Flipkart bets on twice the BAU in fashion this festive season

E-commerce giant Flipkart, which claims to be the market leader in online fashion, is targeting twice their business-as-usual during the festive season, lasting from October to December. The online marketplace is bringing in a larger selection, with newer brands and more products from existing brands, besides a larger selection in unbranded categories. Branded product lines created exclusively for Flipkart is going to be an added attraction.

In an interaction with YourStory, Rishi Vasudeva, VP, Fashion – Flipkart, said, “There will be more brands in the footwear section, with different price points and categories.” Popular brands in clothing are also coming up with footwear, with the likes of Swiss Military, Provogue, and Peter England making products in this category exclusively for Flipkart.

Supply for demand

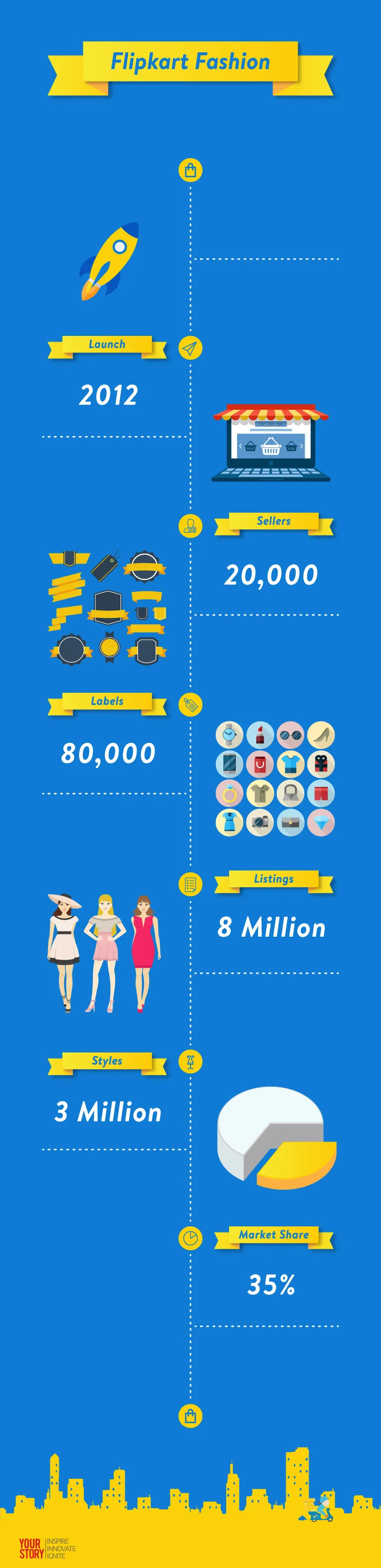

Launched in 2012, Flipkart Fashion claims to cater to the needs of all price segments and geographies across various product categories in the lifestyle division. Their price segments vary from below Rs 500, between Rs 500 and Rs 1,000, Rs 1,000-2,000, and above, and the products come with a no-questions-asked return policy.

While Flipkart has about 20,000 sellers who offer product categories across various sizes, 4,000 of them contribute a major chunk of its sales. The team is constantly working on the supply-demand balance. The point is to have enough supply in the categories that the consumer is keen on. If a customer is looking at a particular category in the premium segment, there may be a large number of suppliers, but not necessarily enough brands in that category.

“We work closely with brands in other categories to create extensions of the product line to cater to that price segment and thereby complete the selection. There is a lot of supply; but shaping supply to meet what the customer is demanding is what we are managing well,” says Rishi.

Fashion forward

Having established themselves as the largest platform for electronics and mobile phones, Flipkart had gained an edge over its competitors Snapdeal and Amazon in fashion when it acquired Myntra last year and Jabong recently. Flipkart claims to have 30-35 percent market share on its own. With Jabong and Myntra included, Flipkart claims to have about 70 percent of market share in the space.

Although more offline players are coming online, Flipkart has no plans for omni-channel distribution yet. Reliance, Tata and the Aditya Birla group have come up with Ajio, Cliq and ABOF respectively, attempting to enter the online channel. But there is no fear of competition. Rishi says, “Fashion is a large market that can accommodate many players - both horizontal and vertical. More offline players coming in is good for the industry as it earns trust from consumers.”

Online shoppers are looking for more variety, cheaper prices and more sizes. No physical store can provide shoppers with the vast number of options or major discounts that online stores do. Arvind Singhal, chairman of Technopak consultancy, says, “Shopping behaviour is different for online and offline customers; the overlap is not too strong. People who shop at Reliance Trends may not buy online from Ajio and vice versa.”

Why Flipkart needs fashion

It is estimated that fashion will be the top category in e-commerce by 2020. While mobile phones, consumer durables and electronics contribute to GMV, their margins are low. To maintain both, fashion is the most promising sector, especially apparels, as they yield good margins.

Unfortunately for Indian e-commerce, GMV has been stagnant. In August, Livemint reported that by September, Flipkart wants to achieve monthly gross sales of Rs 3,700-3,800 crore by expanding sales of smartphones, large appliances and fashion. But Arvind says: “In fashion, offline to online conversion is hard. The domestic market for apparels is worth $50 billion, out of which hardly 4 percent is online. Technology like the one to help people try clothes out virtually is yet to happen.”

Flipkart has not had an easy year. With a double devaluation, top leadership changes and employee layoffs, the struggle has been evident. Reportedly, they have been beaten by arch rival Amazon in sales in the last two months. But the one sector that Amazon is weak in, experts believe, is fashion, whereas for Flipkart, fashion is the largest category in terms of units. The most popular categories on Flipkart fashion are shoes, watches, backpacks, eyewear, and clothing for men, women and kids. One-third of their orders come from metro cities, about 55 percent from other tier 1 cities, and the rest from tier 2 and tier 3 towns.

E-commerce in India has a long road to go in fashion. For instance, in the ethnic wear section, the offline market is widespread geographically, and a majority of the customer base still believes in touch and feel. Although online space will continue to grow, it may not be at the pace e-commerce companies want it to. Yet, an alliance like Flipkart-Myntra-Jabong undeniably has an edge over other players in online fashion. If their claims are true, the upcoming festive season will see their fireworks.