List of Approved GST Suvidha Providers (GSPs)

The sudden introduction of a changed return filing system under Goods and Services Tax (GST) regime created a spur of confusion among taxpayers. Therefore, the concept of GSPs was boosted so as to reduce these confusions among the taxpayers. Lists of GSPs were approved by the GST Network (GSTN) to help taxpayers in carrying out various processes of filing returns.

The topics covered in this article are:

1. What is GSP?

2. How is GSP Approved?

3. List of Approved GSPs

1. What is a GSP?

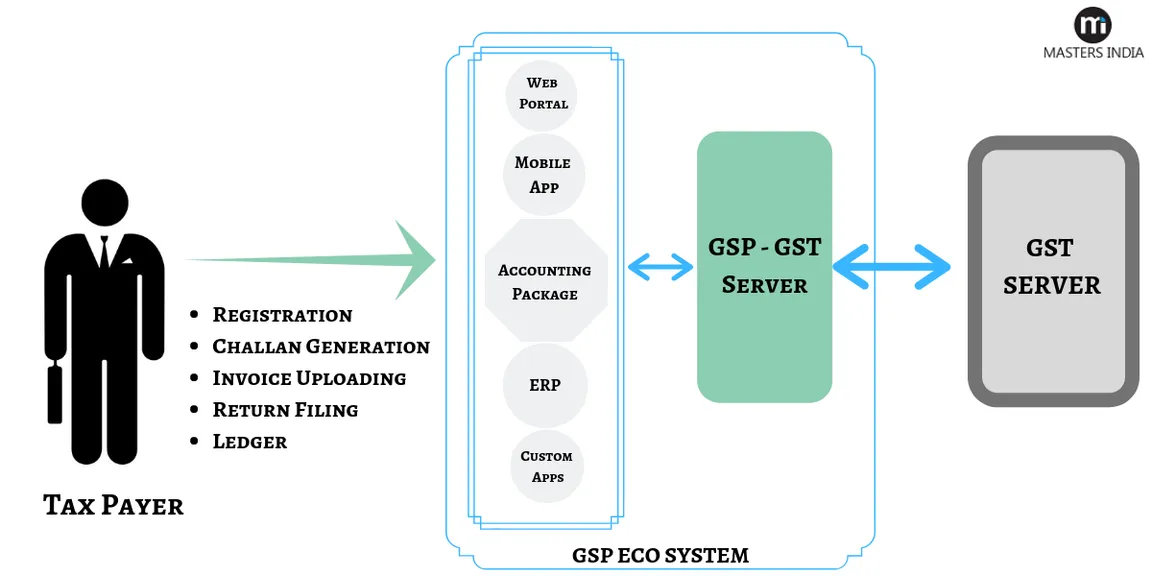

A GST Suvidha Provider (GSP) is a facilitator which helps taxpayers to file their returns efficiently. These GSPs also come of aid to businesses by carrying out various functions of a business. GSPs bridge the gap between taxpayers and the GST Network(GSTN) through their ASPs. They provide software applications to taxpayers in the form of Application Service Providers (ASPs) which provide an interface through which the return filing processes can be made easier.

2. How is GSP Approved?

A GSP first needs to be approved by the GSTN. Once approved, it is provided with an API through which the GSP can enhance systems for taxpayers. GSPs cannot read any data or modify it, but can use the interface (API) that the GST Network provides them to make the return filing processes more simple and accurate for taxpayers. Through these APIs, GSPs can enhance the systems to improve the return filing mechanism for taxpayers.

The criteria for selection of GSP were:

1. Financial Strength:

- GSP must have paid or raised a capital of minimum Rs. 2 crores

- GSP should have had an average turnover of minimum Rs. 5 crores in the previous three financial years (2014-15, 2015-16, 2016-17)

- Unaudited results of the respective Financial Year duly authenticated by only the Company Secretary may be quoted so as to be followed up by signed and audited balance sheets. A copy of audited balance sheet’s relevant page should be shared.

2. Technical Capability: GSP had to create software to file GSTR-1, GSTR-2, and GSTR-3 along with reconciliation so as to demonstrate its technical capabilitywithin a month of being offered the opportunity.

3. Technical Eligibility: Potential GSP should achieve at least 60% marks on the software demonstration test to be approved as a GSP.

3. List of Approved GSPs

Upon passing the criteria, the following list of 34 GSPs was approved by the GSTN in 2017:

- Alankit limited

- Bodhtree Consulting Limited

- Botree Software International Pvt. Ltd.

- Central Depository Services (India) Limited

- Computer Age Management Services Private Limited

- Cygnet Infotech Private Ltd

- Deloitte Touché Tohmatsu India LLP

- Ernst & Young LLP

- Excellon Software Pvt. Ltd.

- Gofrugal Technologies Private Limited

- Hazel Mercantile Limited

- Iris Business Services Limited

- Karvy Data Management Services Limited

- Mastek Limited

- Masters India Private Limited

- MothersonSumi infotech & Designs Ltd.

- NSDL e-Governance Infrastructure Limited

- RAMCO Systems Limited

- Reliance Corporate IT Park Limited

- Seshaasai Business Forms Private Limited

- Shalibhadra Finance Limited

- SISL Infotech Pvt. Ltd.

- Skill Lotto Solutions Pvt. Ltd.

- Spice Digital Limited

- Sugal & Damani Utility Services Private Limited

- Tally solutions Private Limited

- TATA consultancy services Limited

- Taxmann Publication Pvt. Ltd.

- Tera Software Limited

- Trust Systems & Software (I) Pvt. Ltd.

- Vayana Private Ltd.

- Velocis Systems Pvt. Ltd.

- Vertex Customer Management India Private Limited

- WeP Solutions Limited

The most recent list of additional GSPs approved by the GSTN in 2018 is:

- Span Across IT Solutions Private Limited (TaxSpanner)

- Compare Infobase Ltd.

- RajCOMP Info Services Ltd.

- PricewaterhouseCoopers Pvt. Ltd.

- Professional Softec Pvt. Ltd.

- Zephyr Limited

- CSC e-Governance services India Ltd.

- E-Connect Solutions Pvt. Ltd.

- Balaji Mariline Pvt. Ltd.

- APRA and Associates

- Abhipra Capital Limited

- KPMG India Pvt. Ltd.

- VG Learning Destination (India) Pvt. Ltd.

- Webtel Electrosoft Pvt. Ltd.

- Image InfoSystems Pvt. Ltd.

- Binary Semantics Ltd.

- Zoho Corporation

- Gamut Infosystems Ltd.

- Diya Systems (Mangalore) Pvt. Ltd.

- Agile Labs Pvt. Ltd.

- Tally (India) Pvt. Ltd.

- Net Access India Ltd.

- BCITS Pvt. Ltd.

- Winman Software Pvt. Ltd.

- AARMS Value Chain Pvt. Ltd.

- Ray & Ray, Chartered Accountants

- Sreeven Infocom Ltd.

- Focus Softnet Pvt. Ltd.

- Medhassu e-Solutions (India) Pvt. Ltd.

- NETXCELL Ltd.

- Payswiff Solutions Pvt. Ltd.

- Chartered Information Systems Pvt. Ltd.

- Manuh Global Technologies Pvt. Ltd.

- Adaequare Info Pvt. Ltd.

- 3i Infotech Ltd.

- Perennial Systems

- BDO India LLP

- (n)Code Solutions – A Division of GNFC Ltd.

- CDSL Ventures Ltd.

The list of Government Agencies selected as GSPs in 2018 includes:

- Commissioner of Commercial taxes (CCT, Karnataka)

- BSNL

- Gujarat Livelihood Promotion company (GLPC)