All You Need To Know About SBI Term Insurance

SBI Term Insurance plan is a well-defined plan for an individual on whom others are dependent. If you are one of them, then you need to take this term insurance plan in order to avoid financial problems after your death.

Have you ever thought what will happen to your family, if, all of a sudden, you are not there to support them anymore? To make sure your family does not go through any financial crisis after your death, you need to have a term insurance plan. As you cannot take any risk with the future of your family, make sure you go through a proper research to get the best insurance plan for your parents.

When it comes to the competency of the company, you need to know that SBI has received various awards and was also awarded as the best insurance provider. SBI Term Insurance Plan is an incredible protection plan that removes all your stress and worries and provides financial protection to the family of the policyholder.

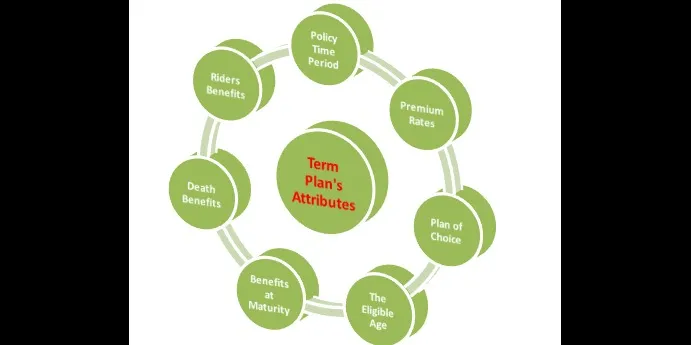

SBI Term Insurance plan offers comprehensive insurance cover at a very reasonable cost. The plan guarantees financial stability and protection in case the policyholder, unfortunately, passes away during the policy term. However, one point which is to be noted is that the policyholder renders only Death benefits and does not offer any maturity benefits. Apart from the main coverage, SBI Term Insurance plan also gives their users an extra death benefit rider that helps them to extend their cover.

SBI Term Insurance Plans can be taken online and through an Offline mode. However, it is advised to apply through online mode, as it is much cheaper and hassle-free as compared to the Offline mode. One of the main things that you need to look into a term insurance plan is that it must offer coverage for a maximum policy term. Moreover, a plan needs to cover all kinds of deaths under this plan. One of the most important things that you need to note under the term insurance cover is their exclusion policy. For instance, suicides and death due to natural calamities are covered only after 12 months of taking the policy.

Benefits offered by the Plan:

• Instant Life coverage.

• High coverage at a very low premium.

• Applicants can avail regular as well as single payment mode depending on their choice.

• Both online and offline modes are available for the purchase of the policy.

• Policyholders of this policy are eligible to avail tax benefits as per Section 80C of the Income tax act

• To extend the benefits of the policy, you can avail an additional rider as well.

Case Study: SBI Term Insurance Plan

Mr. Ram Manohar Gulati opted for SBI Term Insurance Cover Option when he was 40 years of age. His policy term was 20 years and the term insurance plan that he purchased was for Rs. 30,00,000, Which implies that if Mr. Gulati passes away untimely, then the nominee will get Rs. 30,00,000 as the sum assured.

This implies that the basic life insurance cover plan is the one that pays you in case the policyholder passes away during the policy term. However, if Mr. Gulati survives through the policy term, then he will not receive any maturity benefit.

SBI Life eShield Term Plan

One of the popular term plans of SBI is SBI Life eShield Term Plan. The SBI Life eShield Term Plan is a non-participating and non-linked Term Plan. Policyholders can leverage this plan at quite an affordable cost and get financial protection coverage for their loved ones. This helps them to tackle the unforeseen circumstances, as the benefits are drafted as per an individual’s personal requirement. This plan further gives 4 options to the applicants that are as follows:

1. Level Cover - This plan offers the same sum assured throughout the policy.

2. Level Cover including Accidental Death Benefit - This plan offers the policyholders to get an additional coverage if the policyholder passes away due to an accident. However, the insured event should occur before the end of the policy term.

3. Increasing Cover – Those who are considering various factors such as increasing liabilities, inflation, and higher insurance, then you can opt for this plan. Under this plan, the sum assured is increased by 10% on simple interest after each 5 years. However, your premium remains the same.

4. Increasing Cover including Accidental Death Benefit – This plan is similar to that of the Increasing Cover plan. However, the policyholder gets an additional sum assured in case the policyholder meets with an accident.

In a Nutshell!

Every individual wishes a healthy and wholesome life for their near and dear ones. Term plans offered by SBI Life allow individuals to provide a comfortable life for their family even if they are not present to support them.