Boost to FDI in Union Budget may not be of any help to e-commerce

On February 1, when Arun Jaitley entered Parliament with the briefcase holding India’s economic fate for the next year, the whole country waited with bated breath. Two hours later, quite a few sectors were relieved to hear what the Finance Minister had in store for them. However, the startup world was among the ones that were left disappointed.

There was hardly any mention of the sector, which has been the centre of attention in the last few years. Sanjay Sethi, co-founder and CEO of ShopClues, says, “Push for digital transformation and financial inclusion is applauded, but the government has deployed a lot more sticks instead of carrots to push the 'less-cash' agenda. I would have expected zero TDR for small-value digital transitions. Incentive for startups fell short of expectations.”

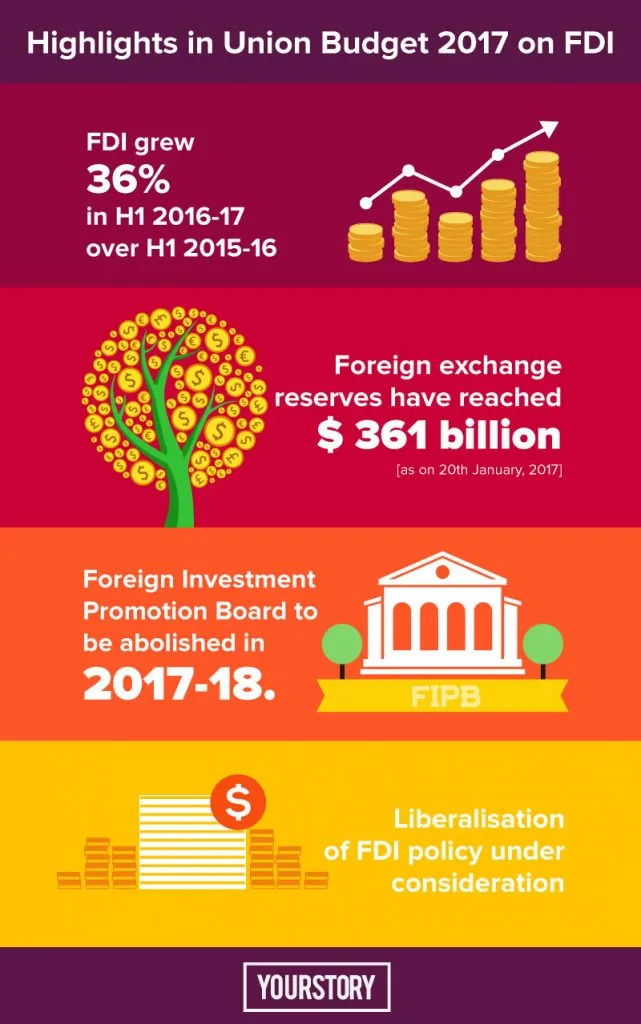

However, there were some developments that have a direct impact on e-commerce, a sector that nurtures numerous startups. The Finance Minister declared that Foreign Investment Promotion Board (FIPB)—the entity that clears foreign investment proposals up to Rs 5,000 crore — will be abolished, thereby easing the processes for getting foreign direct investment (FDI).

"FIPB has successfully implemented e-filing and online processing of FDI applications. We have now reached a stage where FIPB can be phased out. We have, therefore, decided to abolish the FIPB in the year 2017-18. Our roadmap for the same will be announced in the next few months,” Jaitley said. The move has been largely welcomed by the stakeholders – there are already enough checks to keep unwanted foreign investors out.

More than 90 percent of FDI proposals are now processed through automatic route, and they are subject only to sectoral laws. But sectors like retail, defence, food etc., are still regulated. Sriram Ramaswamy, Partner at PricewaterhouseCoopers India, explains, “If a foreign entity wants to get into one of these sectors, its entry has to be approved across many ministries. But if a foreign company wants to set up a manufacturing plant, it won’t need any approval – it just has to do some filings with RBI.”

Income Tax rate for companies with turnover of up to Rs 50 crore has been reduced to 25 percent. This move can indirectly help e-commerce too - online sellers will now be able to plough back money in further scaling up, says Sujayath Ali, co-founder and CEO, Voonik.

Further liberalisation?

According to Union Finance Ministry records, FDI into India increased by 30 percent, to $21.62 billion, during April-September this fiscal. And with Jaitley saying that further liberalisation of FDI policy is under consideration and that announcements will be made in due course, it looks like more FDI money will be funnelled into startups.

This statement has given hope to many. Sujayath of Voonik says, “Once the FDI reforms are announced, they will not only attract fresh funds into the current startup ecosystem, but will also promote new ventures in many untapped or underserved sectors of economy.”

Fintech, the right arm of e-commerce, will be another beneficiary. According to Harshvardhan Lunia, Co-founder and CEO, Lendingkart Group, allowing FDI beyond the 18 specified NBFC activities in the automatic route will provide a boost to the financial services sector. “This move will benefit domestic fund management and advisory businesses which may now raise foreign capital under a relaxed regime,” he says.

But some updates are necessary. Amber Dubey, Partner and Head, Aerospace and Defence, KPMG in India, says,

“The subjective requirement of 'modern technology' should be dropped [for FDI]. India should welcome FDI even if it's in old technology that still has relevance. We can be choosy 10 years down the line.”

The GST conundrum

But e-commerce is not at peace yet. To the disappointment of many, the Union Budget did not provide any clarity on when the much-discussed Goods and Services Tax (GST) will be implemented. E-commerce, which thrives on logistics and delivery systems, will be the most impacted once GST happens. It was drafted in March last year, and was supposed to begin functioning by July this year; but the Finance Minister was curiously silent on the topic during the Budget speech.

According to Sriram of PwC, although GST can make GDP go up by 1-2 percent, no government across the world has been re-elected after implementing GST. In India, GST now has more hurdles than it did before demonetisation.

The micro, small and medium enterprise (MSME) industry as well as consumption-driven (consumer-facing) startups were badly hit by demonetisation – there was about a 40-50 percent dip in demand for more than a month, according to Manish Saigal, Managing Director with Alvarez & Marsal. “A lot of inventory had to be written off, as many items had limited shelf life. Distribution system works on cash – you pay 50 percent in advance in cash for fuel expense, driver costs, trucks’ expenses, etc. So without cash, logistics sector lost balance too,” he says.

What is more, the GST draft itself is complex. It was meant to be a single taxation – but now it has various forms: central GST, inter-state GST, and state GST. “The complexity is worrying. But the government needs to model every possible scenario – so that neither states nor the Centre loses revenue,” says Manish. He warns that once GST is implemented, SMEs will be required to do a lot of work – to report GST returns properly, ensure accurate filings, and maintain the whole trail on payments, liability, and credit offered. Adds Manish,

“Reconciliation will be a hard task and the IT needed for it would be massive. Tax consultants will have to get these companies ready for GST.”

Union Budgets are not the end of policy making. But the government must stick to its promises. For instance, in the first budget presented by the current government, they had promised that corporate tax will be reduced from 30 percent to 25 percent over four years. This is their fourth budget; but there has been no change. For e-commerce too, while FIPB abolition can bring in more FDI, clarity on GST implementation will be the real game changer.

![[Weekly funding roundup July 20-26] VC fund inflow drops to below $100M level](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/funding-lead-image-1669386008401.jpg?mode=crop&crop=faces&ar=1%3A1&format=auto&w=3840&q=75)