Getting the investors your startup needs

Every business begins with an idea. And to bring that idea from thought to a successful enterprise can be a tough and stressful process. In fact, very few new businesses actually make it five years before they fold. In fact, some statistics show a 90% failure rate.

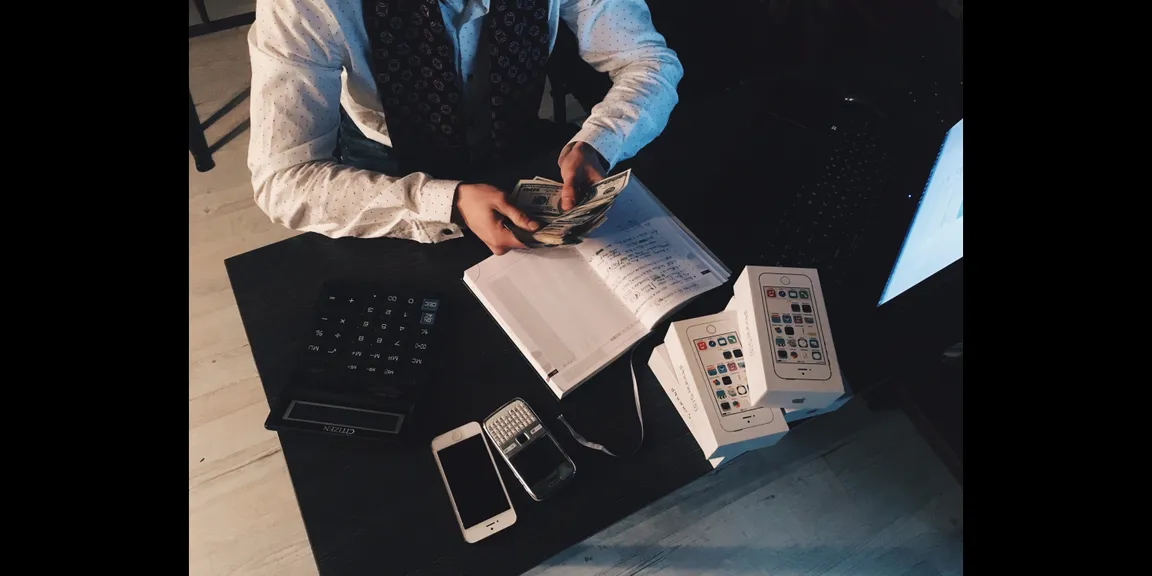

There are many reasons for failure, though a huge factor is simply running out of money. If you have planned well, you know how much you will need to see your startup through to making a profit. And if you don’t have that kind of cash, you have to look for investors. But make no mistake about it – the competition for investors is brutal, and you will have to be well-prepared in advance of approaching any funding sources.

Before You Make Your Pitch

There are some important steps to take before you make your pitch to anyone.

1. Have a solid business plan.

This means that you have done the research, you know the market viability; it means you know how much competition there is and how you are different from that competition; it means you have a marketing plan and more.2. Formal or Informal Plan?

Depending on where you are going to seek to fund, you will make this decision. Some entrepreneurs create both so that they can pitch to all types of investors. Do a bit of research so you understand what must be included in each type and how to format them.3. You must have a very clear idea of how much you need and what it will be used for.

4. You need to prepare yourself

– you may literally go to hundreds of sources before you get funding, and you may have to get funding from more than one source to get all that you need.5. TIP: Do not scrimp on the amount you need.

Nothing is worse than being too frugal, getting close to success, and then running out of money.6. Prepare an oral and a written presentation separate from the business plan.

You will be meeting with investors face-to-face or you will be writing an introductory letter/proposal. These must be engaging and compelling. If you are unsure of your ability to write such a piece, you may want to employ an essay writer to do so. Research top companies reviews and get some samples before you pay for such a service.Sources for Funding

1. Check out Startup Launch Platforms

These are companies that offer assistance and information to startup entrepreneurs, including how to approach investors. Two of the most prominent ones are startups.co, with about 14 million members and Gust. Joining these can get you in front of investors who have an interest in your niche.

2. Crowdfunding Websites

There are lots of crowdfunding groups, and it will take some research to find those that are a good fit for you. Most of them have a focus on specific industries and niches, and there are specific requirements to meet and what incentives are provided to investors. Make sure you are okay with these. The most well-known crowd funders are Kickstarter and Indiegogo for general public investing, RocketHub for wealthy individuals who are committed to assisting new entrepreneurs of merit, and OurCrowd, for groups of investors looking for new ideas.

3. Angel Investors

Angel investors are called such because they are individuals who genuinely want to provide funding, mentoring, advice, and connections to startup founders. There are several organizations of angel investors – Funded.com, Angel Capital Association and Angel Investment Network – among them.

You can even look for angel investors who are in your local area – American Capital Association has a directory. And all of these sites divide up into categories, so you are not presenting your pitch to those who are not interested in your niche.

Interestingly, city governments and even some local Chambers of Commerce are partnering up with angel investors to stimulate new business in their cities.

4. The Small Business Administration

While its services have cut back some in the past decade or so, this is still a decent source for loans and grants. If you want to be totally independent, this is a good place to go. Grants complex, so are certain that you have some help writing yours.

5. Incubators and Accelerators

Your startup is a personal, physical, and emotional investment on your part. One of the things you have to decide is how much you are willing to “let” others in. If you are willing to consider giving an equity position to investors, then incubators may be the way to go. Basically, if you find an investor who is interested, she may provide you with all sorts of stuff, like office space in his building, lots of mentoring and advice, and, of course, funding. These investors want to play a bigger role in your startup, so you must be willing to allow that.

If you want this type of funding, then check out the National Business Incubation Association – you can find incubator members locally.

Accelerators will provide small amounts of funding, but can also put you in touch with larger investors they know. TechStars and Ycombinator are two accelerators you may want to check out too.

6. Niche and Industry Social Networking

You may not have heard of EFactor, Xing, Startup Nation or Plaxo. These are social networking sites that help founders and investors connect, even on a global level. A simple Google search will bring these up and you can “shop” by niche.

7. Web-based Lending Platforms

Getting traditional bank loans have become much more difficult, especially since the 2008 crash. Some of them are peer-to-peer; others are investors looking for startups with potential. Of course, there will be interest and/or equity positions to pay. Check out platforms like TrustLeaf and Prosper.

8. Private Equity Companies

If you have launched, or are close, this is a possibility. These firms look for startups that are “on their way” and promising. Usually, they invest and then sell their stake a few years down the road, making a good profit.

If you go for this type of funding, you really have to have all of your “ducks in a row”, including at least a prototype or MVP of your product or service. If you access FundVenture, you will find a directory of firms looking to invest and in what.

9. Friends and Family

This may be the easiest source of funding; however, it can also be the trickiest. Friends and family members know you and they know how hard you have been working to get this idea launched.

Do not have “handshake” agreements. Put everything in writing, and be certain that they know the risks involved – that they could lose all of their investment. You don’t want “falling outs” with people you really care about.

Steadfastness and Patience

You will not get funding overnight, and you will not be inundated with investment offers. In fact, you will face lots of rejection. But don’t stop. It only takes one source with the amount you need, and that source may be the very next one you contact.