Common myths about emotions in entrepreneurship

Entrepreneurship has commonly been measured against financial indicators such as wealth and jobs. But what about the psychological aspects of entrepreneurship? A lot of articles such as those in the HBR, Economist, or Inc have indicated that we do not pay attention to the dark side of entrepreneurship. It is commonly assumed that though entrepreneurs might be in control of their work schedules, they blur these lines and experience more negative emotions than non-entrepreneurs.

Entrepreneurs are happy!

A new study by researchers at ETH Zurich finds the opposite results. Entrepreneurs display more positive emotions and less negative emotions than non-entrepreneurs. This study was done with a sample of 24,624 individuals. The study relied on Crunchbase to code whether an individual was an entrepreneur or not. To study displayed emotions, Twitter data was employed. Twitter data is gaining credibility among researchers, with tools such as IBM Watson requiring only 200 tweets to produce an individual’s personality profile.

Research has found that when tasks are highly relevant to an individual and/or a task is complex or atypical, emotions become more salient. Also, the ‘romance of being an entrepreneur’ can indeed attract those individuals who would be happier being entrepreneurs.

Despite the high uncertainty, financial pressures, and work overload, entrepreneurs seem to be expressing much more happiness!

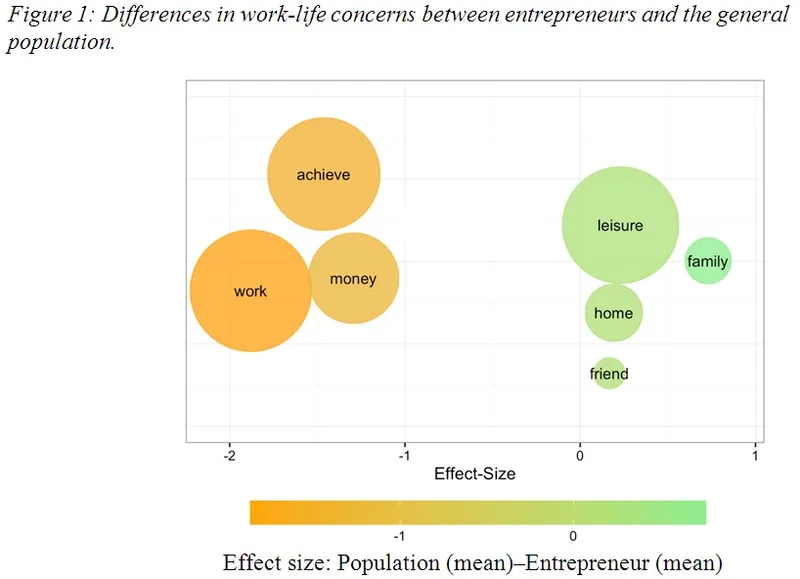

Note: The size of the bubbles represents how often the relevant category was mentioned by each group. For example, compared to entrepreneurs, the general population referred far more to issues related to leisure. For more details, see the article Tata, A., Martinez, D. L., Garcia, D., Oesch, A., & Brusoni, S. (2017). The psycholinguistics of entrepreneurship. Journal of Business Venturing Insights, 7, 38-44.

Passion for your idea is the key to receiving funding

Investors are commonly assumed to bet more on the jockey (the entrepreneur) than the horse (the idea). This has led to the belief that people-related characteristics are extremely important while raising funding. Passion has been thought to be an important quality to signal positive and strong emotions towards projects. Passionate entrepreneurs cannot stop talking thinking or talking about their ideas. There is an assumption that investors draw inferences based on the level of passion displayed by an entrepreneur.

Interestingly, a study by Chen et al. (2009), found that it was ‘preparedness’, not passion, that was the salient cue relied upon by VCs while considering if a business plan was worth funding. Passion can be shown through facial expressions or tone of voice, among many others. Preparedness can be manifested by careful consideration of market needs, how the product/service fits these needs, competitor analysis, and how questions are responded to at the end of the presentation. The authors relied on a laboratory study and a field study to explore investor decision making. So as a takeaway, being passionate is great, but do your homework too, to seal the deal.

Colours and images in business pitches do not impact funding decisions

While we know that the founder qualities and preparedness are important, we rarely think about the visual cues a business proposal could generate in the minds of its observer. Screening of venture proposals is typically done with speed. Some venture capitalists spend only around a minute per proposal.

In a recent study, Chan and colleagues looked at the role of product images and the importance of colours in the screening decisions of investors. They found that the colour red had a consistently negative effect on screening decisions and that the inclusion of product images was favourable. Entrepreneurs could take visual cues more into account while making decisions and investors could avoid making poor decisions just because of a colour.

For more details, see the article by Chan, C. R., & Park, H. D. (2015). How images and color in business plans influence venture investment screening decisions. Journal of Business Venturing, 30(5), 732-748.

Ideas impact our emotions, not the other way round

Emotions can impact ideas too. For example, fear prevents individuals from exploiting their idea, whereas anger and joy increase an individual’s probability to exploit an idea. The subjective evaluation of an idea can be strongly driven by our emotions. Our mood and emotions can be strong influences of evaluations. As entrepreneurs we should be aware of this — judging an opportunity under different emotional states could perhaps lead to better decisions

For more details, see the article by Welpe, I. M., Spörrle, M., Grichnik, D., Michl, T., & Audretsch, D. B. (2012). Emotions and opportunities: The interplay of opportunity evaluation, fear, joy, and anger as antecedent of entrepreneurial exploitation. Entrepreneurship Theory and Practice, 36(1), 69-96.

![[Startup Bharat] With over 7 lakh touchpoints, BharatATM is bringing banking to rural India](https://images.yourstory.com/cs/2/47afd43024ec11ec9ecb9b7afb0df1da/RamShriramBharatATM-1644507580802.png?mode=crop&crop=faces&ar=1%3A1&format=auto&w=1920&q=75)