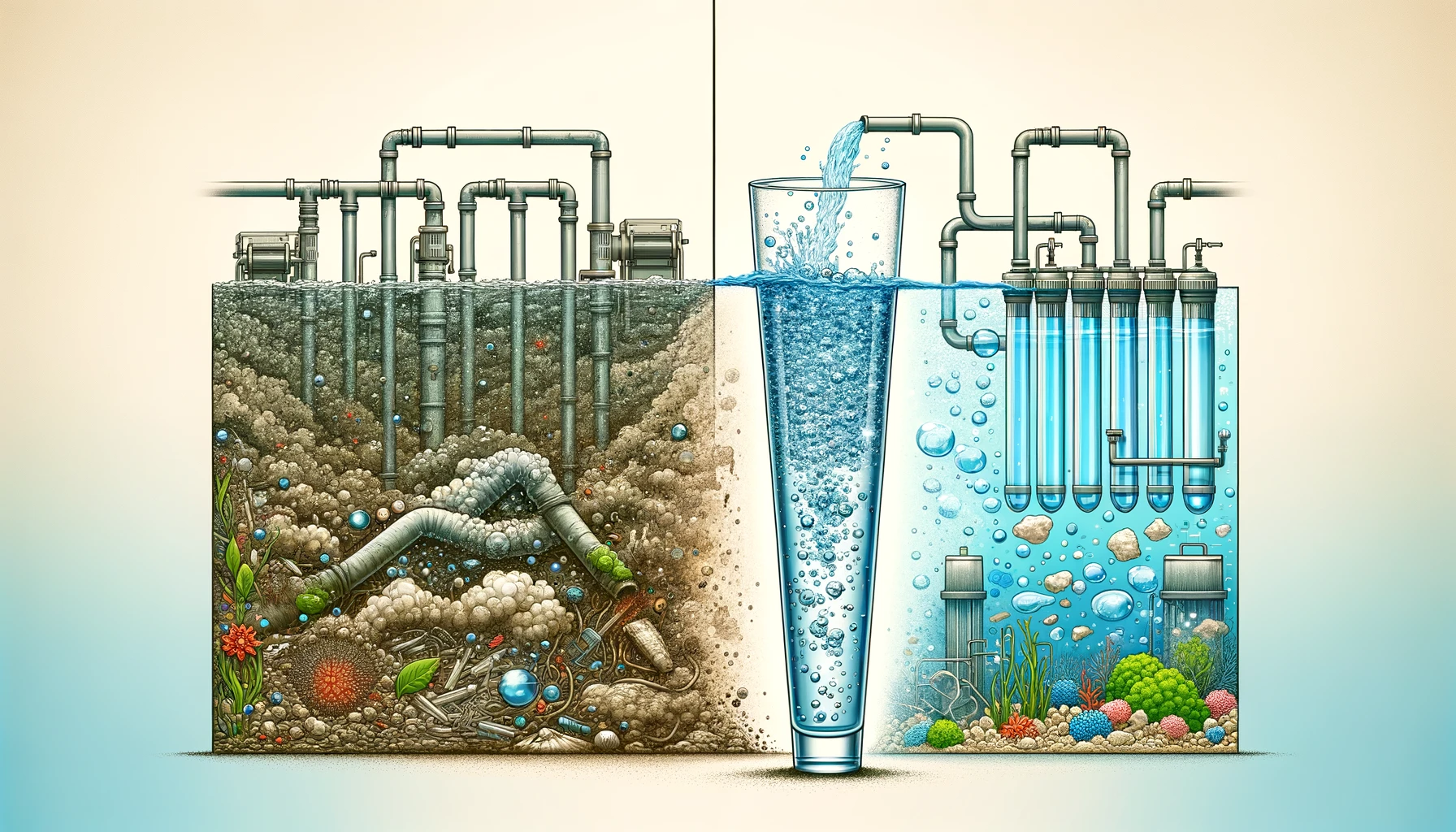

“Lending is an algorithmic business. Only the first 100 loans would have been gut feeling but every 100 loans thereafter, it is the algorithm that underwrites the borrower,” says Ashneer.

The loans business started in April 2019 and BharatPe made it count, raising further rounds of capital. The startup raised two additional rounds — a Series B round of $50 million and a Series C round of $75 million. Investors included Coatue Management, Ribbit Capital, and SteadView Capital.

To grow its business in smaller towns, BharatPe signed up with Salman Khan as a brand ambassador in July 2019 to promote the brand.

Growing into lending

When BharatPe processes a loan, it takes the PAN details of the owner, provided on the merchant app, and checks for any willful defaults. As about 50-60 percent SMB owners are new to formal credit, BharatPe realised that most want to pay back their debts.

“The premise was we need visibility in our QR, and we will underwrite you through how much business you do through our QR,” says Ashneer.

To make it easier for SMBs, the company introduced link-based payments too. In this mode of payment, a business owner can send the goods to the homes of consumers and send them a link for payment.

“We prioritise merchants. You need to have an ongoing relationship with your borrower. The key is to not over-leverage yourself because there is a cost of generating a loan. Our model is to not give too much money to a single person so that we can lend to a larger base of people,” says Ashneer.

Shashvat Nakrani, Co-founder of BharatPe

He adds that even if the startup does a $100 million loan book, it can break even by March 2021. At present, its burn is $1 million a month, which is coming down.

“The payment business gives us a large funnel. There will be competition in the lending business. But the market is huge. I will never lose sleep over competition,” asserts the co-founder.

Market landscape and the way ahead

Right now, everything seems to be going BharatPe’s way, mostly because of UPI, the most contactless mode of transaction averaging 1.3 billion transactions a month.

The pandemic has further pushed for digital transactions and fintech has quite the business opportunity ahead. KPMG reports that there are more than 50 million SMBs in India with very little digital penetration.

BharatPe is also launching a closed-looped credit card, using which a retailer can buy goods from a distributor in one swipe. The distributor receives his money immediately from the NBFC while BharatPe, along with the said NBFC, can recover the money from the retailer over a period of three to four months.

BharatPe is well on its way to becoming a unicorn. But, it is going to do so with an ecosystem of banks, NBFCs, and retailers, making the startup a valuable business for its investors and employees.

The startup claims it garnered $250 million in June in QR code payments, and has disbursed more than 32,000 loans worth $13 million. The value of the transaction per month, on the QR code, per SMB, roughly works out to Rs 4,625 per business. The company says the average loan value is Rs 60000 per SMB.

Its collection rates were 98.5 percent until March 2020, and then, due to COVID-19 and the resultant lockdown, collection rates dropped to 20 percent for two months.

Over the last two months, its collections increased to 80 percent. “Nobody can deny the impact of the lockdown. But most SMBs in the essentials business are coming back,” says Ashneer.

BharatPe has partnered with two NBFC partners for its lending business, and for the QR code, it has partnered with ICICI Bank and Yes Bank. It applied for an NBFC license and is still awaiting clearance.

The startup plans to double its SMB base and propel its lending business to close to $100 million by March 2021.

Edited by Saheli Sen Gupta