Indian startup investments increase by 300% in Q1 2015, beats China in the number of deals

This post has been updated. There were a few inaccuracies in the data points used for the analysis which have since been corrected.

Today India’s story shines with an amazing opportunity. With more connected users, comes growth like never before. Check the Q1 funding infographics here. Or buy the raw data here.

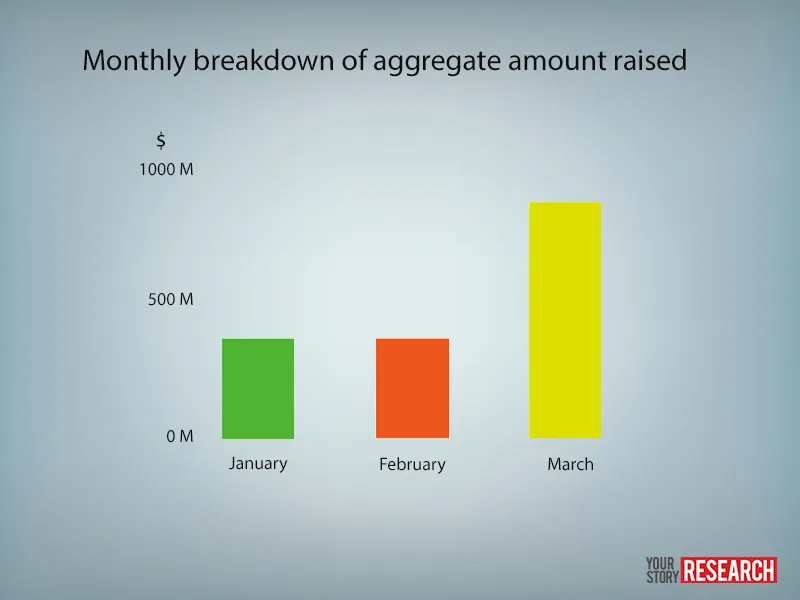

According to the data that YourStory compiled in the first quarter of 2015, Indian startups raised $1.7 billion from investors. On an average, we’ve reported at least two startup fundings per day between January and February 2015. The charts we put together will give you a snapshot of the aggressively expanding startup funding landscape in India.

Last year in Q1, startups in India had raised close to $450 million. That means the 2015 Q1 figures show a 300% growth in the amount raised. There were 300 deals in the entire year in 2014 – half of that many deals were made in Q1-2015. In India we saw 147 deals between January to March, declared investments totaled at $ 1.7 billion plus around 30 deals with undisclosed amount. In the similar time frame, the UK startup scene saw $ 682 million investment and the U.S. startups have raised about $9.7 billion in Q1 2015.

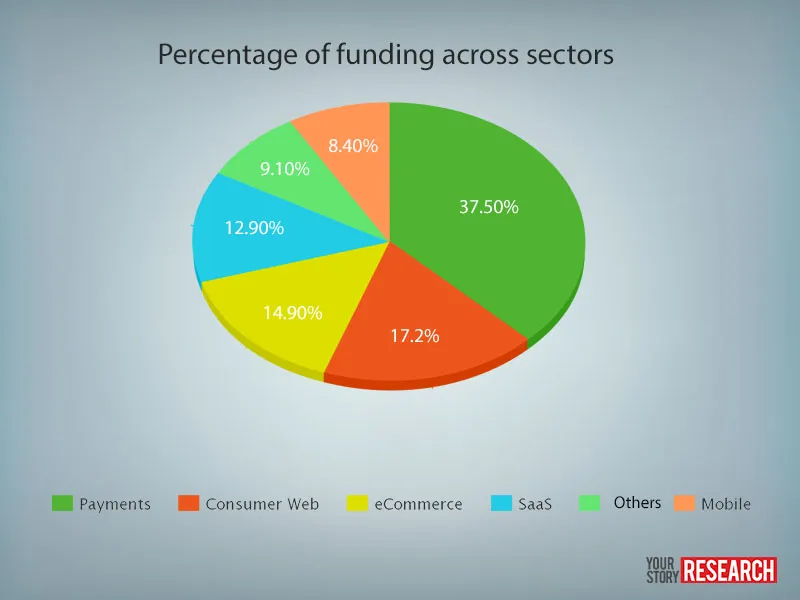

What sectors got how much % of the funding

Payments and consumer web sectors have gobbled up more than half of the entire funding amount; mobile, eCommerce and SaaS companies and others accounted for the other half. Investor money is chasing established e-commerce players, newer e-commerce entrants aren’t getting funded as much.

Highlights e-commerce: social-commerce is becoming a big play, startups like Limeroad, Wooplr and Tripoto are leading the way in offering consumers a more personalized way to go shopping online.

Highlights on mobile: Feeding healthy food and juices to the office goers has become not only cool but also serious business for on-demand food delivery apps. Most of these apps take their orders via WhatsApp or with their own app. Startups like ‘Frsh’ are doing a good job of feeding folks, while startups like FreshFood are serving juices that are not pasteurized but cold-pressed juices to minimize oxidation.

Tech is going mainstream in India

This Hindi saying depicts the very basic human needs: “roti, kapda aur makaan” (which means food, clothing and housing). The Indian internet business was solving the makaan problem with the old players like Sulekha, MagicBrics. And now the new gen players like Housing and CommonFloor are aggressively trying to solve makaan for younger population. As Internet is taking fashion and luxury to all corners of India, the kapda problem is being addressed by all the major e-commerce players from Myntra to Zovi to Jabong and YepMe. Finally the 2015 Q1 can be dubbed as a time startups mushroomed to solve roti with apps. After being familiarized with e-commerce, the convenience economy is making it easy for people to order their food and grocery via apps.

Apart from dating apps scene, the food and grocery delivery sectors were the hottest zones attracting investors money; TinyOwl, TabCibo, FoodPanda, and Frsh were injected with investor money. Also, the budget hotel/accommodation space has been getting hotter for quite sometime – at the forefront of this you’ll see startups like Oyo Rooms getting funded.

The most active investors for the quarter

Apart from the U.S., big VC firms were quite focused in investing in China and India. The first quarter of 2015 saw 67% more deals in India than in China in absolute volume. Though in terms of value, investment in China was 3.9 times bigger than India. Sequoia Capital was the most active VCs of the quarter, in Asia Pacific region they have invested in 32 deals and 13 deals were in India. Tiger Global has invested in nine Indian startups. IDG Ventures has been active in APAC region by investing in 20 deals out of which seven were done in India. Our general observation is that seed and bridge round deals are getting bigger year after year, and large Series A is becoming more common. The general sentiment in the funding scene is investors are willing to fund companies with no revenue but they should have users and traction. Yet not many startups get more than $50M investment in India.

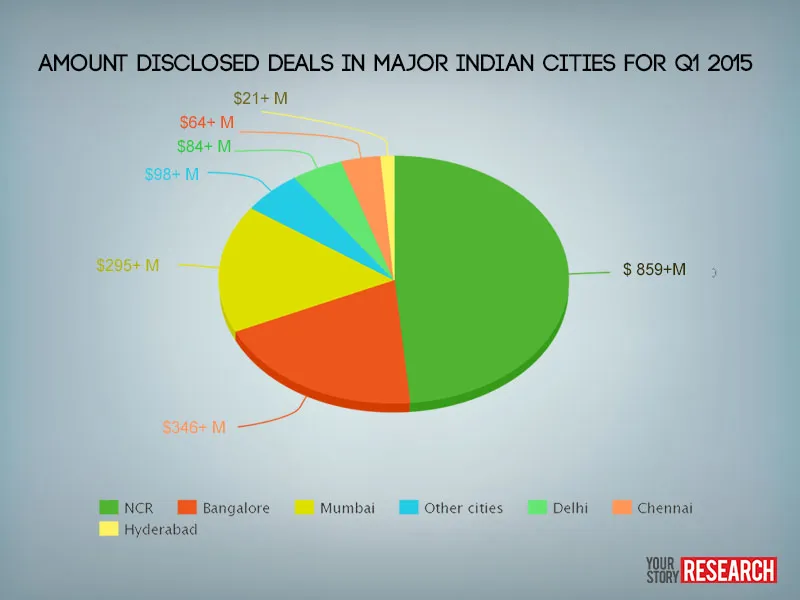

Which cities have seen active investor interest and startup traction?

In the last quarter NCR (Gurgaon & Noida) was the top destination for investments flow, Paytm's half a billion funding has swung the pendulum. Noida-based startups saw the investment of close to $ 859 million. Bangalore followed by $346 million and Mumbai based startups got $295 million funding. Hyderabad got $21 million investment, while Chennai-based startups raised $64 million. Delhi raised $84 million. The rest of $98 million is split between other cities like Pune, Jaipur and Vizag.

Seed rounds contributed 53.2% of the investments which was highest in terms of the number of deals. Other 'Private Equity' deal rounds accounted for 29.8% of the deals made in the first quarter. Series A investments were 8.50% and series B funding stood at 4.30%. While series C accounted for 2.80% of the fundings, the rest 1.45% was invested as series D in growth-stage startups.

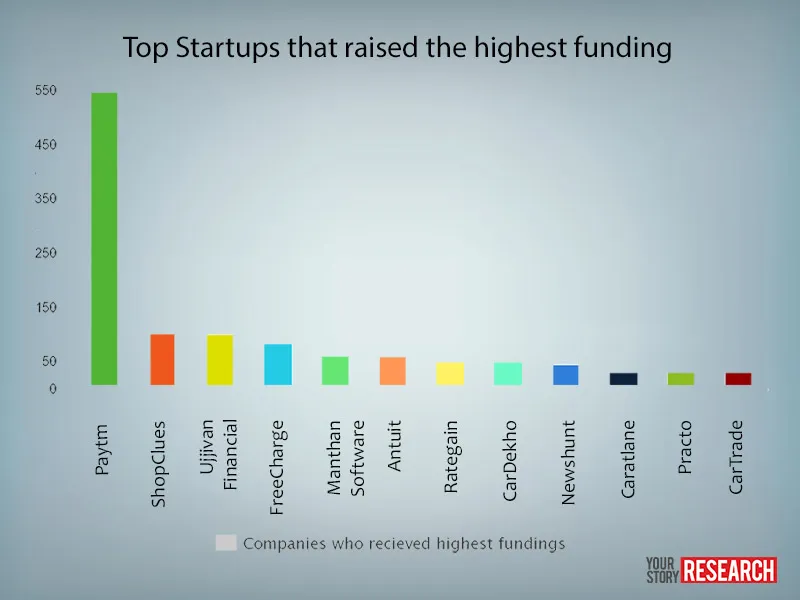

Here are the top startups that raised the highest funding

Paytm has raised the highest amount of the year so far – $545 million from Alibaba. ShopClues pocketed $100 million. Ujjivan Financial raised $96 million. Recently acquired Freecharge raised $80 in series C. Analytics company Manthan Software raised $60 million. Big data startup Antuit’s funding was $ 56 million. CarDekho was fueled by additional $50 million investment. NewsHunt raised a $40 million round in Sereis C. CaratLane got a funding of $31 million. Practo and CarTrade each have raised $30 million.

The most active Angel investors

TV Mohandas Pai and Zishaan Hayath have invested in three deals each. Rajan Anandan, V Balakrishnan, Rohit Bansal, and Kris Gopalakrishnan have done two disclosed deals each.

Talent is the new cash

Earlier this year, we’ve seen a bunch of acqi-hires, this trend will continue to go up. Talent is the new cash. In all startup cities the fight for talent is on – case in point there are many Rs.1 crore per annum salaried folks in Flipkart and Snapdeal. Few years ago this kinds of exuberant exits and salaries were distant dreams. Now global tech giants and local tech players are getting in the acquisitions game. If you look at the streets of Bangalore, there are so many billboards by startups on prime locations. Mind you, these gigantic boards are not startups advertising what they sell but asking talent to come and work for them.

Notable exits of Q1

Earlier this year, Ola bought TaxiForSure in cash and equity deal for a sum of $200 million. Justeat.in got acquired by FoodPanda. Unicommerce & Exclusively were snapped up Snapdeal. Mahindra group had bought Babyoye. The mobile ad network Adquity was acquired by Flipkart. Housing has bought the online real-estate forum IREF. Also two of acquisitions by international players happened earlier this year, Twitter nabbed ZipDial as its first Indian acquisition, NewsCorp bought out Vccircle.

Other highlight of the Q1

The taxi fiasco that happened at the end of last year seems to have been rectified. Ola is leading the way and taking over the market; now they are in 40 cities in India and started to venture out in on-demand food delivery sector as well.

Earlier this year, two startups, Paytm and Quikr, got added to the Indian unicorn club. Previously, there were only six startups with valuation over a billion dollar – Flipkart, Snapdeal, InMobi, MuSigma, Ola and Pubmatic.

PM Narendra Modi has taken selfies with tech entrepreneurs and mentioned apps in his keynote speech at NASSCOM conclave. This is the first time local tech startups have got ample attention from the government. It is a good sign for the future.

When the e-commerce giant Flipkart started blocking access to their mobile site and forced all traffic for the app install in favor of apps shopping instead of browser based shopping, it had raised controversy and debates about the merits and de-merits of such a move.

Just like people troll each other on social media, the quarter was the time startups got comfortable trolling each other. To mention a few, Amazon vs Flipkart. Housing v/s CommonFloor. Amazon v/s Zomato and Oyo Rooms v/s Stayzilla. Increasingly these brands are going to social platforms to settle their scores.

Funders raising funding

Early in 2015, Accel Partners raised fresh funding of $305 million. They’ll be focusing on seed and early-stage venture funding. Flipkart, Mu Sigma, BookMyShow, CommonFloor, PropTiger and Freshdesk are some of their portfolio startups.

With the newly launched $50 million fund Peesh Ventures aims to invest in the IT and mobile space. The fund is located in Bangalore and Gurgaon and typically puts in from $100,000 to $5,000,000.

Infosys pleged a $500 million fund to invest in startups. Corporates starting up a fund to invest in startups or launching an accelerator will continue to grow as a trend.

Another fund that emerged in the quarter is Astarc Ventures. The seed fund is focused on tech enabled companies in emerging industries such as mobile payments, digital healthcare, digital communication, 3D printing, data analytics, etc.

Finally, the Q2 2015 momentum

The start of Q2 was with big bang; FreeCharge which raised a round in Q1 has exited in Q2. The funding momentum is not showing the signs of ebbing. Also, SEBI has released a discussion paper on regulation for startups. This is something powerful that will decide the fate of future IPO and exits of India startups.

The fundamental changes that are coming are encouraging. It proposes a new listing platform for startups. It will abolish the term ‘promoter’ and replaces it with new terms ‘founder’ and ‘founding members’. And startups with no-profits in the initial years, but which have potential to grow in a big way could be listed too. Exciting days ahead that will unfold a lot for the ecosystem.

To conclude, let me borrow Blume Ventures MD Sanjay Nath words: “Entrepreneurs have started focusing more on the fundable startup ideas. Many a times, we see replication of existing ideas from elsewhere but there is no need to reinvent the wheel every time. Because of access to information and spending time in the ecosystem, entrepreneurs care more about how fundable their idea is.”

If you'd like to get the raw funding data in excel, you can buy it here.