Compliances for Private Limited Company, LLP and OPC – a clear comparison

Being a chartered accountant and interacting with several entrepreneurs, I found that the most common question bothering startup founders is which business entity to form and what is the compliance cost of these entities. Hence, there is a need to summarise this essential information in a comprehensive manner and layman terms.

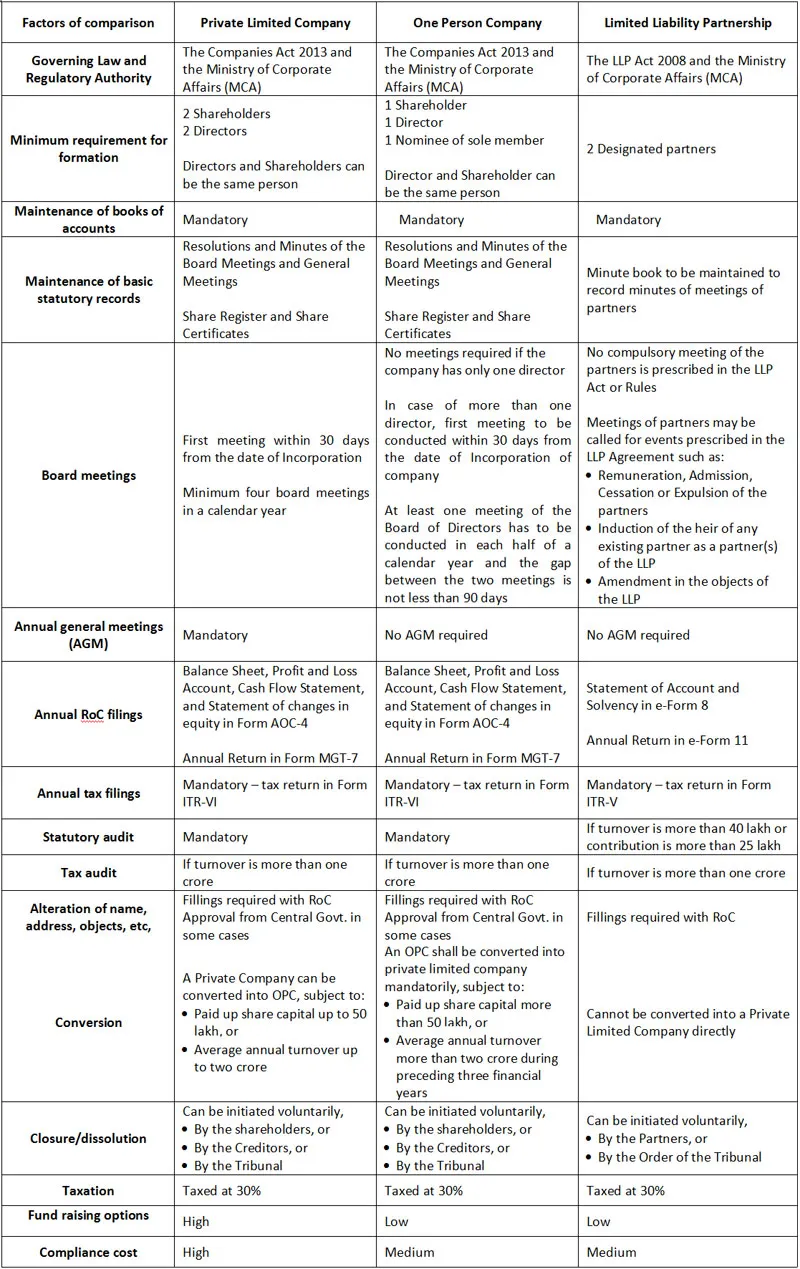

The three most preferred business entities in India – Private Limited Company, Limited Liability Partnership (LLP), and One Person Company (OPC) have some important differences in their compliance structure which affect their running costs as well. This article is focussed on detailing the end-to-end compliance requirements of these entities. There are different set of laws and regulations which govern each business type.

Image credit "ShutterStock"

Private Limited Company and OPC are governed by The Companies Act, 2013, and the corresponding company rules. There are various norms right from maintenance of books of accounts to preparation of financial statements and getting most of important events of your company approved by way of conducting board and general meetings with corresponding Registrar of Companies (RoC) filings.

Similarly, in LLP, immediately after incorporation, should comply with the statutory requirements of the Limited Liability Partnership Act 2008 and the corresponding LLP Rules. In order to achieve this, the accounts, records of partner’s meetings, changes in partners, and LLP Agreement should be prepared and vetted by your legal advisor’s at all times.

It becomes essential to take a note of all the key compliances so that you, as an entrepreneur, are aware of the entire regulatory framework of your business and seep through the differences in each of these entities to take an informed decision.

The comparison chart will give you a clear distinction between the compliance requirements of all the three forms of business.

Simply put, there is nothing better than a Private Company from an Investor’s perspective and credibility; however, the cost of compliance is definitely higher. If you want to take it slow and steady and raising funds is not on cards, hitch to the easiest and simplest option of an LLP.

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory)