Venture capital inflow remains steady in June, but down 60% compared to last year

VC funding for the month of June held steady, with $1 billion flowing into Indian startups, and this is most likely to be the trend for the rest of the year.

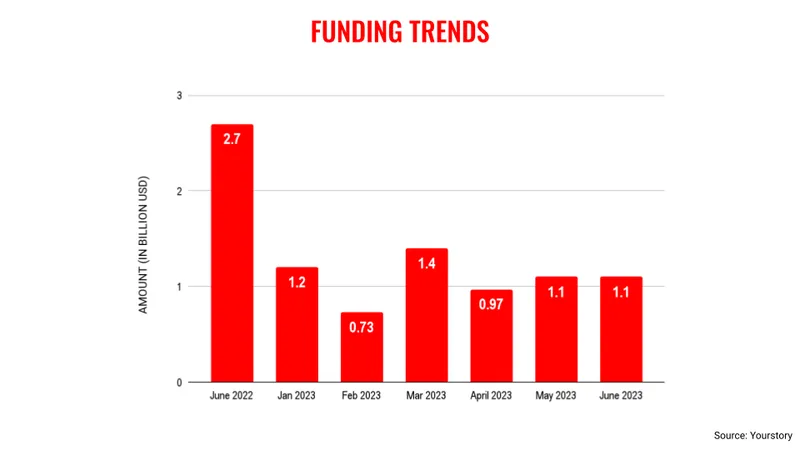

Venture capital (VC) funding for the month of June remained steady for the Indian startup ecosystem, and it was at the same level as in April, but saw a 60% decline when compared to June 2022.

The VC inflow for the first six months of the year has been hovering around the $1 billion range largely due the absence of a significant number of large deals. This has been a key factor for the funding needle not showing any upward trajectory.

The month of June managed to reach the psychologically crucial level of $1 billion in terms of VC funding, with the largest contribution coming in from and . Otherwise, the new benchmark for large deals in the current environment is in the $30-40 million range, which was seen in companies such as , , , and , among others.

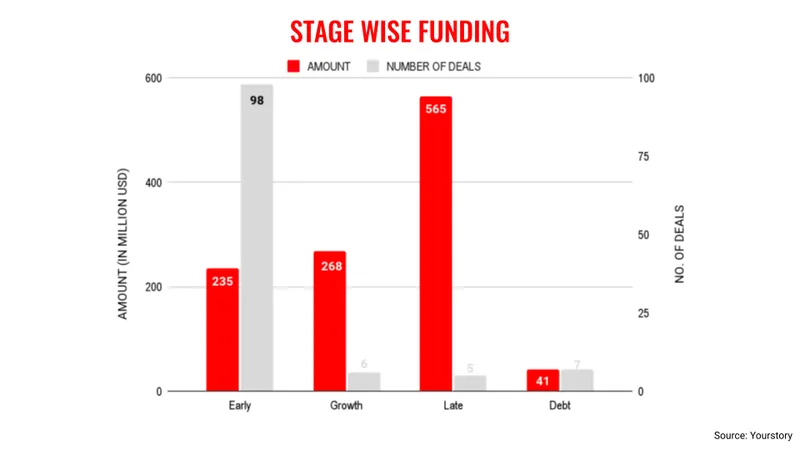

The expectation is that current momentum of funding trends is likely to continue for the rest of the year, and overall VC amount is unlikely to cross the $24 billion level as in 2022. Added to this, another dominant theme of funding is the highest volume of activity in the early-stage category of investment though the value is lower.

There has been a clear absence of large deals in the first six months of the year, and any transaction above $100 million is far and few in between.

In terms of the sectors that received the highest funding traction in the month of June was cleantech, followed by fintech and ecommerce. This was due to a single large traction in the respective categories.

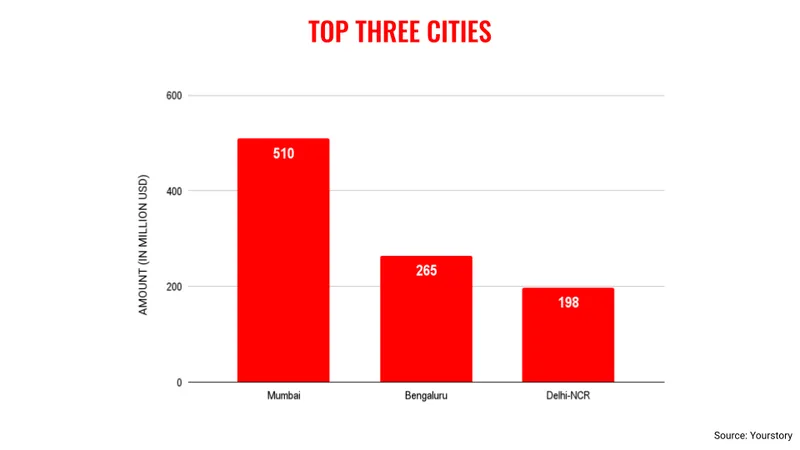

Mumbai received the highest amount of funding in June, and was followed by Bengaluru and Delhi NCR. The top three positions are generally held by these cities, proving that these are the key hubs for startup activity in the country.

However, the positive news for the Indian startup ecosystem is that there has been a steady trend in terms of VC firms raising fresh rounds of capital, with the likes of RTP Capital, Omnivore, Arkam Ventures, Epiq Capital, and Good Capital announcing new funds.

But the big question is that when the capital is deployed, the investors will be in cautious mode and very picky about their investments.

However, the dark cloud which is currently hovering around the Indian startup ecosystem is around governance issues. The developments surrounding Mojocare, where the company said the revenue numbers were inflated, does not augur well for the ecosystem as it creates doubts in the minds of investors.

Similarly, the developments around also does not send any positive signal. The edtech unicorn, which was once seen as the flagbearer for Indian startups, is facing various challenges in terms of raising fresh capital, investors resigning from the board, and certain governance challenges.

Despite these problems, the expectation is that the impact from these developments would be minimal and the Indian startup ecosystem gets onto the path of vibrancy, buzzing with entrepreneurial energy.

Edited by Megha Reddy