Khuljaa SimSim: Or how Alibaba and its 40% will help PayTM disrupt banking in India

"Banking is necessary, but banks are not" - Bill Gates, 1994

A financial storm is brewing in India that will manifest in that innocuous five-inch rectangular slab that sits so quietly in your pocket. When Alibaba invested in PayTM in March of this year, it catapulted the promising startup straight into the unicorn league, but more importantly it set into motion a series of events that will forever change the face of banking in India.

Imagine a world where everything related to your finances happens on a mobile app. Your salary account, investment portfolio, insurance premiums, credit scores and debit card all rolled into a little icon on your home-screen. Imagine a day upon when using that app, any shop that sells a shampoo sachet will become an ATM where you can deposit or withdraw cash instantly. That’s right, no cash, no cheques, no OTPs, no broker calls—all of that will be replaced by taps on a screen.

All this will very soon become possible once PayTM launches the payment bank, for which it recently received a nod from the RBI. Before I go into explaining why PayTM will become the most influential financial institution in the country, you must first understand what payment banks are and why they are such a big deal. This excellent article by R. Jagannathan lays out what they will mean on a broader level.

To put it succinctly, they’re banks without the ability to distribute loans. This is more important than it sounds! IDFC and Bandhan Bank were given full banking licenses in 2015 after an arduous wait, but before that the last bank to get a license was YES Bank in 2004, 9 years ago. Payment Banks aren’t full-fledged banks because they were conceptualized by the RBI as a tool for financial inclusion. It was a way to leverage the digital payments infrastructure to provide the unbanked with and I quote “(i) small savings accounts and (ii) payments/remittance services to migrant labour workforce, low income households, small businesses, other unorganised sector entities and other users.”

These are goals that now have a much better chance of being realized now that there is a whole new category of financial institutions purpose built to be asset-light and digitally enabled. However, one of the prospective payments banks has already built a significant install base on an app platform and hence has the potential to go much further and become India’s first truly digital full-stack (almost) [1] bank.

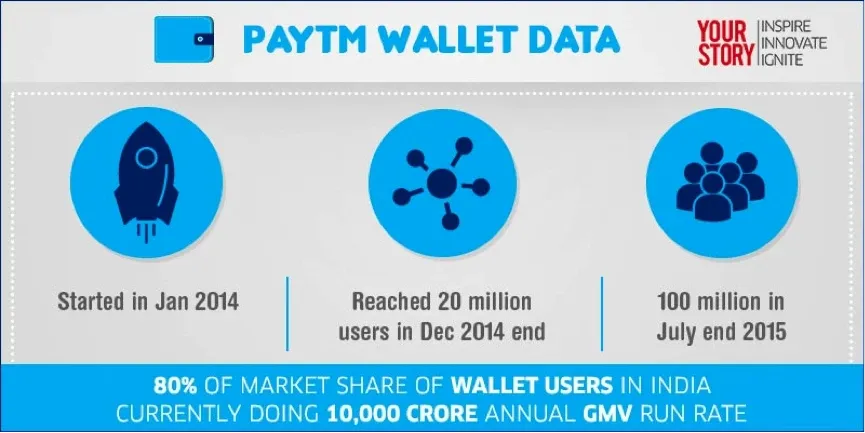

PayTM and the Hierarchy of Financial Needs

I’m speaking of course, of Vijay Shekhar Sharma and his labour of love, PayTM. From it’s humble beginnings as a mobile VAS company, to it’s pivot to a prepaid recharge app, which was followed by the wallet phase whose growth was turbocharged by Uber’s inability to automatically charge a credit card (another nod to the RBI here for making 1-click payments impossible), to it’s launch of a mobile commerce marketplace and finally receiving a payment bank license; PayTM has nimbly maneuvered itself into a position of prominence in India’s burgeoning mobile ecosystem. With an install base of over 100 million wallets, PayTM has become India’s de facto digital store of value.

Exhibit 1: Key stats on PayTM’s journey (Courtesy: YourStory)

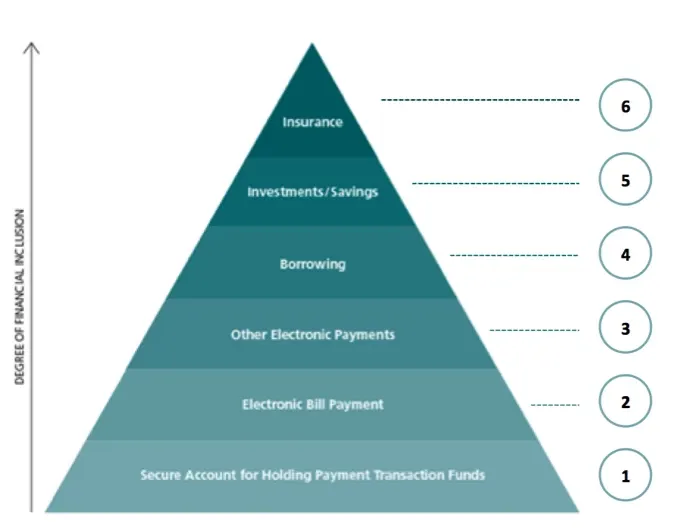

To understand why PayTM will graduate from a wallet and truly redefine banking in India, we need to look at the hierarchy of financial needs. Thanks to MasterCard [2] for a fantastic position paper on the comprehensive structure for financial inclusion, which provides interesting perspective on how enabling electronic payments (and bill payments in particular) have the potential to drive financial inclusion on the whole. The crux of the argument is as follows:

Exhibit 2: Hierarchy of financial needs

The first thing any individual needs is a secure store of funds. For the average person, the only thing that meets the definition of “secure” is a bank account, and only when someone can fully trust an institution will they deposit their money in it. A wallet is a good start, but people really need a bona-fide bank account to fully gain conviction in an institution as their primary store of value.

"PayTM has spent the last 5 years building layers two and three of the pyramid."

This brings us to the second and third layers. Every individual has bills to pay, which are a recurring and foundational financial reality. Payment platforms are most convenient target for fintech startups looking to enter the hierarchy, because the recurring nature of payments (particularly bill payments) provides an opportunity to build stickiness with a user. Enabling a cashless, online payment method, which is by its very nature traceable, also builds a transaction history. Transaction history is the very bedrock of credit scoring, which is the foundation of lending and credit. Which brings us to the fourth layer: Borrowing.

Credit allows an individual to reach beyond her daily needs and make purchases that will pay off in the future. For example, a loan for new equipment allows a small businessman to make better products yielding better margins, or enables a small merchant to buy more inventory allowing her to make more sales, thus facilitating higher income. Generating income beyond expenditure finally enables individuals to think about investments first and insurance next (layers 5 and 6) and thus the pyramid is fully realized.

PayTM has spent the last five years building layers two and three of the pyramid, as digital payments are bread and butter for the company. Becoming a payment bank could allow PayTM to become a full-stack banking solution (albeit without the ability to lend, but we’ll address that shortly). To truly peek into the proverbial crystal ball and predict PayTM’s future growth path, we must look at their newest investor.

Khuljaa SimSim: Alibaba’s banking playbook

Consider Alibaba’s investment in PayTM. Creating a transacting user base of 35 million users per month is not easy, although PayTM managed to do it. [3] ANT financial services [4] can now provide PayTM with a detailed step-by-step guide on how they can dominate Indian banking. At a high level, I think the plan could unfold like this:

Step 1 – AliPay :: PayTM Wallet: Create a payment system that incentivizes users to maintain an account balance at all times

As we’ve already established, obtaining a banking license is not easy; therefore, the simplest way to create a store of value is via a wallet. Although in China, Alipay isn’t a wallet in the truest sense of the word. It began as an online payment service in 2004 to address issues of consumer trust on Alibaba. Instead of directly transferring money from buyers to sellers (as Paypal did in the case of eBay), Alipay would hold the amount paid by the buyer in an escrow account. The amount would be released to the seller only once the customer confirmed that the goods were received in good condition and were as advertised on the website. This simple quirk of process, at a time when less than 1% of the Chinese population had credit cards, set the Chinese e-commerce market on fire. Alipay grew to 150 million users by 2009, a number which has doubled to 300 million active users in 2014.

"PayTM wallet users grew 10x between Nov 2014 and June 2015"

In November 2014, PayTM had about 10 million registered users, and without sounding uncharitable, could have been considered just another mobile wallet.

However, once the RBI blocked auto-debit from credit cards, PayTM took off, thanks largely to an integration and exclusive arrangement with Uber [5]. Suddenly there were millions of users, including yours truly, who needed a PayTM wallet and had great incentive to put money into it, in my case in order to continue to use Uber. Once this happened, anyone else with a PayTM integration could also accept payment from that same wallet. Thus a virtuous cycle was born, driving real transaction volumes with real money! Between December 1st 2014, when the Uber integration happened, and July 2015, then number of PayTM wallets grew 10x to 100 million. I believe that most of that surge was already realized by February 2015, and that was what truly drove ANT Financial to invest in PayTM. Because while at 10 million wallets you’re marginally interesting, at 100 million wallets you’re a threat.

Step 2 – MyBank :: PayTM Payment Bank: Convert that account into a secure store of value

Once you have a significant transacting base in the wallet, it can be leveraged to push the regulatory authorities toward formally recognizing you as a secure store of value. In China, ANT financial services was finally able to receive a banking license from the Chinese government on September 29th, 2014. Ten short months later on July 25th, 2015 ANT financial launched a full-fledged digital bank called MyBank; an all-digital, branchless banking operation to serve customers in China 24/7. With only 300 employees, MyBank will be able to run a much leaner operation while utilizing synergies unavailable to other banks. Ant Financial also created Sesame Credit (credit scoring) and Yu’e Bao (Money market fund) and thus MyBank will have access to petabytes of consumer transaction data, which will allow them to make significantly more informed credit and lending decisions.

In the case of PayTM Payment Bank, receiving a nod from the RBI in June this year was the biggest hurdle they’ve crossed. They now have the opportunity to convert some portion of their 100 million wallets into payment bank accounts. This will test PayTM’s execution capabilities, as registering for a payments bank account will still require compliance with existing KYC norms. If they manage to come up with creative solutions to drive wallet-to-account conversions rapidly and cost-effectively, they will significantly boost trust with their users and thus further incentivize them to transact on their platform. However to turbo charge growth and increase stickiness with customers, I suggest three measures:

- Embrace Cash to Eliminate Cash:Leverage their significant network of 90,000 merchants and convert them into mini-bank branches by leveraging the business correspondent arrangement provisioned by the RBI [6]. My next ATM should be as small and easy to reach as an Airtel prepaid recharge shop. I should be able to walk up to the merchant and deposit or withdraw cash. Once I stop worrying about whether I’ll be able to cash out, I’ll be much more comfortable transacting on my app.

- Remove all friction from digital transactions:No minimum account balances, no withdrawal fees, no transfer fees. I should never think twice about putting money into or removing money from my PayTM bank account. It’s heartening to see that PayTM is already thinking this way.[7]

- Incentivize offline merchants to accept PayTM payments:Leverage IMPS[8] (a homegrown payments switch) to implement digital payments through mobile app. Today merchants are charged anywhere between 0.75%-1.25% (for debit cards) and 1.5-3% (for credit cards) of the total bill value to accept a payment. IMPS provides an alternative that charges the user less than Re. 1 per transaction. If PayTM can leverage this it will provide significant incentive to merchants to accept payments via PayTM.

Step 3 – Sesame Credit :: PayTM Credit Score: Big Data analytics for effective credit scoring and lead generation

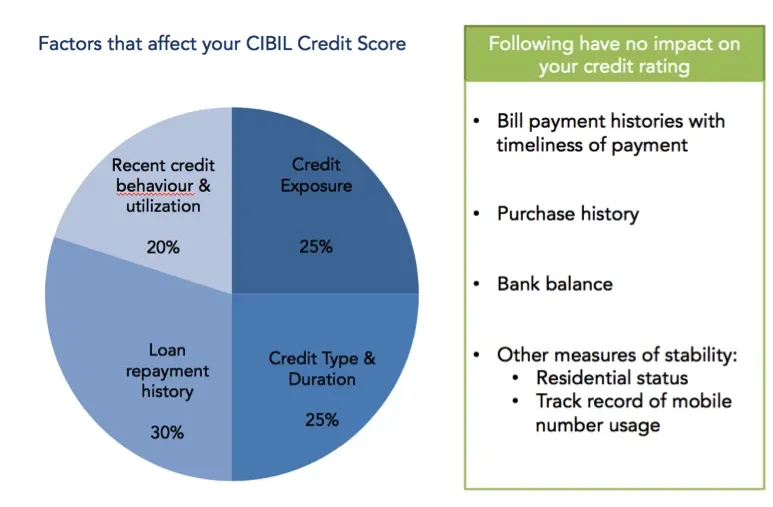

Credit scoring in India is broken; I know this because my credit score sucks. During college I took a loan to buy a laptop (despite the fact that my father offered to buy one for me) and then promptly forgot about the loan. By the time I remembered that I had a loan to repay, I had already defaulted and it was too late to do anything about it. I haven’t taken a loan since and even though I repaid the loan in full, and I’m well compensated as a VC, I don’t qualify for a credit card. Several of my friends have faced similar issues.

This continues to weigh over me because a credit score cannot be calculated if you don’t have borrowings like a loan or a credit card. However, you might be active Internet user who shops online often, pays your utility bills on time, has a stable residential status and has been using a mobile phone for a long time. Perhaps these factors should therefore be taken into consideration when assessing in order to generate a credit score that is truly reflective of an individual’s creditworthiness?

Exhibit 3: Credit ratings – Exclusively determined by loans and credit card histories

Sesame Credit’s scoring system, launched by ANT Financial in January 2015, looks at data generated by 300 million registered shoppers and 37 million vendors in the Alibaba network (including Taobao and Tmall.com, two of China’s largest online merchants), along with payment histories from Alipay. This data is supplemented with information from public agencies and financial institutions. Sesame Credit then applies customer behavior analytics to generate a credit score which can easily be checked on the Alipay app.

PayTM could build model and generate a proprietary credit score using the millions of transactions it sees every month, from both their wallet and ecommerce portal. For instance, since bill payments remain their core business, they can effectively generate a very granular credit score based on an individuals bill payment history. Importantly, this score will not require you and me to take a loan or transact with a credit card to build our score. Just going about our everyday business via PayTM will be sufficient to generate a more reflective credit score.

It is not hard to imagine how PayTM’s more transactional (and therefore more current) credit score might end up becoming the backbone of borrowing for all other financial institutions. At the same time, PayTM will also become the most effective lead generation and targeting engine, anticipating a user’s credit needs and matching it to the ideal debt products from different banks, essentially posing an existential threat to BankBazaar, PolicyBazaar, and their marketplace competitors.

Step 4 – Yu’e Bao :: PayTM Money Market Fund: A mobile-first investment experience to challenge incumbents

Once PayTM opens the payment bank, it will be free to sell relatively risk free investment instruments. This includes mutual-funds, money-market funds, insurance and pension products[9]. Each of these have different return profiles but will typically return more than the 4% that most savings bank accounts yield.

Alibaba faced a similar scenario in China as savings bank account yields were capped at 3.3% by the state. In June 2013, ANT financial services launched Yu’e Bao, meaning “Leftover Treasure” in Mandarin, by partnering with Tianhong Fund of China. Money market fund yields were hovering around 6% (nearly double the savings bank rate) and Yu’e Bao facilitated the ability to buy into money market funds straight from an AliPay wallet by just tapping a button in the app. The offering spread like wildfire as it racked up 185 million accounts totaling a fund size of $93 billion[10] by the end of 2014. In 18 short months, Yu’e Bao had become one of the world’s top (and China’s largest) money market funds.

Yu’e Bao did three things right. First it made investing a super simple process, with no minimum investment and no documentation. Just click a button in your wallet app and boom, you’re an investor making double what your bank gives you. Now that’s financial inclusion!

Second, they made it really simple to take money out with no restrictions on withdrawal amount or timing. They even allowed you to shop with the balance in your investment account, which is extremely beneficial if you’ve never considered investment because you’re afraid you won’t have the money on hand in case of an emergency. This is how most of India and China thinks.

Third, they chose the right investment product (at that time) for the average individual consumer. Since most users were first time investors, Yu’e Bao had to offer a relatively risk free investment, with superior returns. By choosing liquid Money Market debt instruments and presenting returns generated in simple terms and not using jargon like “7-day annualized returns”, they fit this need perfectly.

"PayTM's investment offering cannot depend on pure interest rate arbitrage"

I must qualify this with a note of caution. A brilliant article in The Economist outlines the limitations of this strategy. Yu’e Bao’s rapid rise and subsequent challenges were “Fueled by a liquidity crunch, which pushed up interbank rates, creating plenty of short-term assets with juicy yields. These were essential to Yu’E Bao’s success and to its safety, given the short-term funding base that comes with allowing instant withdrawals. But since the start of this year, the central bank has steadily injected cash in the banking system, bringing money-market rates down from roughly 5% to closer to 3% for much of the past few months.”

Yu’e Bao responded by straying into longer-term securities, which hasn’t really paid off. Their returns continue to decline and while they remain higher than the bank figure of 3.3%, incoming deposits have slowed down significantly.

Exhibit 4: Yu’e Bao returns declined as China’s liquidity improved

(Courtesy: The Economist)

PayTM could execute a similar strategy. Savings bank accounts today provide 4% returns (except for Kotak and YES Bank which yield 6%). Money Market funds in comparison yield around 8.5% with a similar risk and liquidity profile. If PayTM can negotiate favourable terms with a liquid MMF, such as no-minimum investment and instant withdrawals, they could no doubt become the biggest money market fund managers in India, and therefore address the fifth layer of the hierarchy of financial needs.

However, if PayTM decides to choose this course of action, it must do so with a long term plan that does not depend on pure interest rate arbitrage. As Yu’e Bao has demonstrated, managing liquidity while providing higher returns is a huge challenge as markets have the ability to correct. It must instead leverage the ease and convenience of app-enabled investing to bring a new category of investors onboard.

Middle and high-income individuals (annual salary above Rs. 5 Lakh) would have no use for a PayTM payment bank account as their monthly salary is close to or higher than the account balance cap of Rs. 1 lakh. However, they are high value customers as their ability to invest and transact is that much higher. Banks currently depend heavily on wealth advisors leading to sluggish and inconsistence customer experience. By providing a superior and more convenient self-serve investment experience, PayTM could legitimately challenge the incumbents.

Step 5 – Profit!!!

By now, PayTM would have generated four new revenue streams: Interest on deposits, credit score fees, lead referral fees for targeted advertising of loans and insurance, and finally investment management fees for money market funds. Any estimate of these profits are bound to be wildly inaccurate; however, a cursory back of the envelope calculation tells me that in their first year of operation alone that PayTM could be managing well over a $10 billion in deposits and $500 million in their Money Market fund.

A Note on the Competition

All this, begs the question, what’s so special about PayTM’s payment bank license[11], given the fact that there are 10 other entities with the very same approval. To answer that question, let’s look at who they are and what their “DNA” is:

Existing Financial Services players (FINO PayTech, Cholamandalam Distribution Services): This bracket has plenty of experience in offering financial products to customers, meaning they understand the world of traditional finance very well. However, they’re legacy players and therefore have a legacy mindset. They’re operations have primarily been offline and bound by the same processes that are the plague of the financial services industry. A notable exception maybe FINO Paytech, which has built tech solutions for customer enrolment, biometrics and generally brought a lot of technological rigour to the financial inclusion initiatives of many banks. However, it’s not clear how ready they are to build a large transacting base on a mobile app, which poses a serious weakness in the fight against PayTM.

Corporates (Reliance Industries, and Tech Mahindra): Reliance Industries has interests in several sectors, but no experience in building a mobile-app based business at scale. In consumer businesses, product and distribution matter more than the capital you have at your disposal. Reliance may be able to buy some distribution by coupling the payments bank offering with the upcoming Reliance Jio launch. Tech Mahindra has an interesting track record of running a technology services business. With inputs from Mahindra Financial Services, they might come up with some interesting offerings, however their install base and product capabilities are both dwarfed by PayTM.

Telcos (Airtel M Commerce Services, Vodafone M-Pesa, Aditya Birla Nuvo (Idea), Dilip Shanghvi of Sun Pharma with Uninor): In my book, these are the only serious challengers to PayTM’s near-inevitable dominance. Telcos have long wanted to become banks, as they believe (quite rightfully) that they are the only players that truly understand distribution and therefore can solve the penetration problem. The only catch is that they’ve already solved it. With nearly 900 million active mobile subscribers in India, they’ve nailed it. Now they have to learn how to build a mobile bank.

Airtel’s latest apps (Hike, Wynk) have struggled to gain widespread traction. Vodafone has a much better track record of building a financial services system with M-pesa in Kenya. Aditya Birla Nuvo has both a financial services arm and a telco (Idea) under its umbrella and could pose a legitimate challenge. Another interesting player is Dilip Sanghvi of Sun Pharma, who’s entering the race along with Uninor. It remains to be seen how they plan to approach the problem.

Government (Department of Posts, National Securities Depository): While the Department of Posts has an intimidating distribution network (1,56,000 post offices across the country) and experience in financial services, their inexperience in effectively leveraging technology to build a digital consumer experience will let them down. NSDL is a pure play financial services provider without the reach of India Post, if anything they’re worse off. But they try because they must—they are the Air India in this fight.

Conclusion: The greatest victory is that which requires no battle – Sun Tzu

PayTM has had a charmed run in the 10 months. It is the classic coming together of a rising tide of external forces lifting a well-poised startup into stratospheric heights. In a seminal TED talk Bill Gross, the founder of idealab studied over 200 startups to determine which of the following factors: idea, team, business model, funding, and timing, mattered most in a startup’s success. He found that timing was by far and away the most important factor in a startups success. A classic example is Meru vs. Ola Cabs. Online taxi booking was possible before Ola, but in the pre-mobile era, the best Meru could do was build their own fleet and provide services. The mobile revolution unlocked the spare capacity of independent taxi operators and allowed Ola to shoot past the incumbent and dominate the field.

When I look at PayTM’s dream run: The Uber tie-up (Dec 2014) lead to a surge in active wallet users, which lead to Alibaba’s funding (Mar 2015). This in turn strengthened their payment banks license case significantly (June 2015) and has now brought us to this point where PayTM is poised to fundamentally change Indian banking. It also helps that the company is lead by a charismatic founder, who is in tune with India’s changing needs and is not afraid to adapt rapidly to serve them. It is only a matter of time before we all get our PayTM bank account and leapfrog from our economy straight into the mobile banking age.

[1] Payment banks cannot extend loans, but more on that later in the article.

[2] A New Perspective on Bill Payment—A Demand-Based Path to Financial Inclusion, Amit Jain and Gidget Hall, MasterCard Advisors

[3] No available data on average transaction value. PayTM founder claims there are 75 million transactions every month on an active user base of 35 million users. http://techcircle.vccircle.com/2015/08/12/paytm-claims-100m-mobile-wallet-users-with-75m-daily-transactions/

[4] ANT Financial was spun out of Alibaba, China’s largest e-commerce company, before the IPO. It is comprised of Alipay (3rd party online payment platform), Yu’e Bao (China’s largest Money Market Fund) and MyBank (China’s first Internet Bank). Privately valued at ~$50 billion, it is controlled by Alibaba founder Jack Ma.

[5] When Uber launched in India, it did so without two-step card authentication, meaning that your credit card would get charged automatically at the end of a ride, as per standard operating procedure in most markets. However, in India, card transactions generally require pin code entry and two-step authorization, and the RBI briefly tried to shut Uber down for non-compliance. Once RBI directed Uber to comply, Uber chose to integrate PayTM wallet because it was the only way to auto debit a user and because they didn’t want the poor UX associated with an SMS OTP process.

[6] This link contains RBI’s framework for BCs. Payment Banks have been actively encouraged to leverage this model to increase reach.

[7] Vijay Shekhar Sharma in an interview to VC Circle. Link to interview

[8] Immediate Payments Switch (IMPS) is a payment infrastructure for debit payments, built by NPCI (National Payments Council of India) that side steps Visa, Mastercard infrastructure.

[9] RBI guidelines for licensing of Payments Banks. See section ii(e)

[10] http://www.cnbc.com/2015/07/16/how-chinas-rout-disrupted-online-funds-like-alibabas-yue-bao-in-a-good-way.html

[11] An interesting aside: PayTM technically doesn’t have a payment banks license. The license in question is held by its founder Vijay Shekhar Sharma. This is because RBI mandated that company receiving the license should be majority owned by a domestic entity. Since majority of PayTM is owned by foreign entities (Alibaba, SAIF Partners), VSS applied and received the license. ANT financial has a remarkably similar history. Government regulations meant that Jack Ma and not Alibaba owns the majority stake in the company.