Is demonetisation a blessing in disguise for marketers?

A brief study on how a cashless economy can help brands and marketers in understanding and reaching their customers better than ever

As the dust from India’s much talked about demonetisation drive settles, Corporates and MSMEs alike can be seen chalking out strategies and pivot models to make the most of a cashless economy. While a lot has been discussed on hits and misses of the move for the masses, an increased digital trail of cashless transactions brings a huge plus to the marketers in understanding their customers better. Before we get to how a cashless economy helps with it, I’ll just lay out the underlying reason on why we feel that understanding your customer’s behaviour is more important than ever.

It’s no rocket science that to sell any product/service to a customer, you need to understand the buyer’s psyche. Although, the rapid digitisation has enabled the marketers to reach out to millions of customers through the click of a button, a flood of promotions and offers has considerably reduced an average customer’s attention span to a mere 8.25 seconds – shorter than that of a goldfish. It is, therefore, imperative that the marketers know How, When and Where their customers like to spend and reach out at the most opportune moment. As mentioned in one of our earlier blogs, the recent outburst of heavy discounting as a customer acquisition strategy has gotten brands low-lifetime value customers, with a below par Return on Advertisement Spend for the longer term. It is about time that the brands treat their offers as a privilege by reaching all and specifically, the right customers at the right time.

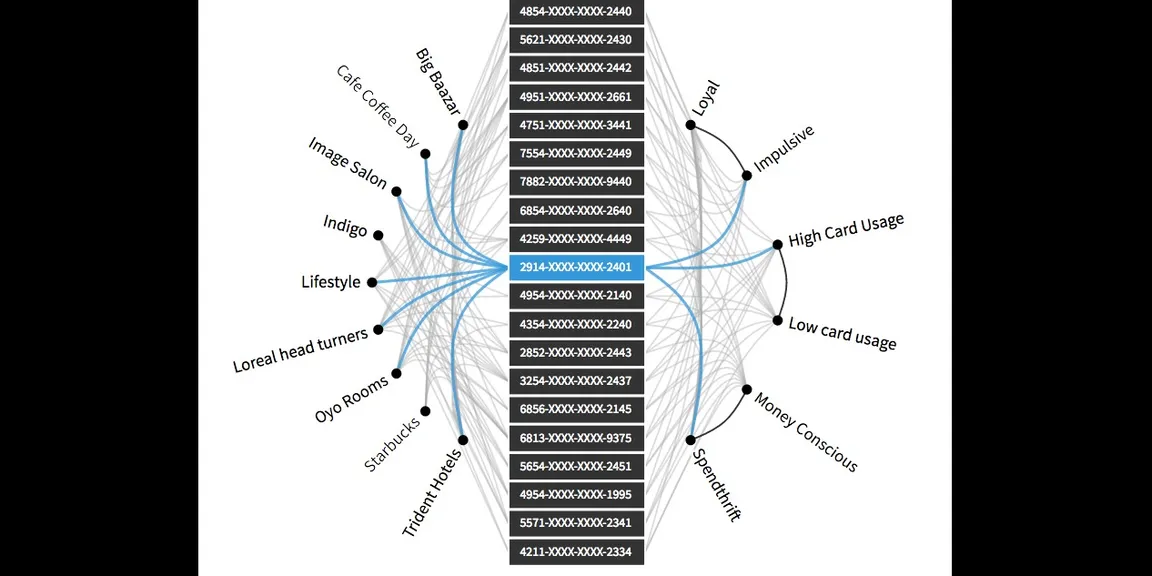

Back to how demonetisation promises to be a blessing in disguise for marketers. At present, a traditional customer profile based on demographics looks something like this: Male, middle class, 20-30, salaried professional, has kids, likes movies. But can we really rely on targeting customers with such broader buckets of categorisation? If you ever wondered, transaction data can tell a lot about a customer. What if someone could tell you the shopping pattern of your regular and infrequent customers (not just at you, but everywhere they shop) to help you appeal to them better? What if from a pool of millions, you could identify the thousands who’ve never been to your store but match the profile of your regular shopper? Wouldn’t you, as a marketer love to reach them specifically at the right time with a better deal?

It is a common practice among marketers to engage in discounting wars for customer acquisition. To give you an idea about the power that this cashless trail entails, we found out a very interesting insight coming out from the data while crunching numbers for fun. We looked at the transaction data of 1 lac customers of one of our partner banks in Delhi and Mumbai, spanned over 3 months. Even amongst two e-commerce giant competitors, which may look identical in their offerings, the profile of high lifetime value customers can be easily distinguished. For example, on an average, a frequent 'X e-commerce company' customer has an average transaction size of about Rs. 1500 across all his shopping patterns whereas for the other competitor, the numbers go upto Rs. 1800. The insights only got more interesting and meaningful once we started looking for the devil in the details. Yes, there will always be switchers who shop at a particular store just for the discount but spray and pray marketing doesn’t seem to work to drive a customer’s long term value towards a brand. A thought to ponder upon after looking at these insights is ‘How much value can these brands gain if they attracted more of their prospective loyal customers with a marketing strategy focused on the right target audience.’

Being able to intricately understand a group of customers, predicting when and how their next purchase can be is where spend based micro-targeting could be a kingmaker for the brands of the next decade. Being customers ourselves, we all love when someone showers us with a gift, just at the right time. A more cashless economy opens a host of avenues and we, at Connaizen are stoked about bridging this gap between a brand and its customers, thereby driving a higher customer affinity and happy sales for our partners.