FY23 ends on positive note; VC funding touches $1.4B in March

March 2023 witnessed a total venture funding inflow of $1.4 billion, which comes as a relief compared to February, where the amount stood at $734 million.

The Indian startup ecosystem ended the financial year 2022-23 on a slightly positive note as the total venture funding into startups in the month of March, 2023 was the highest in the last quarter of the fiscal.

March, 2023 witnessed a total venture funding inflow of $1.4 billion. The corresponding amount for the month of February stood at $734 million, according to YourStory Research. In January, Indian startups received a total funding of $1.1 billion.

Venture funding in March 2023 saw a 52% decline compared to the same month last year, revealing the challenges of the ongoing funding winter.

Companies, including , , , and , raised $100 million and above in funding in March—a trend witnessed in the last three months where established startups have managed to raise significant capital.

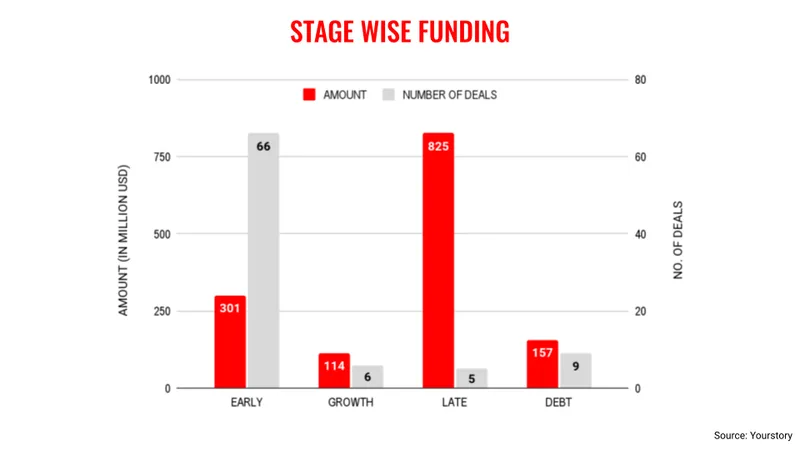

In terms of stage-wise funding, late-stage startups received the highest funding amount in March at $825 million, followed by the early-stage segment at $301 million. Venture debt funding for the month stood at $157 million as startups are increasingly relying on the debt route to raise capital.

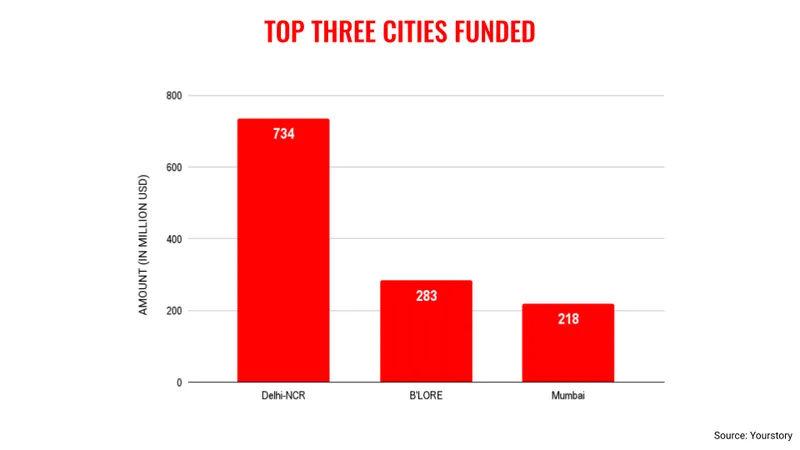

Surprisingly, startups in the Delhi-NCR region received the highest funding at $734 million, followed by Bengaluru at $283 million and Mumbai at $218 million.

Traditionally, Bengaluru occupies the number one position, given the city is regarded as the startup capital of India.

In terms of sectors, ecommerce received $521 million in funding—the highest amoun, followed by fintech at $469 million.

Despite the uptick in venture funding, the startup ecosystem will continue to face challenges to raising capital as the overall macroeconomic situation remains volatile and uncertain.

The ongoing banking crisis in the US will only extend the funding winter, and startups will have to increase their focus on sustainability, which would mean controlling losses, aiming for profitability, and laying off some workforce to control the situation.

Meanwhile, the ecosystem saw unicorns like Digit Insurance and OYO revisiting their IPO plans amid market uncertainties.

Edited by Suman Singh

![[Startup Bharat] From solar stoves to 3D printing, four stories of innovation from Gujarat](https://images.yourstory.com/cs/wordpress/2019/01/dhaval-startup-bharat-gujarat.png?mode=crop&crop=faces&ar=1%3A1&format=auto&w=1920&q=75)