[World Health Day] 6 funding and consolidation trends in the Indian healthtech sector

On World Health Day, we take a look at some funding and consolidation trends in the Indian healthtech sector.

The COVID-19 pandemic has had a huge impact on the Indian healthcare industry. Although the unprecedented crisis put immense pressure on the weak healthcare infrastructure, it also offered opportunities for several healthtech companies.

Since last year, the Centre has taken several steps to boost innovation and help startups build and scale solutions to fight the pandemic and future crises. This includes an increased allocation for healthcare in the Union Budget, financial and policy support, and easing innovation challenges.

Representational Image

Between 2010 and 2015, healthtech emerged as a key sector for venture capital (VC) investments. Closer to 2020, investors became bullish on new-age tech startups. However, with the pandemic prompting innovation in healthtech, startups in the sector are once again attracting investor attention.

Hemant Mohapatra, Partner at Lightspeed India Partners, said healthcare is one of the sectors where a significant behavioural shift to fully digital solutions is expected. The other sectors of interest in this regard are edtech, content, software as a service (SaaS), fintech, and ecommerce, he said.

On World Health Day, we take a look at some funding and consolidation trends in the Indian healthtech sector, based on YourStory Research data. The period considered for analysis is January 2015-March 2021.

Investors renew interest in healthtech

Due to COVID-19, there have been several innovations in the healthtech sector, leading investors to test the waters with small ticket-size funding in 2020. Although the total value of funding fell in comparison to each of the previous three years, the number of deals was more than in each of those years. Now with the sector turning stable due to increasing innovations to fight COVID-19, funding has picked up pace, so much so that healthtech startups have raised $234.4 million in just the first quarter of 2021, exceeding the total amount for the whole of last year by 14 percent.

[Image Credit: Karuna N, YS Design]

B2B startups gain traction

Considering India’s 1.3-billion population, startups offering business-to-consumer (B2C) solutions have usually led the healthtech sector. Last year, funding for business-to-business (B2B) and B2C startups in the sector tumbled 30 percent and 53.5 percent, respectively, in comparison to 2019. However, the number of deals jumped 57 percent for B2B startups, with a minimal increase of nearly 2 percent for B2C counterparts. In the first quarter of this year, B2B startups have already raised 2.6 times the total funding amount secured by them in the whole of 2020.

[Image Credit: Karuna N, YS Design]

Mature startups draw investors more

Healthtech is a sector driven by experience and research, with products and services requiring validation across several data points. This makes it difficult for stakeholders to predict revenues early on. Perhaps this explains why mature startups, that is, those founded in 2015, have so far secured the highest number of funding deals (144) compared to startups set up in each of the years during the period 2016-20. At five, the number of deals secured by startups founded in 2020 was the lowest.

[Image Credit: Karuna N, YS Design]

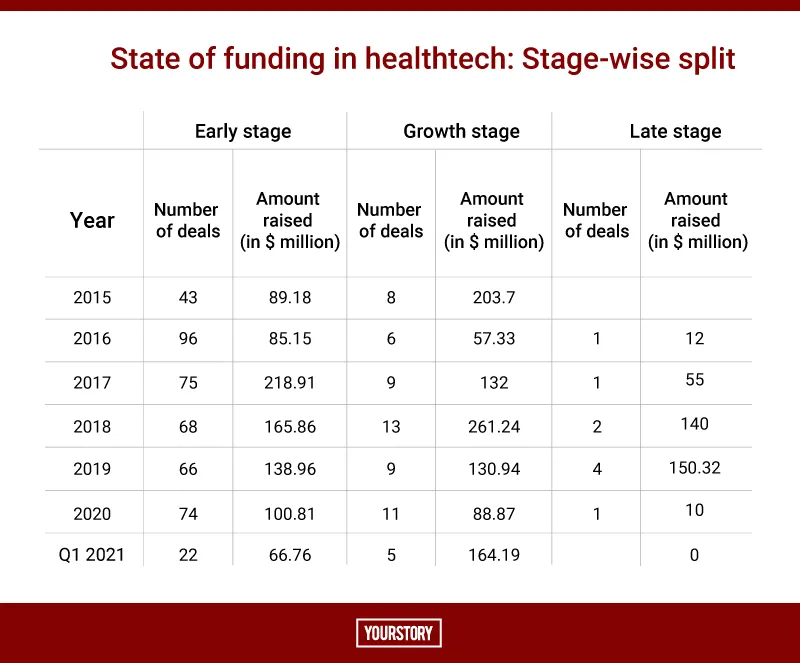

Investors sceptical of late-stage deals

There have been no late-stage deals in healthtech for Q1 2021, even as other sectors had a better time. Instead, healthtech saw 22 early-stage deals and five growth-stage ones during the period.

[Image Credit: Karuna N, YS Design]

Investors explore startups based in new places

For several years including 2020, when the pandemic started, healthtech deals were concentrated in top-tier cities Bengaluru, Mumbai, and Delhi-NCR. However, in Q1 2021 investors explored startups based in other cities. Thus, Ahmedabad gained 11 deals and Bhopal, three. Considering this was the first quarter, it is too early to say whether the trend would continue. However, this is likely to encourage more innovation at startups based in places beyond top-tier cities.

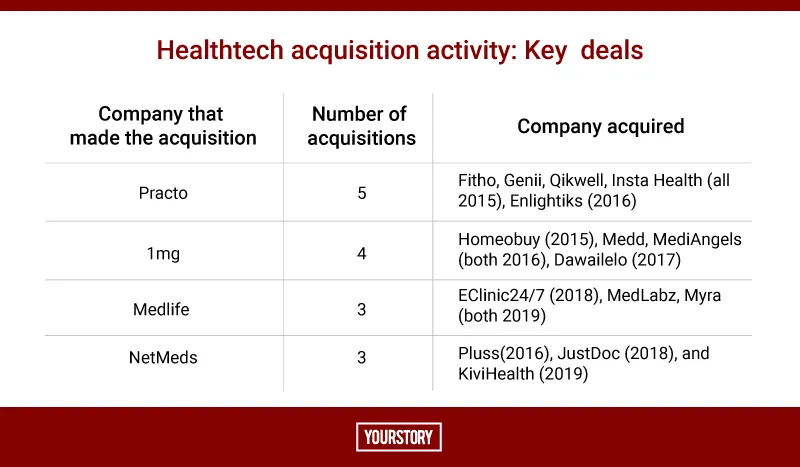

Some big acquisitions, but overall not many

Since 2015, acquisitions in the healthtech sector have risen for every subsequent year till 2018, after which they have declined successively till 2020. In fact, despite the uncertainties stemming from the pandemic last year, the sector did not see much consolidation. After four acquisitions in 2020, the first quarter of 2021 saw three such deals.

[Image Credit: Karuna N, YS Design]

[Image Credit: Karuna N, YS Design]

Last year, the healthtech sector witnessed two major consolidations:

i) Reliance Industries acquired a majority stake in online pharmacy startup NetMeds

ii) The Competition Commission of India approved the merger between online pharmacy PharmEasy’s parent, API Holdings, and rival Medlife.

The first quarter of 2021 recorded three acquisitions. Fitness startup Cure.fit bought fitness aggregator Fitternity, Vidal Health Insurance TPA (third party administrator) acquired competitor Vipul MedCorp, and online pharmacy startup Saveo Healthtech acqui-hired retail startup ShuttrStores.

The healthtech startup ecosystem has played a significant role in battling the COVID-19 crisis. While it struggled when the pandemic began last year, innovation has helped it build a way through the tough times. Now, it is also supporting the country’s vaccination drive. With adequate financial support from the government and VC funds, India’s healthtech sector could position itself as a global leader.

Edited by Lena Saha

![[World Health Day] 6 funding and consolidation trends in the Indian healthtech sector](https://images.yourstory.com/cs/2/f02aced0d86311e98e0865c1f0fe59a2/funding-1615270729201.png?mode=crop&crop=faces&ar=2%3A1&format=auto&w=1920&q=75)

![[World Health Day] What does the Indian healthtech startup ecosystem need to build a robust future](https://images.yourstory.com/cs/2/f02aced0d86311e98e0865c1f0fe59a2/healthcare-1612976752240.png?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)

![[Funding alert] Groww enters unicorn club after latest $83M fundraise](https://images.yourstory.com/cs/2/f49f80307d7911eaa66f3b309d9a28f5/PHOTO-2021-04-07-17-52-26-1617798291703.jpg?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)