Budget 2021: Education sector expects loan subsidies, reduced GST slabs, tax breaks for startups, NEP implementation plan

Ahead of Budget 2021, the education sector expects the government to announce a wide array of policy measures and initiatives that will continue the growth of edtech and digital learning models.

India has one of the largest student populations in the world — over 260 million in K-12 education alone — with more joining the fray every year.

Hence, a country that is tasked with training, coaching, and skilling such an enormous number of young people requires efforts and policies at all levels.

Last year brought about new educational reforms in the form of the National Education Policy (NEP 2020). It brings foundational education into focus and stresses on experiential learning as opposed to scorecards and pass marks, and has been hailed as “progressive” by most industry experts.

They believe that NEP 2020 could be the start of many policy changes, initiatives, and programmes in the sector, and will help India achieve its goal of 50 percent Gross Enrolment Ratio by 2035.

Photo: YS Design

“It is compelling as it has changed after more than three decades. Pushed by the pandemic, NEP 2020 is paving the way to democratise education. It brings numerous changes in the education system, and for good…. The major challenge is the implementation that I look forward to seeing,” says Shashank Pandey, Co-founder, ConveGenius.

With the NEP 2020 build-up to Budget 2021, the education sector is awaiting key announcements and policy measures from the government on February 1.

YourStory’s conversations with edtech entrepreneurs, VCs, education financiers, schools and educational centres, helped pin down the industry’s top expectations from Union Budget 2021-22.

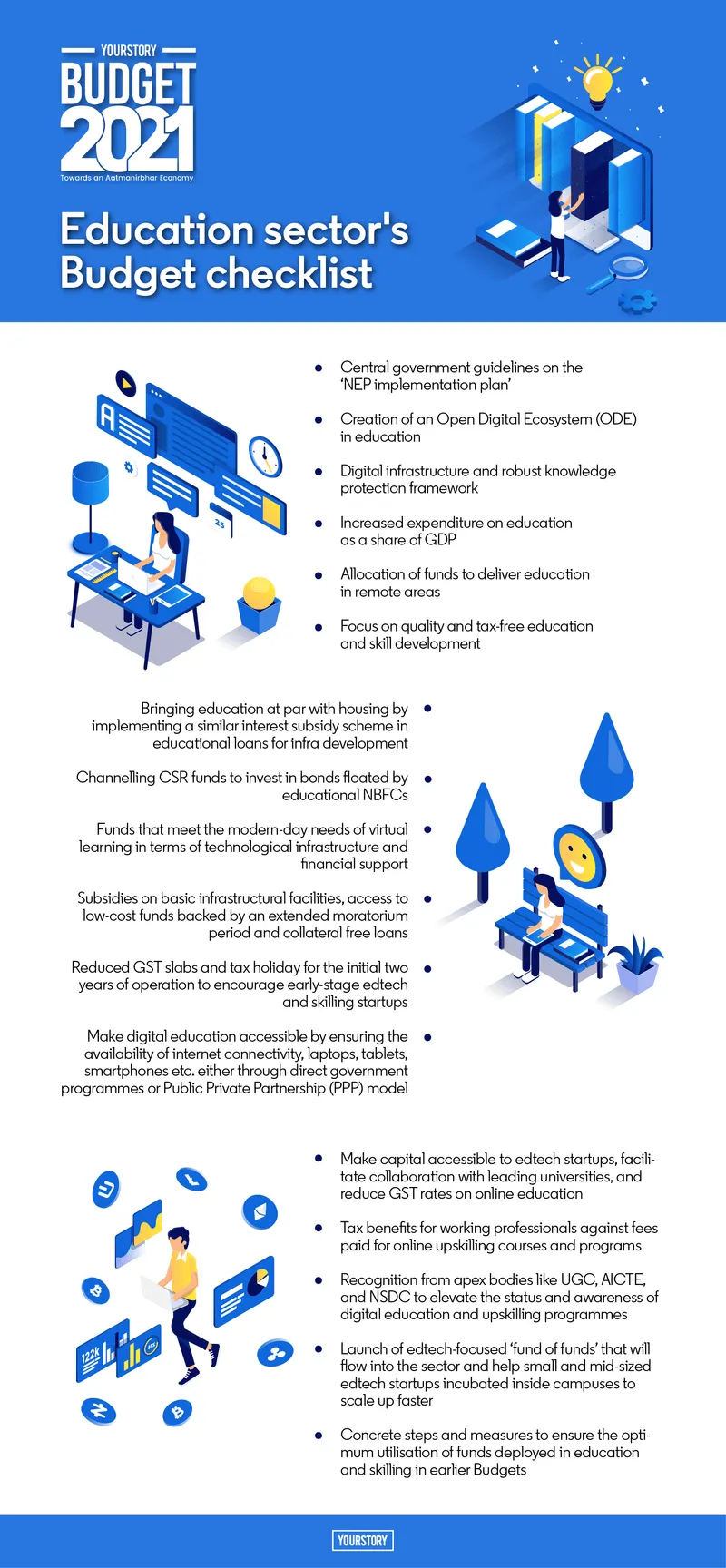

Infographic: Anubhav Anurag

What India’s top education executives expect

Mayank Kumar, Co-Founder & MD,

"It would be very beneficial for the government to extend its rule of allowing only 100 top universities to offer online courses under the Prime Minister's futuristic e-Vidya programme. Permitting more colleges to join the bandwagon of online education and conduct online courses would further enable collaborations between offline universities and edtech providers to help augment the reach of education.

Budget 2021 could also be an opportunity for the government to accommodate special tax deductions for online education and align education/learning as part of the investment bracket. Education is an intangible form of investment and should be treated as such to attract more people to sign up for courses."

Aakash Chaudhry, Managing Director, Educational Services (AESL)

“NEP 2020 has already set the pace for enormous skill development for the youth. We expect the government to increase education expenditure in the current education budget. With more focus on the implementation of the new policy, quality and tax-free education and skill development, the reforms will pave ways for more blue-collar jobs. We expect the government to put more focus on the usage of digital education in Tier II, III, IV cities.”

Charu Noheria, Co-founder and COO,

“Given that there has been significant surge in e-learning in the pandemic, the government must support us by allocating sufficient funds and devise strategies to make digital education accessible by ensuring availability of internet connectivity, laptops, tablets, smartphones etc. either through direct government programmes or through Public Private Partnership (PPP) model.

With NEP 2020 already setting the pace for enormous skill development, we would expect the government to increase the education expenditure in the current Union Budget for its implementation. This will provide the impetus required for upgradation of school infrastructure with state-of-the-art technology and will help to meet the demands of jobs in the future.”

Sandeep Wirkhare, Director & CEO,

“In the Budget for FY 21-22, we would like to see special provisions for the education segment that is the worst hit in the pandemic. Quality of education is directly impacted by the quality of infrastructure in schools. Private sector institutions including NBFCs have been playing a very critical role in this transition that got affected most during last year.

Bringing education at par with housing by implementing a similar interest subsidy scheme for educational institutions loan for infra development would go a long way in boosting much needed quality education in India. Also, channelling CSR funds to invest in bonds floated by NBFCs for education infra financing can be a big boost to the schools to get funding at affordable rates.”

Ankur Bansal, Co-founder and Director,

“For continued growth of the edtech industry, it is important that the government allocates appropriate funds to develop the digital infrastructure as demand increases beyond Tier-I cities. Funds can also be allocated under the education budget as the blended learning model will be more effective in solving India’s literacy problem rather than continued spend on physical infrastructure. Some official recognition can also be provided to edtech certifications to increase adoption.”

Varun Chopra, Co-Founder & CEO,

"Budget 2021 should introduce a few changes across the education and fintech sector to help the growth of the economy. Changes like encouraging spends on digital infrastructure as demand increases beyond Tier I cities will enable higher enrolment rates for online education. Also, reducing the GST to five percent or so from 18 percent for the edtech startups or by offering Budgetary concessions such as a GST waiver for digital transactions for education will ensure more participation in learning and skilling for the youth. All this will have a direct impact on the growth of the economy.”

Divya Lal, Founder and Managing Director, Fliplearn

“For a developing nation like India, with the world’s largest youth population, leverage provided by technology for education access and quality has been increasingly recognised and accepted. However, the prioritisation in the Union Budget has not kept pace. We hope all that will change in the forthcoming Budget. The edtech industry will need higher digital infrastructure and robust knowledge protection framework to build on the inroads it has already made in COVID-19 times.

Education’s expenditure share, which has seen some incremental increase over the years, needs to now see a substantial jump so that the opportunity for the spread of technology-led education across the length and breadth of India is not lost... It is the hope that the government will allocate suitable funds in the Union Budget 2021 to assist the edtech sector in building strong digital infrastructure across the country, including the remote areas.”

Sumeet Verma, Co-founder and CEO,

In this Budget, we would like the FM to extend some relief in terms of GST and subsidy on education loans given for both formal and skill-based learning. The government should also look at launching an edtech-focused ‘fund of funds’ that will flow into the sector and help small and mid-sized tech companies and startups incubated inside campuses to raise the much-needed money for a faster scale-up.

Rameswar Mandali, Founder and CEO, SKILL MONKS

“Keeping skilling as a priority, the government must provide training institutions with financial support through the Union Budget 2021- 2022, by offering subsidies on basic infrastructural facilities, providing access to low-cost funds backed by an extended moratorium period and collateral free loans. Similarly, to encourage quality edtech startups and more professionals to get into the skilling domain, the government should look at a tax holiday for initial two years of operation.

To ensure that skilling is prioritised the government in this Budget must make provisions for reduced GST slabs, encouraging young graduates and working professionals in getting skilled in a domain of their choice and stay relevant in a dynamic market environment.”

Beas Dev Ralhan, Co-Founder and CEO, India

“Stakeholders in education have an array of expectations from the government. This includes support in facilitating a smooth transition from traditional methods of teaching-learning to an online mode of education. The education sector is looking forward to a Budget that meets the modern-day needs of virtual learning in terms of infrastructure and financial support.

The shift to virtual learning requires sufficient funds that will empower the education system. Promoting the inclusion of AI and other emerging technologies into teaching-learning practices will change the face of education for the better.”

Amit Gainda, CEO, Services

"To make the sector stronger, it is crucial to grant infrastructure status to education institutions, thereby, making quality education affordable and accessible for deserving Indian students. The focus from the government and the easy availability of capital will induce an environment of innovation in the field of education, which can help bridge the demand-supply challenges in this sector.

The Union Budget should also implement reforms such as refinancing of retail education loans for lower ticket sizes. Such financing schemes can provide a boost to the education loan segment and contribute to liquidity management for NBFCs."

Achin Bhattacharyya, Founder and CEO, Notebook

“The pandemic has highlighted the need for investment in technology across levels, and it’s high time that this be taken up on a war footing. We need to digitally connect all schools in the country and also ensure smooth glitch-free working of the digital infra post its implementation. Also, the creation of tech hubs, from where quality vernacular content can be disseminated, is the need of the hour.

Considering the role that edtech companies played during the pandemic, it will be a prudent step if they are given the required support and impetus to grow by making capital accessible to them, facilitating various collaboration with leading universities and by reducing GST rates on online education.”

Surabhi Goel, CEO, Aditya Birla World Academy, Aditya Birla Education Academy, The Aditya Birla Integrated School

“The new normal in education calls for a renewed focus and investments in order for our educational institutions to be at par with their global counterparts. There is an increased need for investing in virtual forms of education and training through digital tools, upskilling and digital training for teachers through interactive mentoring sessions, leadership training and more.

We hope the government increases the funds allocated to the education sector especially when it comes to resources such as the internet as this will open up countless new opportunities for the sector to grow and thrive.”

For YourStory's multimedia coverage of Budget 2021, visit YourStory's Budget 2021 page or budget.yourstory.com

Edited by Saheli Sen Gupta