Fintech futures: How incubator Afthonia Lab connects fintech startups to mentors, investors, and customers globally

Five startups in this fintech incubator have already reported success with product development, customer engagement and fundraising. Here’s how it works.

[This article is part of Startup Hatch, a series by YourStory on incubators, accelerators, makerspaces, and coworking spaces in the startup ecosystem. See earlier profiles of initiatives at IIT Bombay, IIM Bangalore, BITS Pilani, NCL, Tata Elxsi, Axilor, NID, IIIT-Bangalore, IIIT-Hyderabad, Vellore Institute of Technology, PSG Coimbatore, Electropreneur Park, Workbench Projects, Makers Asylum, NetApp Excellerator, TechStars, Indigram Labs, WeWork, Z Nation Lab, Sandbox Startups, Brigade REAP, Target India Accelerator, Maersk, Anthill Studio, UnternehmerTUM, AZO, EXIST, InsurTech Hub Munich, CoWorks Foundry, and Ashoka Innovators.]

Based in Bengaluru, Afthonia Lab is an incubator for fintech startups. Launched in 2019 by Tanul Mishra, it helps startups become business-ready via incubation strategies for product-market fit, mentoring, and access to investors. The mentors are from diverse sectors in India and abroad, and help Indian startups scale and expand globally.

Tanul Mishra, Founder and CEO of Afthonia Lab, has over 20 years of industry experience. She earlier founded and sold Eatelish, a food service startup connecting artisan food makers across India directly to consumers. Her previous roles were at (AVP Revenue), Reliance Communications (Senior Manager), VSNL (Alliances Manager), and INOX (Alliance Manager).

Tanul practices self-defence technique Krav Maga, and is a passionate trekker and trained classical dancer. She joins us in this interview on the journey of Afthonia Lab, opportunities for entrepreneurs in India, resilience during the pandemic, and startup tips.

YourStory [YS]: What was the founding vision of your incubator, and how is it supported?

Tanul Mishra [TM]: Many startups in India usually begin with ingenious ideas but lack structured support systems to bring those ideas to fruition. Our aim is to help startups reach an inflection point moving from idea to business stage in the most effective and efficient manner.

Afthonia Lab’s founding vision is to create sustainable, scalable, and responsible startups that have solid business models with a long term success outlook. We do this with our ecosystem approach that covers the entire spectrum of needs that a young startup has in its initial days.

From operational support to strategic intervention, we hand-hold the startups we incubate every step of the way. Our ecosystem ensures an insight-forward environment while providing interventions from seasoned thought leaders who provide valuable advice and guidance to help our startups hit the ground running.

Another crucial cog in our incubation wheel is the global access we provide to our startups. With an experienced body of global mentors from diverse sectors with cross functional expertise, our startups have the unique advantage to experiment and tweak their innovation across geographies and also getting their product market fit right from an early stage. We also provide our startups with access to capital as required through empanelled investors and potential clients across the world.

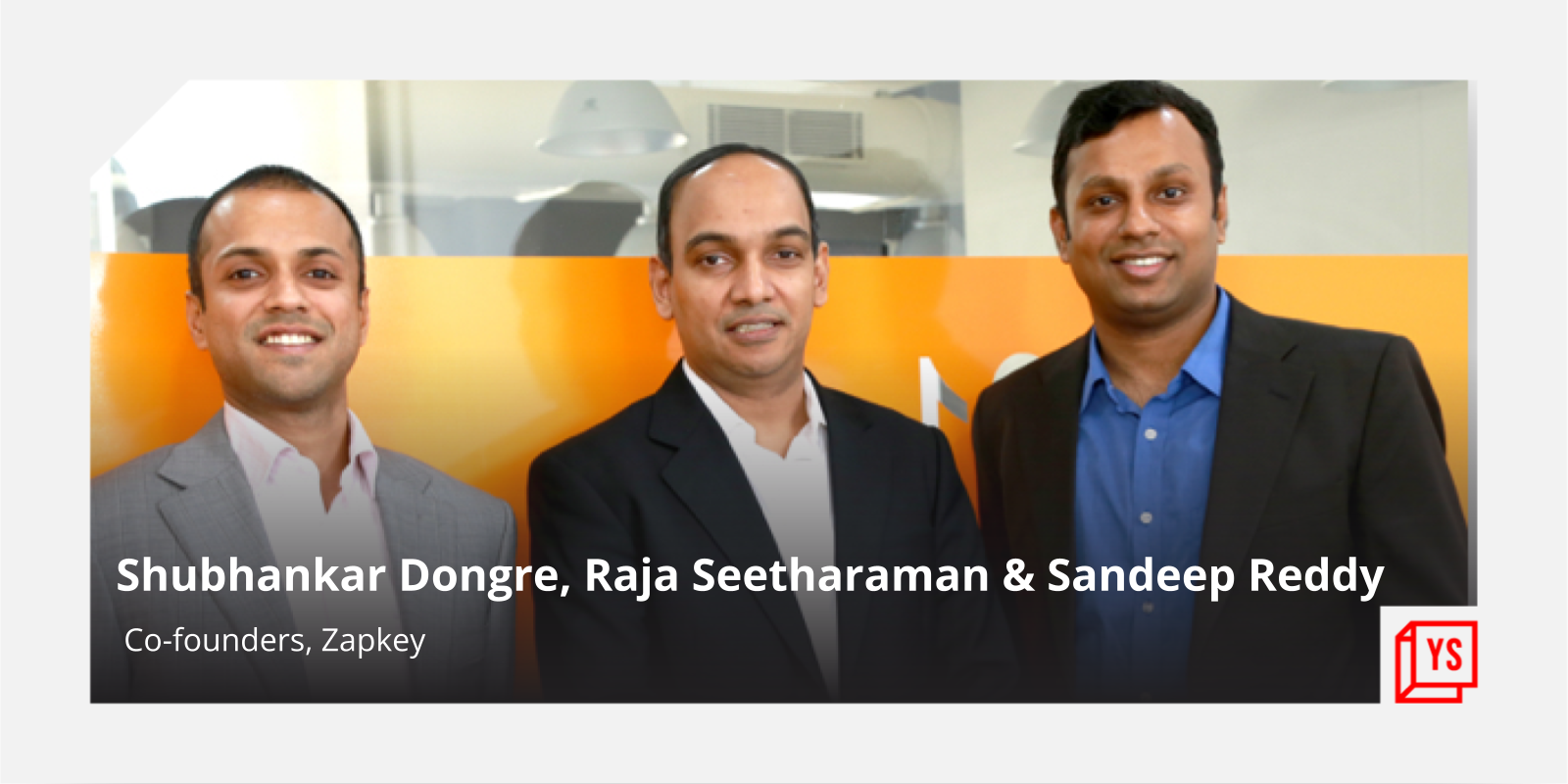

Nabil Nayak (L), Tanul Mishra, Anna D’souza

YS: Which startups have graduated from your incubator so far?

TM: As of now, we have four early stage fintech startups as part of our programme. They are soon going to graduate, and we have recently signed on a fifth startup as well.

Ginger Root Code Factory, founded by Hozefa Muchhala, enables core banking solutions and card processing systems to service customers in remote to urban areas with just a swipe. This helps enable payments and remittance, builds business environments around the payments space. The startup received its first round of seed investment earlier this year, and has inked two deals in international markets for BFSI payment facilitation and marketplace payment processing.

BlockSurvey, founded by Wilson Bright, is a privacy-focussed data collection application, which advocates digital ownership of data by customers. It has turned cashflow-positive during the pandemic, and won client deals in the US market. The startup uses tools such as surveys, polls, and forms, and deploys blockchain technology. It has around 500 customers and a healthy pipeline in the coming months.

Tarrakki, founded by Saumya Shah, is a wealth management app that provides wealth creation opportunities through its strategic investment strategies across different asset classes. It tackles customer challenges such as complicated investment options, mediocre advice, and unbalanced asset allocation. The startup helps customers invest money responsibly and intelligently. It has recently raised an undisclosed amount in a pre-seed round.

Niivo, founded by Puneet Saxena, is an end-to-end integrated platform for intermediaries that provides intuitive UX, visually-appealing reports, integration with social platforms like WhatsApp, and mutilingual features. The startup already has 21 intermediaries serving 2,478 retail clients with a combined AUM of Rs 36.5 crore, all within the first month of launch. It has raised undisclosed amounts of funding through mentor connections.

Earnvestt, founded by Kunal Ahirwar, is at prototype stage. It is building a decentralised, peer to peer validation-based platform for SMEs to manage their working capital. It helps those SMEs that are usually left out by the banking and financial system for a variety of reasons. They are expected to launch in early 2021.

The total capital raised by these fintech startups stands at $150,000 (fund raise and bridge capital amount) through a diverse clutch of angel investors based in India and overseas. This has happened even as the pandemic continues to adversely impact business.

YS: What is the profile of the managers of your incubator?

TM: I am assisted by Anna D’souza, Programme Manager, and Nabil Nayak, Associate Coordinator. Anna has a background in media and advertising, and is responsible for connecting the incubated startups with investors, solution providers and potential co-founders.

Nabil has a background in strategic management, and handles operational activities like project planning and client communications. He also assists in content management and design.

YS: What would you say are the top three opportunities for Indian fintech entrepreneurs?

TM: Fintech is an integral part of all industries and sectors today. Especially in the post-COVID era, fintech solutions are more relevant now more than ever.

Opportunities in the upcoming financial year include insurtech, credit risk, and fraud management, and products and services aimed at financial inclusion.

Team BlockSurvey

YS: What are the key challenges faced by fintech startups in India, and how can you help bridge the gap?

TM: There are quite a few challenges faced by fintech startups, ranging from product development and market access to fundraising and regulatory changes.

Product building is a consistent and time-consuming activity that requires customisation. It’s about creating a unique value proposition and an experience from trying to buying and post buying. This whole process has to be designed to be easy, intuitive, engaging, and fulfilling.

India is a large and complex market with different buying patterns regionally. It needs a lot of time and money to break into the market and gain traction. Sometimes it is easier for India-based startups to gain traction faster overseas.

Lack of seed stage funding and access to the investors is one of the major problems faced by the early stage startups. Afthonia Lab, with the help of the mentors panel, aids the startups with access to international markets and investors at the right time. As mentioned earlier, some of our incubatees have inked deals and raised funds with the help of mentors.

Afthonia Lab also has a few empaneled investors such as Itigo, Sridham, and Gilda VC. They look at early stage startups and even those that are at the concept stage

YS: What are the unique challenges for social entrepreneurs as compared to tech or profit-led enterprises? Are you targeting this space also?

TM: As of now, Afthonia Lab is not explicitly looking or targeting social entrepreneurship but we are happy to look at this space if it has a fintech element to it. I believe that the key challenges faced by them may include access to funds, especially given the current crisis since you mainly look for rapid growth with a long-lasting impact.

Social entrepreneurship requires dealing with social issues a well. It will require the right kind of education and finding the right kind of resources to run the company, because running social enterprise is much difficult than any other enterprise.

YS: What is the selection criteria for startups in your incubator?

TM: At Afthonia Lab, we have a team that takes a joint call on incubating the startup. The screening/due diligence process consists of mentors (global and Indian) getting involved in the selection process based on the area of expertise of the startups.

We have a stringent tech evaluation phase to understand how and what else can we bring to the table to help the startup in the best possible way. Our goal is to refine the vision of the startup, and through multiple rounds with our mentors and advisors we see how we can add value.

For us, the most important thing is the founding team because they are going to be executing the idea. We also take into consideration how the startups approach their ideas, and their problem solving capabilities.

Team Tarrakki

YS: Who are some of your institutional partners, and what kinds of agreements are in place?

TM: We look at our partnerships in various ways. We have ecosystem partners who have been brought on board to support the startups. These partners include Innove Law, Everestek, Ankhya Infinity, , MNBK and Associates, Vivaa Consulting, F6, AWS, Digital Ocean, Toppeque, and Freshdesk.

The next set of partners are the associate or investor partners like Shridham, Gilda VC, and Itigo who help the startups with access to the VC community as and when required.

YS: What support and services do startups receive in your incubator?

TM: Afthonia Lab is standing on four pillars helping the startups from 360 degrees in order for them to experiment, grow, and disrupt the industry. The pillars include access to markets in India and overseas, as well as access to capital.

We are stage-agnostic. We also provides startups with global knowledge with the help of our mentors and advisors.

YS: What percentage of equity do you take in your startups?

TM: Because Afthonia Lab is stage-agnostic, the equity typically depends on what stage the startup is coming onboard and the effort and time we have to put in. Depending on our involvement and the terms of engagement with any startup, the equity range varies anywhere between 2-5 percent.

YS: What kinds of IP are being created by your startups?

TM: Afthonia Lab doesn’t have any IP since we incubate startups who develop their own IP. Our role is to help them in that IP creation journey with our unique incubation strategy and provide them with techniques to help them achieve scale. So in a sense our program design is our biggest IP.

YS: How would you differentiate your incubator from other incubators in the field?

TM: We provide startups access to the international market as well as the ability to provide access to capital at a very young stage for startups, which gives them an edge in the market to hit the ground running.

We are stage-agnostic and our programme isn’t a ‘one-size-fits-all.’ We give access to a quality pool of knowledge who can handhold the startups throughout their journey of becoming business ready.

The hands-on approach, which includes grooming, creating pitch decks, and helping in daily operational hurdles – is another differentiator where every startup is provided support on the areas where they need development.

The most important differentiator is that we view ourselves as a part of startup’s journey and a partner in their growth path. This is reflected in our on-boarding process where we spend a lot of time understanding the team’s vision; we are not transactional.

YS: What are some challenges you face, and how do you plan to overcome them?

TM: One of the major challenges I would like to highlight is that our goal is to build a support system that provides access and brings together the relevant industry stakeholders, our startups, investors, mentors, and businesses.

So, a lot of times, it means we fight hard to pull in the right stakeholders that will help the startups we incubate and also work in tandem to align everyone's individual goals and nurture a shared vision to help our startups thrive. It can mean a lot of people management, expectation setting and providing crucial interventions that can help startups thrive despite the roadblocks that emerge.

Another major challenge is around the perception that incubators have in the Indian market today. We find a lot of resistance and a lack of clarity on just how important the role of an incubator can be in a startup’s success. I think it is extremely important to establish the value incubators add to a startup's early journey and not be seen as merely a partner that provides a co-working space.

Team Ginger Root Code Factory

YS: What would you define as success for your incubator?

TM: It is too early to talk about the success of the incubators for us at the stage we are in. We see our journey as an iterative process because the startup ecosystem in India is young and fluid and we need to keep pace with that and adapt.

However, as a long term goal we see our success reflected in that of our alumni and how they contribute to the growth of startup ecosystem in India.

YS: How do you compare and contrast India’s incubators with that of other countries like the US and China?

TM: Well, there is a yawning gap between the incubators of the matured countries like US and China in comparison to India, but the scenario is drastically improving.

As per Nasscom’s report in 2019, the country has over 335 active incubators and accelerators with a capacity to enable over 5,000 startups every year. More than 65 percent share of incubators and accelerator programmes were added in the last five years, out of which 57 percent are active outside Tier 1 cities.

Maturity-wise and approach-wise, the US and China are way ahead of us. The US has many specialised incubators, which I believe India lacks – for example, insurtech, payments processing, and clean-tech incubators.

They are focussed on a particular segment rather than the larger industry. So I believe we are at a nascent stage as compared to where they are, and it’s a long journey for Indian incubators.

YS: What are your plans for the coming 3-5 years with respect to new startups?

TM: As of now, we have five fintech startups as a part our programme, and we plan to expand it to 20 in three years and 30 startups in five years.

YS: What challenges has COVID posed for Indian startups? And at the same time, what new opportunities are opening up? How are you positioning yourself here in this regard?

TM: Startups are facing significant challenges due to the COVID-19 crisis, as they are more vulnerable than older incumbents to the shock brought by the pandemic.

They tend to engage in high-risk activities as they face constraints in accessing traditional funding, and have a formative relationship at best with suppliers and customers. They also often crucially rely on a small founding team, and this can further increase their vulnerability to labour supply shocks during the pandemic.

However, the pandemic cloud bears a silver lining too, with the leapfrog in digital tools adoption and the sharp change in consumer behaviours. The two factors combined have opened up a plethora of opportunities for any startup willing to rise to the challenges and deliver solutions for the new normal.

There has been a sharp hockey stick growth in industries such as ecommerce, hyperlocal deliveries, edtech, and healthtech segments among others. Startups in the fintech space in particular have a huge opportunity with this digital shift, once they are able to navigate the operational and financial hurdles that have risen sharply during this period.

Startups may have become even more financially fragile and in need of support for their short-term liquidity needs, but, at Afthonia Lab, we see it as an opportunity to help create value for them and for their end customers by giving them the guidance, access, and space they need in order to thrive.

We have always worked remotely because our panel of mentors and advisors have been operating globally. In that sense, our approach has not changed. But having said that, we want to scout for more startups in Tier I and II cities and we are also open to talking to mid-range startups who are struggling to scale.

Afthonia Lab mentor session

YS: How can better partnerships be forged between incubators, industry, and universities?

TM: Essentially as incubators, we play a catalytic role between industries and universities to fill the gaps wherever possible to make it a mutually beneficial partnership of innovation and commerce. I feel that our role is creating value for the startups and industries at large along with universities that nurture innovators.

For industries, it is reduction in the cost and time of transaction and helping them with innovative solutions. Think of an incumbent enterprise like Bajaj – instead of creating the solution from scratch, they will partner with a fintech company which can help them in getting a scalable solution at a better cost because of the expertise.

With universities, they have the knowledge and space and I think one thing that they lack is the industry expertise or business acumen. That is where we can fulfill the gap in understanding and eventually action.

YS: What are your recommendations for Indian policymakers to make business easier for incubators, investors, researchers, and startups in India?

TM: Creating an environment that encourages innovation and entrepreneurship is a great first step that our policymakers have taken. Having said that, being able to improve ease of business for startups and reducing the regulatory hurdles is an iterative process that the policymakers need to drive continuous focus on.

This holds even more relevance in the fintech space where things are evolving rapidly. Policymakers need to adopt agile approaches that allow more collaboration opportunities more easily and create a level playing field for fintech innovators solving different parts of the larger financial infrastructure problems that we as a nation face.

We could look at common sandboxes for different types of fintech innovations for instance. This could allow for cross-pollination of ideas and products that ultimately deliver a seamless experience to the end consumer, no matter what type of financial transaction is taking place.

YS: What are your recommendations or words of inspiration to the startups and entrepreneurs in our audience?

TM: The best advice that I can give to entrepreneurs is citing this quote by Rumi:

“Load the ship and set out. No one knows for certain whether the vessel will sink or reach the harbor. Cautious people say: “I’ll do nothing until I can be sure.” Merchants know better. If you do nothing, you lose. Don’t be one of those who won’t risk the ocean.”

Edited by Megha Reddy