Online Fixed Deposit: Why it's the best, things to know

Save your precious time by opening FD online

Opening a Fixed Deposit (FD) online was never this easy! There is no need to visit the bank physically and a term deposit can be opened at the click of a button at the convenience of your home. This not only saves time but also gives you a number of other additional benefits.

Opening a deposit online is very simple. For example, if you have a State Bank of India (SBI) account, first check out the FD rates of SBI, choose the best tenure that pays a high rate of interest and also choose the type of deposit. All this can be done online by logging on to the bank website, where information about the types of deposits and interest rates will be available.

To open an FD online, the prerequisite is an active internet banking account. If you do not already have one, then request your bank to provide you one.

Let us now understand the steps involved in opening an FD account online. Let's say we want to open an account with SBI.

How to open SBI FD online

Step 1: Log on to the SBI portal and key in username and password

Step 2: Navigate to the home page, go to the main menu on the top and then click on the ‘e-fixed deposit’ tab. Here you have to click on ‘Open new a/c’

Step 3: Now, proceed to choose the type of deposit account you want to apply for. Be it a regular fixed deposit, tax saver fixed deposit or term account with sweep in facility

Step 4: Choose the savings account from which the money has to be debited in case you have multiple FD accounts.

Step 5: Fill in all the columns such as account number, type of interest payout option, principal amount, etc

Step 6: Read all the terms and conditions and then accept them

Step 7: Verify all details and then click ‘Submit’

How can a senior citizen open an FD online

Senior citizens can make use of online facilities as it will be more convenient for them, thereby, eliminating the need to physically visit a bank. Online term deposits are an ideal option for everybody and especially senior citizens. This gives them a number of advantages and the best of all, it is the convenience factor. The aged can simply, sit at home, compare FD rates online and apply for the best deposits online without any hassle of running around or paper work.

Step-wise process for senior citizens to open FD online

Step 1: Log on to the bank website internet banking portal

Step 2: Go to the online deposit option in the main menu

Step 3: Before proceeding, click on the ‘senior citizen’ option. This will automatically apply the additional interest rate benefit that those above 60 are eligible for

Step 4: Fill in all relevant details such a principal amount, type of term deposit, tenure and choose the interest payout options

Step 5: Verify all details and click on ‘Confirm’

Step 6: Enter the password and complete the transaction to successfully open an deposit account

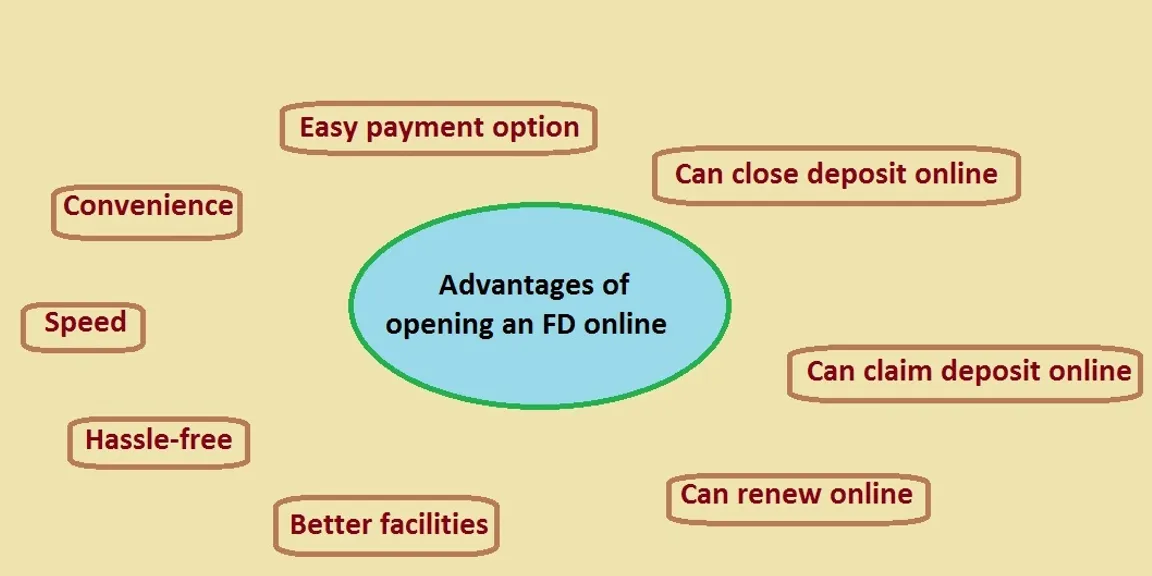

8 Advantages of opening an FD online

There are numerous benefits of opening a fixed deposit online. Let us understand some of them:

Convenience: The online advantage factor cannot be ignored because it gives you the convenience to open a deposit account while sitting in your own home or anywhere in the world and at anytime. FDs can also be opened through mobile banking by downloading the particular bank’s app on your phone. This gives an added convenience factor.

Speed: A time deposit can be opened within a matter of a few seconds online. There is no need to spend time to travel to a bank's branch, wait in a queue and then travel back in traffic. All you have to do is log in to the internet banking account, fill in relevant details and open the fixed deposit. The money for the term deposit will be automatically transferred from the savings account of the customer.

Hassle-free: When it comes to an online time deposit, there is no hassle of filling forms or doing paperwork. Since all KYC details are already with the bank and verified through the internet banking account, there is no hassle of paperwork.

Better facilities: Many banks provide extra perks or discounts for those who open a deposit online. These may be in the form of gifts or other types of benefits. Many banks also provide insurance offers for those who open term deposits online. Also, one can take advantage of all benefits by opening an FD online, such as loan/overdraft facility, nomination facility, etc.

Can renew online: The best part is that renewals can be done online at the click of a button. This is a great advantage because it eliminates the need to fill multiple forms and requests for the renewal of the deposit.

Can claim deposit online: Once the maturity period has been completed, sometimes people forget to renew and in such a case it automatically goes for auto renewal. However, in case a deposit has matured, the customer is likely to forget to claim the amount in some instances if the deposit in not opened online. However, if it is online, it will appear on the net banking account and notify the customer, hence the chance to miss claiming the deposit is less likely.

Can close deposit online: Another benefit is that premature withdrawal can be done online at the click of a button and the money will be automatically credited to your savings account in no time. Unlike, the offline method of closing the deposit, where the customer will have to appeal to a bank manager to close the time deposit account.

Easy payment option: In the online method, the amount is directly debited from the savings account of the customer and thus it is an easy payment option. This eliminates the need to carry a lump sum to the bank or visit the bank, etc.

To sum it up, going the online way is a very wise decision. Not only is opening a fixed deposit online an easy and hassle-free process, it offers a number of additional benefits and perks that is not available through the traditional method of opening an FD.