Non-for-profit Catalyst aims to catalyse digital payments at bottom of the pyramid

A joint initiative by the Ministry of Finance and USAID is helping small businesses and low-income consumers utilise digital payments and financial inclusion.

The beginning of this story dates back to 2014, a few months after Narendra Modi became the Prime Minister of India, following promises of progress in the manufacturing sector and financial inclusion. During the visit of then US President Barack Obama, their strategic dialogues included digital payments and financial inclusion. This went on to become an agreement between the United States Agency for International Development (USAID) and the Ministry of Finance, with the former funding this work.

Named Catalyst, this initiative aims to help India's small businesses and low income consumers utilise digital payments. Catalyst was officially launched in October 2016. With an independent charter under an umbrella collaboration agreement with the Government of India, Catalyst is a not-for-profit organisation. YourStory caught up with Catalyst CEO Badal Malick recently to learn more about the initiative.

Need for an ecosystem approach

Digital payments are at an inflection point, with core technology initiatives like UPI and Aadhaar and the liberalisation of payment banks proceeding in full swing. However, when it comes to digital payments, the last mile remains broken due to fragmentation of end users in the network (consumers, merchants, and suppliers) as well as solution providers. But almost all innovations that have happened in fintech have been for the top 20 percent of the population. It is the bottom 80 percent, however, that is the focus for Catalyst.

Catalyst’s first phase entailed running two or three experiments across the country, to get a good idea of merchant and consumer behaviour. It evolved as a dedicated PPP organisation, with a team from the private sector with domain expertise.

“The idea is that every merchant should be able to accept various kinds of payments. For instance, if a customer has a RuPay card, he also needs a merchant ecosystem which accepts it. On the merchant side, unless a merchant is able to pay the suppliers digitally, why would he or she accept the digital payments option? You need some kind of facilitation to bring people together for proper coordination,” says Badal.

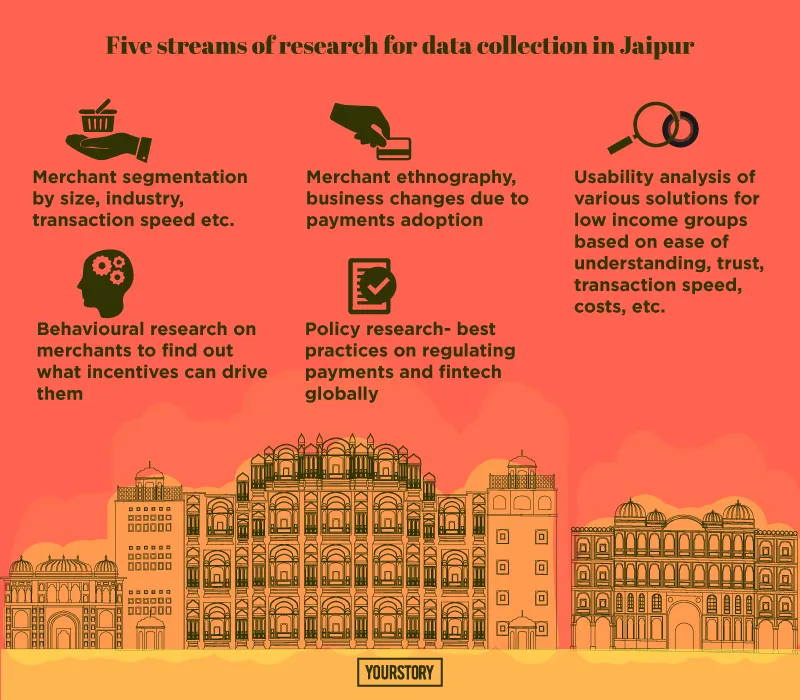

One of the major challenges is the paucity of credible data on payments and payment gateways. So, they put an operational presence on the ground with some specialised research analytics and skill sets for collecting data regarding behaviour, motivation, and attitudes. They have a partnership with key private sector service providers, public sector experts, nodal agencies, and knowledge partners in research.

While the NPCI’s UPI solution could be a possible game changer for the digital payments industry in India, it requires some financial literacy and understanding of banking processes. Catalyst holds merchant enablement camps in target clusters to educate merchants about different digital payments solutions available to them. “Once they are onboard, they will also have access to a platform to lodge complaints related to services so that we can monitor and ensure effective service outcomes,” says Badal.

Jaipur pilot

The right technology, business model, market distribution, incentives, and rewriting policies are all essential for an end-to-end solution in digital payments. Badal says, “The first step was to zero in on a representative city with decent implementation of infrastructure like Aadhaar or JAM (Jan Dhan-Aadhaar-Mobile). The city’s population, economic hubs, diversity in socio-economics, different types of trade, and most importantly, collaboration from the state government also matter.” He adds that the government’s branding helps the target audience relate to Catalyst better.

Smartphone penetration, local economy, and administrative feasibility also matter in choosing the location for a pilot. Finally, Jaipur was selected for its enabling environment. The behavioural shift towards digital payments has not happened yet in this Tier II city, making it the perfect geography to test different business models and incentives.

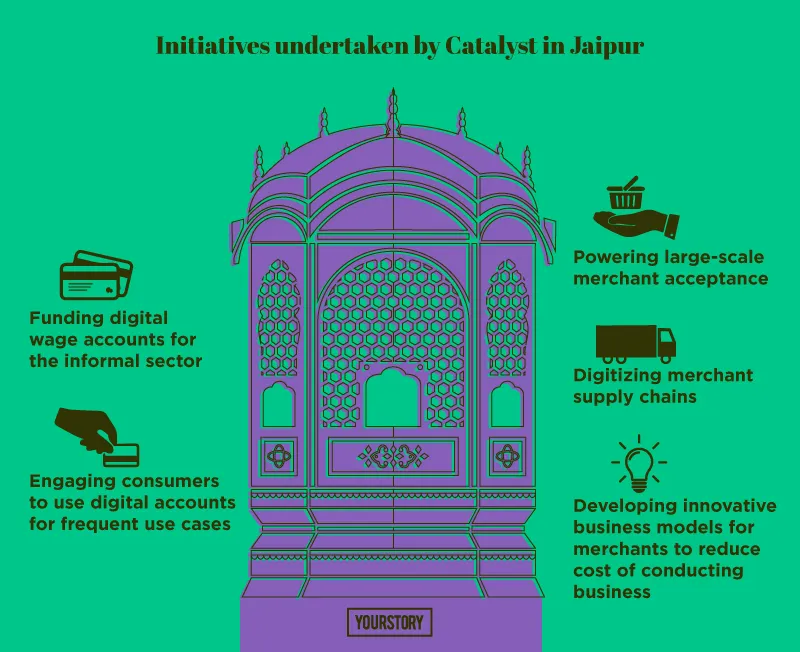

“In Jaipur, we are rolling out a set of initiatives that test technology-based solutions and business models to drive rapid but sustainable adoption of digital payments. The goal is to validate ecosystem-level templates to replicate those strategies (for payment digitisation and financial inclusion) at the state and national levels,” says Badal.

One of the first clusters being targeted is a busy marketplace in Jaipur with small merchants, out of which only 20 percent have access to digital payment facilities. It is also a student hub, with many coaching institutions, meaning that there is huge potential for the adoption of digital payments. Catalyst will also target tens of thousands of roving merchants, individual service providers, and home-based businesses in the city.

Catalyst has signed an MoU with the Government of Rajasthan, under which a digital payment lab has been set up to test and validate key components of a scalable cashless/cash-light economic system across consumers, merchants, and suppliers. Learnings from Jaipur payments lab will be evangalised on a national level to inform policymakers and the fintech industry.

Multiple collaborations

To ensure data-driven feedback, Catalyst has partnered with US-based Ideas42, which works on behavioural research to improve interfaces. It is also working with Delhi-based People Research on India’s Consumer Economy (PRICE), which conducts India’s Citizen Environment & Consumer Economy survey to figure out financial behaviour that helps go deeper in payments.

They are also collaborating with fintech startups, besides banks, for a one-stop solution on the merchant and customer sides so that all sorts of payments can be covered as per consumers’ choices. Badal adds, “We are also working with E-paisa, FT Cash, Axis bank, BHIM, Capital Float, Indifi, and iSPIRT to test adoption of their current and new hybrid solutions in the first phase.”

Catalyst provides merchants with educational material in print, digital, and video form. It has tied up with CAIT (Confederation of All India Traders) for a pan-India merchant literacy campaign, to enable small merchants to make informed decisions on choice of digital payment methods.

The catalysers

Catalyst has 15 members in its team spread across Delhi, Bengaluru, Mumbai, and Jaipur. The team comes with solid experience in digital payments, financial inclusion, public policy, behavioural research, social marketing, and communications.

Alok Gupta, former Chief Operating Officer at the World Resources Institute’s Sustainable Cities programme, and member of the original Unique Identification Authority of India (UIDAI) team that developed and implemented Aadhaar, has been appointed Director of Project Incubation. Badal himself was head of omni-channel at Snapdeal before becoming CEO of Catalyst.

Future plans

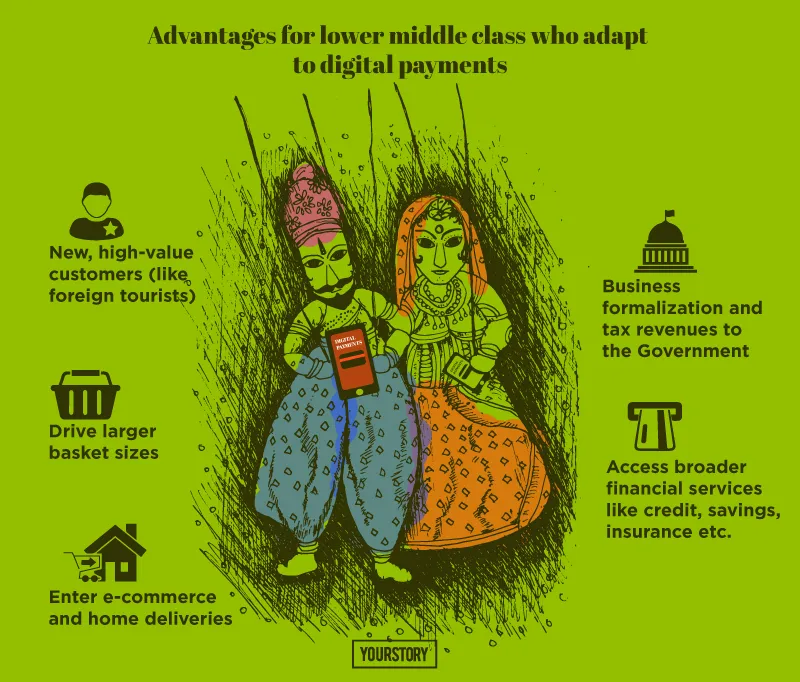

Catalyst sees digital payments as a gateway to offer financial services (like easy credit, insurance, and investment funds) to underserved segments. But for the lower middle class, compartmentalising of savings, payment, and credit is not easy.

“We are expecting new products for financing this target segment based on their needs by working with the existing ecosystem – VCs, incubators, and so on,” says Badal. Catalyst will launch a dedicated incubator by April in partnership with VCs to fund fintech startups that are developing products for the bottom 80 percent. They also aim to build new mechanisms for policy regulators and innovators to engage.

Catalyst is also building a ‘Data Vault’ to ease data gathering for regulatory purposes and more efficient data exchange between multiple financial service providers. Initiatives like digital lending to small merchants, transit payments, supply chain payments, and wage digitisation in the informal sector will also be rolled out over the next three to six months.