Grofers' more than $100 million valuation may not sound crazy after all

Gurgaon can be a difficult place to be in. Outside the metro stations, one can see hundreds of auto drivers fighting to take you for a ride. Inspite of government making efforts like the pre paid auto booths, the situation isn't any better. At times like this, one feels that Uberification of services in urban India can make things easier because even though the companies are losing money to get customers, they are helping to bring in a process which is smooth and efficient. And once the customers and service providers experience it, they'd make efforts to stick to it for reasons apart from prices.

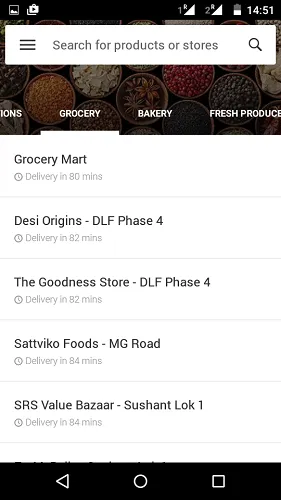

I am in Gurgaon to meet Albinder Dhindsa, the Co-founder of Grofers, an instant delivery app, that lets users order anything (mainly groceries and veggies) from stores around them. The company was started as OneNumber by Saurabh Kumar and Albinder in early 2014 and the idea was to have an efficient fleet which will help merchants deliver items that customers order. From a B2B model, Grofers has shifted to a B2C mobile startup and has raised $46.5 million, valuing the company at around $115 million. But for the customer, nothing has changed. Users can order for things from shops around them and Grofers will deliver in less than 90 minutes.

Before the meeting, my intention was to talk about crazy valuations and the (futility) of instant gratification in the long run, but the urban Indian conditions can offset that thought process and justify the need. "The entire supply chain is broken," says Albinder. There is supply, there is demand but the chain in the middle is very sluggish. This is a very Indian problem. In the west, the backends for retail stores and chains are sorted and powered by technology which means that a consumer facing company doesn't need to look at the backend. For India, a company like Grofers (or Ola or Oyo Rooms) will need to sort this backend as well. And to do this, Grofers need more and more conusmers using the service so that they can penetrate the backend supply chain. Initial numbers show that Grofers has the power to achieve that. "We're probably the biggest retailers in Delhi! We are doing more than 3,000 transactions every day in NCR alone. I think we'd overtake the likes of Spencer's very soon (per day transactions in a city)," says Albinder. Grofers has been live in NCR, Mumbai and Bengaluru for a , Grofers went live in five cities- Jaipur, Ahmedabad, Chennai, etc. This takes the total count to 9 cities. The average ticket size is Rs 560 and the company is doing about 6000 orders every day.

This volumes are tripling every month. In April, Grofers was doing 1000 orders every day in NCR, and the number had gone up to 3000 in May. "We are growing quicker than we expected; May was huge!" says Albinder. The company employs more than 1000 people now, of which 700 are delivery boys. This again takes us to the India problem. Thousands of people are migrating to cities from villages in search of jobs everyday and there’s a need for proper avenues to absorb this inflow. Otherwise, it only adds to the chaos.

For local merchants, Grofers is an interesting play as well. E-commerce takes away business from local merchants but Grofers provides a platform for local merchants to compete. For some shops, Grofers contributes to 30% of their revenue. "We're wiping out inventories from stores around us very quickly. This has also given us the clout to enter the supply chain further and we have also started working with bigger brands directly and agri businesses as well," says Albinder. Local merchants are not going away in India. With only 10% of India buying online with any sort of trust, e-commerce has only begun its journey here.

"A lot of uproar about the funding and valuations is because this is happening for the first time in India. I was in China recently and there are angel deals worth $10 million happening there. There will be sieving and consolidation in India, and only a few companies will remain. It is important to track the follow up funding rounds that companies raise," says Albinder. Grofers is sitting on over $45 million of funding, but Albinder tells us that they've not used more than a million from all their funding rounds. Their free mango campaign was a huge hit in May when they gave away two free mangoes with every order. This one exercise didn't cost them a lot (Rs 50-60 per customer) and also ensured that every customer could experience the service as they all made a transaction (Rs 250 for free mangoes). And their campaigns have been coming in at very opportune moments. For instance, the very recent 'free umbrella' campaign which recently went out for Mumbaikars on the day it rained for the first time in the city.

Albinder says that it becomes unsustainable in big ticket sizes like mobile phones, TVs, etc and that is not where Grofers plays. "Once we expand categories, we are more interested in areas like accessories that include mobile chargers, data chords, etc, where no one gives a quick delivery," says Albinder. And working with local merchants gives them a big heads up when they want to open up categories. The likes of Zopnow and other grocery players work with a few big retailers while Grofers wants to go the hard way and onboard more local merchants:

Grofers has confidence from investors, especially the biggies -- Tiger Global and Sequoia Capital. The agenda is clear -- grow at all coasts. Grofers is bearing a 10% loss at the moment (including operation costs) and Albinder claims this to be the lowest in the industry. "The investors are extremely happy with our business and our only focus is to grow right now. We are already making profits on a majority of our transactions," says Albinder.

Yes, just looking at the headlines, the funding and valuations might look crazy but the bigger picture has the sprinkling of sanity. India needs companies to streamline many broken processes through the chain of the economy and if some companies need time and money to solve it, the effort is worthwhile.

Website: Grofers