How to approach a VC for funding on LinkedIn

Reaching out to a potential investor can be a time-consuming and painful process if you are not connected to the relevant people in the industry. What should entrepreneurs do to reach out to a potential partner, and how can founders leverage a professional networking site such as LinkedIn to connect with potential VC’s and raise money?

There is no doubt that LinkedIn, with close to 500 million users, is the biggest professional network out there, and most of the VCs, be it in India or abroad, are on the network. The advantage of LinkedIn is that you can connect with people with the clear intention of doing business, unlike Facebook or any other social network. VCs also typically write very often on LinkedIn, sharing their stories and insights on the ever changing startup ecosystem, and it would be good idea to follow them and know more about them.

When pitching to a VC, building trust and credibility at the first contact is very important, and LinkedIn does that better than a cold email. The VC can view your profile, education, past experience and see your recommendations etc. A good LinkedIn profile will go a long way in establishing credibility for you and your business.

So as an entrepreneur who is out there fundraising, you cannot ignore the power of this network — be it finding mutual connects with VCs, understanding their sectors of interest or knowing their present portfolio companies. All this information can be very valuable as you are out there not only to find money but the right partner for your venture. Having said that, it is important to engage with a VC correctly using this platform and not make blunders, as only few will get a reply.

Things to do and not do when writing to a VC:

- Keep it short and compelling- Most of people who write to me make the mistake of send large texted LinkedIn messages. Entrepreneurs need to understand that one LinkedIn message is not going to get you funding but what it can get you is a meeting or call. Therefore, the message should be crisp and, importantly, seeking time. Your message is like a teaser to your movie — tell the VC about the hot makeout scene of Scarlett Johansson (my favourite) is doing in your movie etc. So keep it short; not more than 40 words, and extremely compelling.

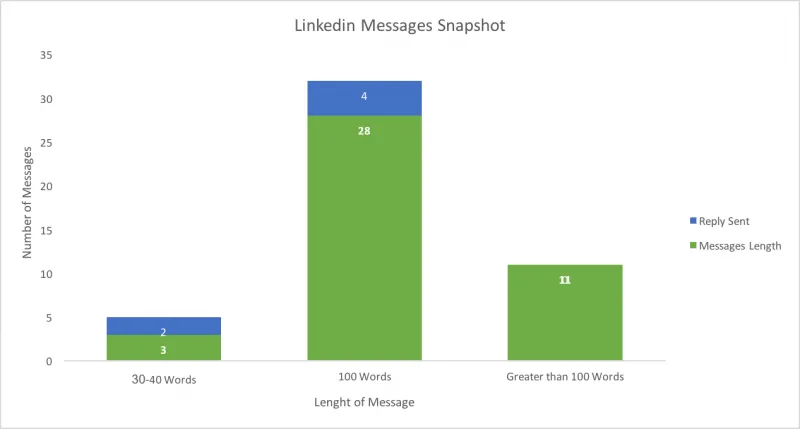

- Snapshot of break-up of my messages and number of those to whom i replied.Some examples of short-pitches- “My company, Ai travel hai Mushkil, is developing a web-based social seating check-in platform to help air travellers see who is on board their flight and use Facebook and LinkedIn to assign all flight seats with one click.”

- “My company, Dilwale Dulhaniya ko Gift de jayenge, is developing a gift recommendation engine to help men foster better relationships through periodic and thoughtful romantic gestures, utilising behavioural science, models of preference and social trends.”

- Pro tip: If the message has a scroll, it is long.

- Make the message personal: — Now that you know we get a lot of LinkedIn requests/messages, how about you make the message a little personal and not do a copy-paste job. Do some research about my interest areas or any article that I might have written or follow my latest tweets. This is very important to break through the clutter. Be genuine and authentic and not be transactional.

- Note- Don’t get too personal as well- “I met your wife this weekend at an event, and let me tell you she is very beautiful ;-)” will definitely not get a response.

- Shift conversation to email: Remember the time when you used Tinder and after the match and some conversation, you asked for their number and moved the conversation to WhatsApp? Do the same after you get an initial response; seek the VC’s email id and move the conversation to email. Understand that it is hard to manage so many conversations through LinkedIn and enabling another message notification can be irritating so it is important that you take initiative to move the conversation to email after initial reply.

- Get on THE calendar: — VC job demands that we have a lots of calls and meetings so we are constantly shuffling calendars. Once you have moved the conversation to email, it important to send calendar invite or get one from the VC or his assistant. Remember — the call/meeting is scheduled only if it is on the calendar.

- Be persistent but patient:I miss messages sometimes or forget to reply. Follow up with the VC if he has not replied (again, do not copy-past earlier message sent) with some update on your company, or if your company got featured on some startup publication like YS, or maybe you just won some award etc. However, do not send a follow-up email every day. Typically, follow-up email should be at least 2–3 days after first email, next after a week to 10 days and then after a month.

- Advice to contact — I checked up the LinkedIn profile of some of the top VCs in India, and noticed one thing- they have explicitly mentioned their email coordinates to contact. Even if it’s not on their Advice to contact section, it is there on their profile; it just requires two eyes, intent and some scrolling to find it.

- Emailing on personal email — Typically, I get anywhere from 4–5 LinkedIn requests daily and I don’t mind adding them as there is no harm. Some people follow up this request with a message but some of them do this and email me on a personal email and sometimes take it a step further do the same thing for my other colleagues, and email everyone... like, everyone! PLEASE DO NOT DO THIS. This is definitely the road to no response.

- Ideally, try and get 'warm introductions' but if not you can use the above tips to reach out to prospective VCs. You can also send cold emails and getting email id is not tough, as VC firms are typically small outfits, with anywhere from 5 to 15 people, and to guess the email id of any person you want to reach out to should not be difficult.

- Take a shot — [email protected]/in/vc or [email protected]/in/vc or [email protected]

- All the best with your fundraising!

Disclaimer : It is strictly an independent opinion of the writer, not representative of Kstart or Kalaari.

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)