ESI Inspection

How to prepare yourself for an ESI inspection

Most ESI inspections are preceded by an auto generated mailer / notice of Inspection by the ESI department. We would like to appraise you about how to be prepared to handle the ESI inspection without hiring a consultant.

Though ESI is a HR subject, help is required only from the Finance team when it comes to ESI inspection. Hence ask the Finance team to be available to help because every ESI inspection starts with verification of the Financials of the entity. It is all to do with, how the numbers match. The break-up of the employee related numbers in the financials and how the same matches with the employee wise pay records.

Don't just focus on the ESI deduction as per pay records & subsequent on-time payments. There are other factors that take importance during an ESI inspection. What are such other factors that take importance?

1. Contractor related ESI deductions - Obtain ESI registration certificate from the contractor. Ensure that the contractor has remitted ESI payments to its employees posted in your premises. Examples of contractors are Security, Housekeeping, staffing contractors, Job work contractors etc

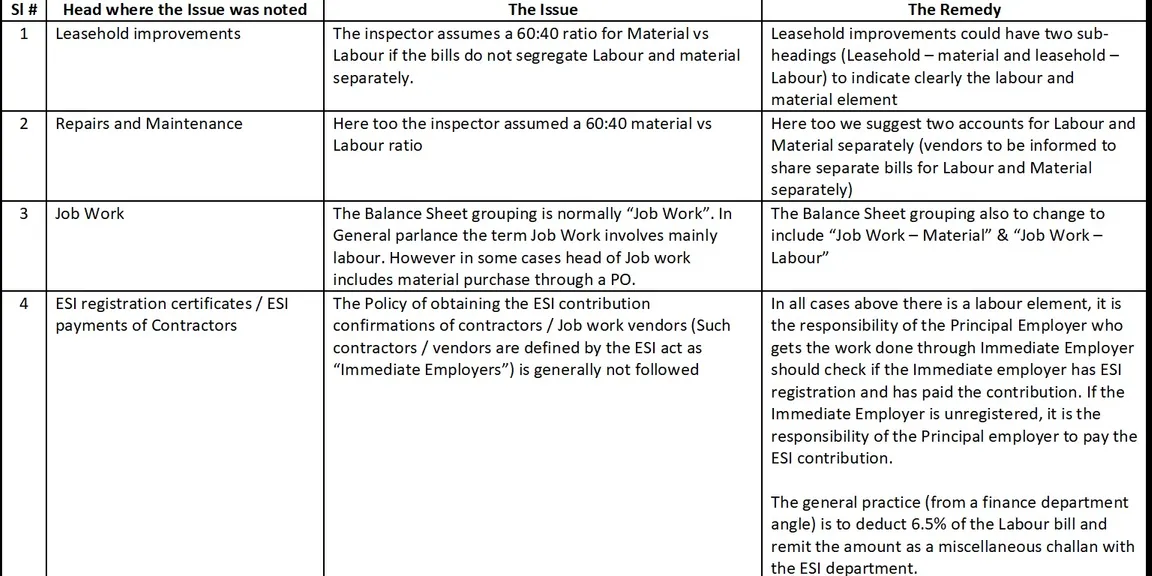

2. Repairs and Maintenance, Lease hold improvements, Professional Fees - These are common accounting heads that are used by the finance team. The ESI officer will browse through the ledgers and verify the bills of these accounting heads to see if there is an incidence of labour in any of the activity performed. If there is an incidence of Labour, ESI would be applicable on the labour related costs. Any other head of account that would warrant an incidence of labour expenditure like Warehousing charges or miscellaneous expenses could also be reviewed.

3. Cash Ledger - It could be normal in the course of business that certain small and miscellaneous salaries of certain employees would be paid in cash from an ease perspective. The ESI officer would review this ledger to check for unapplied ESI liability on cash based salary payments.

The above clearly explains why the ESI inspection is a Finance subject and not an HR subject. Some advice to the Finance team to ensure correct accounting to prevent an ESI interest / penalty after inspection.

Hope this gives some insight on how to be prepared for an ESI inspection.