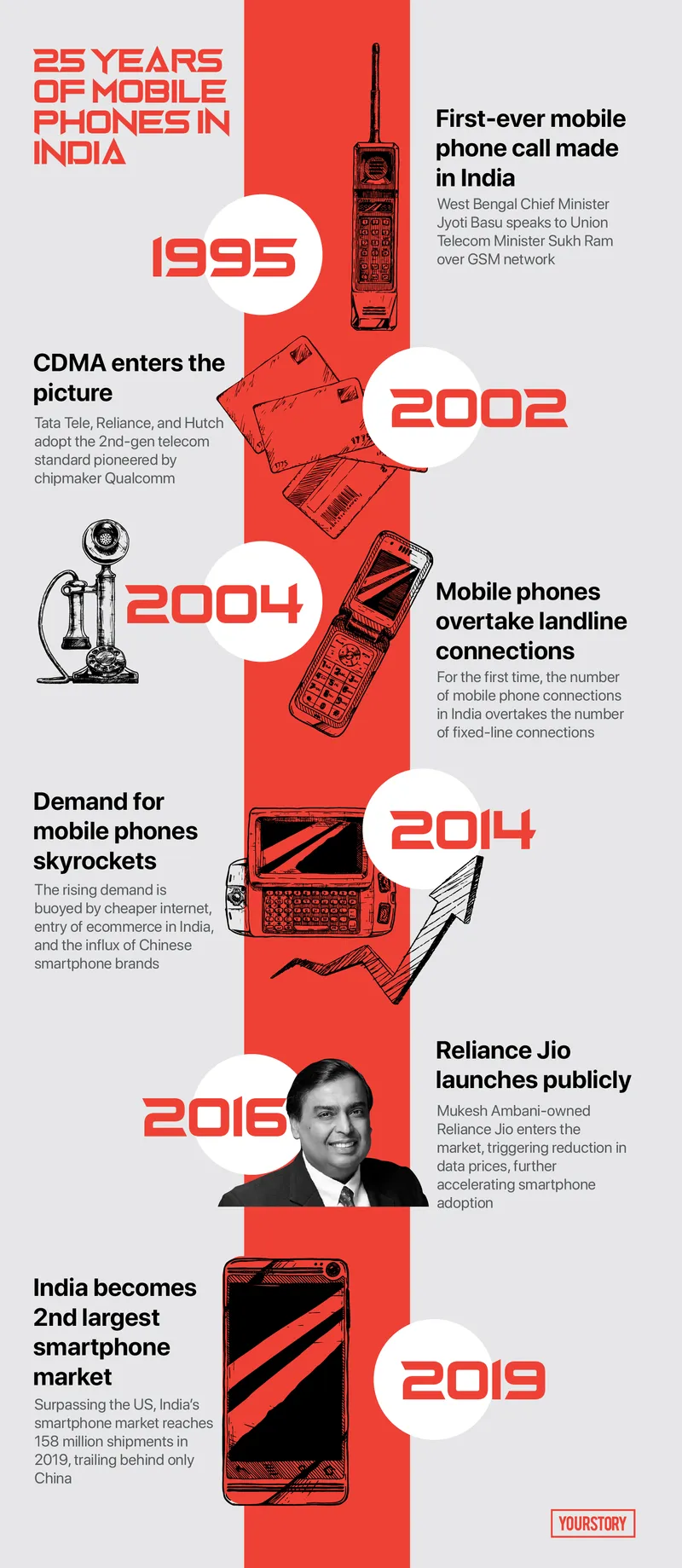

25 years of mobile phones: India’s journey to becoming world’s second-largest smartphone market

It all started in 1995 when India’s first-ever mobile phone call was made between Kolkata and New Delhi. At present, 25 years later, India is the world’s second-largest smartphone market.

Would you pay roughly Rs 4,900 for a prepaid SIM at a call rate of Rs 17 per minute for incoming and outgoing? Sounds almost absurd, considering India has one of the lowest call tariffs in the world. But if you owned a mobile phone in 1995, these were the rates you would have to pay.

That year, exactly 25 years ago from today, the first-ever mobile phone call was made in India when West Bengal Chief Minister Jyoti Basu, sitting in The Writer’s Building in Kolkata, spoke to Union Telecom Minister Sukh Ram at Sanchar Bhavan in New Delhi.

With 158 million shipments in 2019, India is the second-largest smartphone market in the world, trailing behind only China.

The historic call was made on a GSM network, and between two Nokia handsets over Modi Telstra’s MobileNet service. This sparked the beginning of a telecom revolution in India — a movement spearheaded by the likes of Jio, Airtel, Vodafone Idea, and BSNL today.

GSM vs CDMA and the rise of grey markets

In 2002, CDMA entered the picture. Pioneered by US-based chipmaker Qualcomm, CDMA was a second-generation telecommunications standard.

By then, GSM was already a dominant standard for 2G communications, holding 80 percent of the market. Several telecom companies in India operated on a GSM-based network. But Tata Tele and Reliance went ahead and began operating on a CDMA-based network.

Eventually, Hutch also became a CDMA operator. As a result, CDMA was able to stabilise its market share at 20 percent for the time being.

Back then, mobile phones were expensive. Customs duty made up around 60 percent of the cost of handsets made by Ericsson, Siemens, Sony, Philips, Nokia, and Motorola. Further, sales tax and turnover tax added to it.

Also, as mobiles did not have tracking systems or security measures at the time, it was easy for burglars to swipe these devices from unsuspecting people and households.

As a result, with the rise of mobile phones and SIMs in India, the grey market also grew. People would often buy smuggled phones in the grey market for half the price, since these devices did not include customs duty.

Thus, the retail market for mobile phones was split between legal sales of branded phones and sales of smuggled handsets.

Infographic by Aditya Ranade

A rapidly growing market

Despite some momentum for mobile phones, most of India that could afford telephone services still relied on landlines. The government-owned BSNL and MTNL were the only entities allowed to provide landline phone service in India.

But in September 2004, the rapidly growing Indian mobile phone market crossed an important milestone. For the first-time ever, the number of mobile phone connections in the country overtook the number of fixed line connections.

However, it still took some time for India’s mobile manufacturing industry to pick up steam.

Cut to 2014 — India has only two mobile manufacturing units. But, with internet becoming cheaper, the entry of ecommerce in India, and the influx of Chinese brands keen to sell at low prices, the demand for smartphones skyrocketed.

Chinese brands quickly overtook homegrown manufacturers like Micromax, Lava, and Intex in popularity.

Jio enters the market

In December 2015, Mukesh Ambani-owned Reliance Jio was soft launched with a beta for employees and partners.

In September 2016, the service became commercially available, launching 4G services with free data and voice call until March 31, 2017.

By February 2017, Jio had acquired 100 million subscribers. Its entry in the market triggered a massive reduction in data prices across networks, accelerating smartphone adoption all over India. Today, Jio is the largest mobile network operator in India.

Today, Jio is the largest mobile network operator in India

In the same year, the production and assembly of smartphones became a cornerstone of Prime Minister Narendra Modi’s ambitious Make in India campaign.

In July 2017, Mukesh Ambani made another strategic announcement — the launch of JioPhone, a 4G handset that further changed how Indians use mobiles.

2019 and onwards

By 2019, the number of smartphone manufacturers in India grew from two to over 60. In the same year, India’s smartphone market surpassed the US for the first time on an annual level.

Reaching 158 million shipments, it became the second-largest smartphone market, second only to China, according to research from Counterpoint’s Market Monitor service.

At present, all the leaders in India’s smartphone market are Chinese brands, with the exception of Samsung, which is from South Korea. India’s smartphone market is led by Xiaomi (30 percent market share), Vivo (17 percent market share), Samsung (16 percent market share), Realme (14 percent market share), and Oppo (12 percent market share), as per Counterpoint Research’s latest rankings for Q1, 2020.

Despite the recent clarion call to boycott Chinese goods, Chinese smartphones that assemble in India continue to dominate our market. Samsung is now looking to capitalise on the anti-China sentiment and arrest its declining market share.

The government is also taking steps to boost local manufacturing through initiatives such as the Production Linked Incentive (PLI) scheme for large-scale electronics manufacturing, Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors (SPECS), and the scheme for modified Electronics Manufacturing Clusters (EMC 2.0).

These are expected to attract investments in India, boost local production of mobile phones and components to Rs 10 lakh crore by 2025, and usher in a new era of mobile phone manufacturing in India.

Edited by Saheli Sen Gupta