Are startups from non-metro cities still struggling to raise money?

Given the multiple questions investors asked Hemalatha Annamalai, raising funds could not have been an easy task. The founder of Coimbatore-based Ampere Electric recalls,

When an investor provoked me to prove if we have the tenacity to pull out big players from the electric vehicle game who have long arms and deep pockets, it gave me the guts to look straight and tell him, ‘Sir, the big players are fighting not to lose on a brand created; I am fighting to win to create something new.’ He then realised that he was talking to a daring entrepreneur who would not accept a NO easily.

Hemalatha’s sheer persistence in due course has attracted the investment from Chairman Emeritus of Tata Sons, Ratan Tata, last year. This year, Ampere Electric has raised $1 million from Infosys Co-founder Kris Gopalakrishnan along with participation from Venk Krishnan, CEO of NuWare and Partner NuVentures, as reported by VCCircle.

Today her venture is one of the few to have made their mark in the developing Indian electric vehicle industry. Founded in 2007, the company is in the business of designing and manufacturing e-cycles, e-scooters, e-trolleys (for carrying load), and special-purpose vehicles for waste management and to cater to differently abled persons. The cost of e-cycles ranges between Rs 20,000 and 30,000 and e-scooters are available in the range between Rs 20,000 and 45,000.

Hemalatha is quite content with setting up base in Coimbatore and is reluctant to move to metro cities. She asks,

Who will then give jobs to people in tier II, III, and IV towns if everybody moves to metro cities?

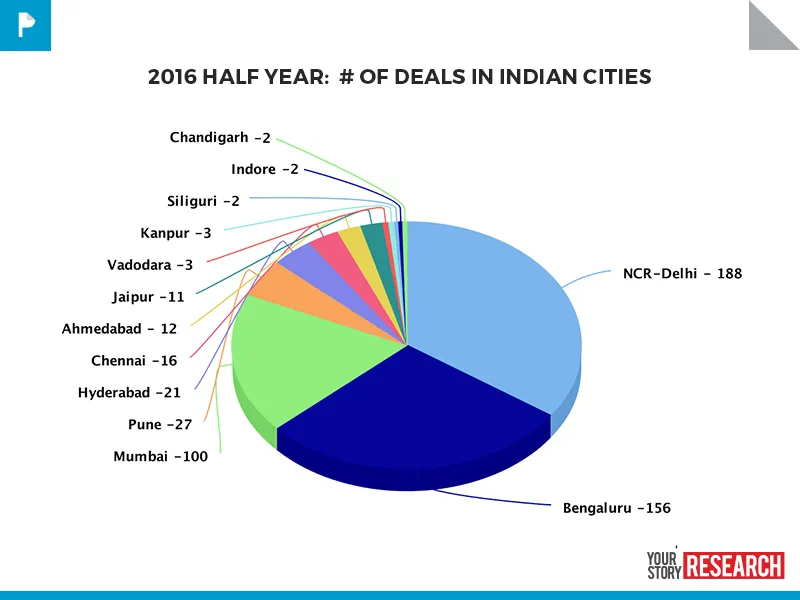

According to a Yourstory Research, the startup fraternity attracted a total funding of $1.42 billion in Q1 2016 and $870 million in Q2 2016, while Q1 2015 had seen a total infusion of funds worth $1.7 billion and Q2 2015, $3.8 billion.

This year, startups from Delhi, Bengaluru, Mumbai, Pune, and Hyderabad seem to be the front runners in the funding game. Sectors receiving heavy funding include Healthcare, Marketplace, SaaS, Fintech, -E-commerce, Edtech, and Hyperlocal.

Do investors treat startups from non-metro cities equally?

IDG Ventures Founder and MD TC Meenakshi Sundaram stated that they do not differentiate among startups based on location but go by the quality of the entrepreneurs. However, 80 to 90 percent of the deals that happened through IDG Ventures were from cities like Bengaluru, Delhi, Chennai, Hyderabad, Pune, and Mumbai.

"VCs are travelling to smaller towns these days to evaluate the availability of highly specific investment opportunities,” says Vikram Gupta, Founder and Managing Partner, IvyCap Ventures. He highlighted that unavailability of infrastructure (roads, power, water, and internet), language, local political issues, and limited channels of marketing and distribution are some of the factors that deter startups from remote areas from to attracting capital.

Unlike metro cities, the ecosystems in small towns are restricted to limited infrastructure, dearth of talent pool, unawareness of the market competitions, and smaller client base. Sundaram emphasised that strong angel network, mentoring startups in those areas, and supportive role of incubators and accelerators are the need of the hour to elevate the ecosystem.

“Chandigarh Angels Network (CAN) has been trying to build the local startup ecosystem. We mentor startups, invest in them, help them validate their ideas, and offer them our business networks. We have also sensitised over 5,000 young, wannabe entrepreneurs via startup bootcamps, startup weekends, and hackathons,” says Vineet Khurana, VP (Operations), Chandigarh Angels Network.

Founded in September 2015, CAN has 26 investors and has made three investments — inventory liquidation platform JumboBasket, social learning platform Eckovation, and DoneThing, a concierge delivery, bill payment, and personal assistance platform. Their range of investment is between Rs 10 lakh to 2 crore.

“Startups in smaller cities need to become more mature with better capabilities. They should spend more time learning about the key factors required for their venture to succeed,” says Priyansh Rai, Investment Associate, Swan Angel Network (Indore).

Swan Angel Network was started in January 2016 and now has 38 members with a committed capital of about Rs 15 crore. Last month, they have committed to investing in Onspon, an event discovery and sponsorship platform. They invest in the range of Rs 50 lakh to 1.5 crore.

Madurai-based Nativelead Foundation’s range of investment is between Rs 10 lakh and 50 lakh. Founded in 2012, the angel network has 145 investors and two portfolio companies in the water technology and agriculture sectors. Geographically, they cover Tamil Nadu’s tier II and III cities, among which Madurai, Trichy, Coimbatore, Erode, and Salem are a few.

Is geographical location a barrier for small-town startups?

Lucknow-based EduAce Services Founder and CEO Gaurava Yadav does not consider location a barrier when it comes to raising funds. Instead, he believes small towns offer more opportunities as compared to metro cities.

According to him, getting access to investors in the world of internet is not a challenging task, thereby minimising geographical barriers. If one has the knowhow of the markets he/she is going to target accompanied by the right set of products, one will be able to attract investors regardless of where one is based. Economic manpower, strong operations, low burn rate, and high cash flow will definitely lead to success.

EduAce Services offers holistic learning solutions for students between Class VI to XII which include General Knowledge and Quizzing Aptitude Test (G-QAT). With 2,500 schools and 2.5 lakh students on its platform, this Lucknow-based edtech startup recently raised $1 million funding. Why he chose Lucknow over Delhi and whether he planned to expand operations beyond Lucknow were a couple of the things Gaurava had to explain to investors.

A $1 million fund for a startup based out of tier II, III, or IV cities is huge because the cost of operations is one-third of the total expenses of a startup based out of a metro city," says Gaurava.

Founded in 2010, Madurai-based poultry farming startup Happy Hens raised Rs 50 lakh from Native Lead Foundation. They cater to 45 outlets across Bengaluru and produce 25,000 eggs per month. The startup also claims to have received a lot of queries from Hyderabad, Chennai, Pune, and Mumbai.

“An entrepreneur may have the knowledge of the product or service he is into but may not have the experience on the financial aspects and its presentations. When we were asked what amount of money we wanted to raise, we underestimated our requirement. That’s when the investors asked us to rework on the financials which made us do the exercise all over again and it was a great learning experience,”says Happy Hens Founder Manjunath Marappan.

According to Vikram Gupta, there are two types of business models that are suitable for the tier II and III towns:

(1) The ones that have been proven in the metros and are now ready to be launched in tier II and III towns

(2) The ones that are suitable primarily for tier II and III towns. Moreover, they should develop products and solutions that are highly localised.

Ensuring growth

Small-town entrepreneurs should focus only on creating sustainable business models to gain an edge over their peers in metro cities. Moreover, getting the right co-founders and mentors who can bring enterprise-level expertise and capabilities can also lead to incremental growth. There is no reason why startups from interior locations cannot grow if they have the capability to think big, plan strategically, and build strong teams.

Udupi-based mobile solutions provider Robosoft Technologies bore testament to that when it raised Rs 22 crore from Kalaari Capital in 2013 in its first round of funding. The story of how Robosoft Founder Rohith Bhat dared to build an IT company in Udupi, generating hundreds of jobs in the town, is one that has encouraged many. It forced a lot of people into thinking about what they could achieve in a big city if someone could do so much in a small town.

Last April, the company secured its second round of funding from Ascent Capital with participation from the existing investor Kalaari Capital. Founded in 1996, Robosoft partners with clients both in India and abroad, with a majority of business coming from US-based clients. Rohith says,

Everybody struggles to raise funds irrespective of where they are based out of. VCs do come down to small towns to evaluate your business model if you have built an innovative product. One should focus only on escalating the business without losing hope.