Financial Inclusion: How Chqbook is making finance easy for India’s 63 million small businesses

Gurugram-based Chqbook’s all-in-one financial services platform provides bespoke solutions for small business owners, and makes daily ops easier with bank accounts, online book-keeping, short to long-term business loans, and insurance products.

Fintechs have been a boon for the nearly 63 million small businesses in India, which have otherwise had negligible access to institutional financial services owing to a range of issues such as haphazard bookkeeping, frequent loan defaults, and unverifiable documentation, among others.

New-age financial technology companies have found innovative ways to bridge the gap between these two important parts of the country’s economy, whether it’s by creating a platform to help banks verify data faster, or providing a full suite of services - including a savings account - to provide an end-to-end one-stop solution.

, a neobank specifically designed to service small businesses, is one such startup.

Founded in 2017 by Vipul Sharma, Rajat Kumar, Sachin Arora and Mohit Goel, Chqbook aims to build a financially inclusive ecosystem for small business owners through a host of products that can help power their day-to-day financial requirements.

From current accounts that offer rewards on daily transactions, customised insurance coverages and easy access to loans to digital ledger services that simplify tracking and maintaining transaction records, Chqbook’s suite of products claims to solve multiple pain points for small businesses. Its AI-driven platform also helps give small businesses better control over their finances.

“Small business owners have unique challenges and needs that we are trying to address through our mobile platform, which offers choice and access to a diverse range of financial products and services that are tailormade for this underserved segment,” Vipul tells YourStory.

Chqbook serves more than 500,000 unique customers across 25 cities in India. Each month, the startup processes over 40,000 customer applications, and has been onboarding more than 25,000 customers on its platform over the last few months.

Making banking easier for small businesses

The neobanking startup says its USP is its all-in-one “financial control centre” that brings all the products and services a business might need – daily, monthly, or yearly - together on a single platform.

For business owners, that translates into saving time that they would have otherwise spent sifting through paperwork or cumbersome banking procedure to access basic services, or even working on multiple apps.

Chqbook’s razor-sharp focus on this segment also allows it to offer products that fit the unique needs of small businesses. Its insurance service, for example, allows business owners to buy plans that are congruous with either the size of their shops and ventures, or even their cash flows.

Its lending business, which has so far helped disburse Rs 40 crore in total loans, takes into account the absence of formal documentation that is characteristic of micro-businesses in India, and helps them get swift access to loans without having to pay hefty fees or provide extensive documentation.

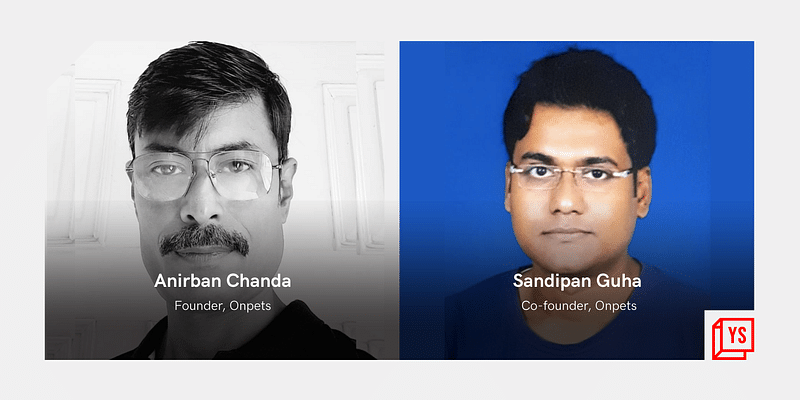

Mohit Goel (L), Vipul Sharma, Sachin Arora, and Rajat Kumar, the Co-founders of Chqbook

Choice, convenience, and speed

“Our service is powered by artificial intelligence and data analytics, which help assess the eligibility of a potential customer and ensures their financial requirements are fulfilled speedily, with minimum documentation,” Vipul says.

“By bringing choice, convenience, ease, speed, and access to financial products, we help small business owners manage their finances on a single platform so they can focus on what they do best – growing their businesses,” he adds.

Most of Chqbook’s clients - around 60 percent of them - come from Tier II cities while the rest comes from Tier III cities. The startup processed transactions worth $7 million within three weeks of launching its app. The average transaction value per small business is around Rs 2,000.

The Delhi-based company is planning to scale to more than 50 cities in the current financial year, and add 500,000 more customers.

The startup closely competes with services such as for Business, , , and , although not all provide end-to-end small business solutions.

The SME lending market alone represents a $1 trillion opportunity for fintechs by 2023, according to a PwC report.

“Over the next three to five years, we want to be the financial control centre for 10 million small business owners,” Vipul says.

Edited by Teja Lele