Q2FY25 results: The Big Four of India's IT sector sow seeds of optimism

The performance of the top four Indian IT companies—TCS, Infosys, HCLTech and Wipro—for the second quarter of FY25 showed certain signs of growth, but it is still not a case for strong recovery.

The $250 billion Indian information technology (IT) industry has shown signs of optimism, going by the financial performance for the second quarter of FY25 from the top four companies of the sector—Tata Consultancy Services, Infosys, HCLTech and Wipro.

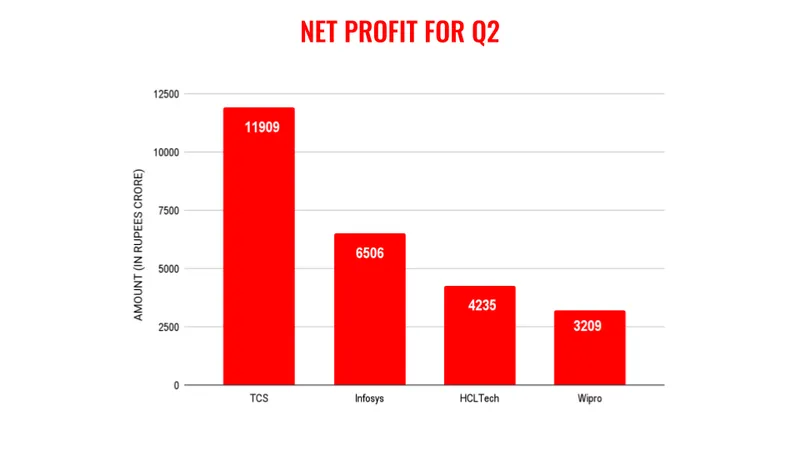

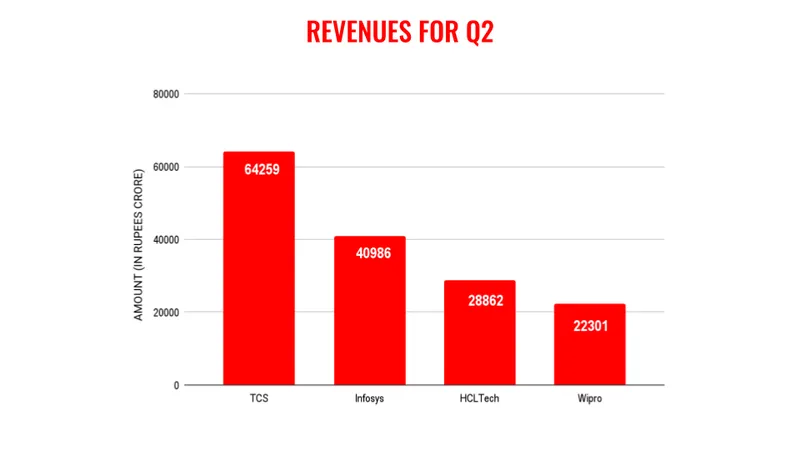

The companies' second quarter performance has not been uniform on any of the main parameters—net profit, revenues, margins and headcount addition, but each company had its own positives.

In the case of TCS, the country’s largest IT services exporter, it continues to maintain a steady rise in revenues and net profit for the second quarter but saw a marginal dip in its operating profit margins. On the employee addition front, the company continued to add more people to its workforce.

“We saw the cautious trends of the last few quarters continue to play out in this quarter as well. Amidst an uncertain geopolitical situation, our biggest vertical, BFSI showed signs of recovery. We also saw a strong performance in our growth markets,” TCS CEO K Krithivasan said.

Brokerage house Jefferies said in its note on TCS that a return to growth of its key verticals and net hiring being at a seven-quarter high are emerging signs of a revival.

On the other hand, Infosys also showed a similar growth in net profit and revenues. Though, the big positive for the company was the revision of revenue guidance for FY25 to 3.75-4.5% from the earlier range of 3-4%. The company also added new employees for the second quarter in a row after six quarters of decline.

However, Infosys remained cautious in saying there would be a steady rise in revenues hereafter, as discretionary spending, that is, fresh investments into technology have not picked up yet. The company noted that majority of the deals in the market were largely from the non-discretionary category, or the kind of projects that required a cost takeout.

Motilal Oswal in its note said that despite broad-based revenue growth this quarter, the commentary by Infosys and guidance dampened expectations of a significant rebound in discretionary spending.

“We were enthused, however, by the double digit YoY growth rate in small deals (less than $50 million total contract value). The company was cautious in calling this out as a trend, but we believe these are the early signs of flow business returning to the company and the sector, positioning it well for FY26E,” it said.

Meanwhile, for Wipro, results were a mixed bag as the net profit for the second quarter grew by 21% but the revenue growth was largely flat. A big positive for the company was the improvement in the operating profit margins to 16.8% from 16.1% a year ago. However, it provided a dowcast outlook for the third quarter of FY25.

Brokerage house Emkay was enthused by its healthy operating performance of Wipro along with strong large deal wins and healthy cash conversion. At the same time, it had concerns over the weak revenue guidance for the third quarter and softness in business verticals such as energy & utilities and manufacturing.

“Wipro reported better-than-expected operating performance in Q2. Revenue grew 0.6% QoQ CC (highest in last 7 quarters), ahead of our expectations and closer to the upper end of its guidance,” it said in a note.

The strongest performance among the top four came from HCLTech, which registered a 10.5% rise in net profit and 8.2% growth in revenues for the quarter. Further, it also increased its revenue guidance for the fiscal year. However, it saw a marginal dip in headcount during the second quarter.

BNP Paribas said, “HCL Technologies (HCLT) has made a remarkable journey from being a predominantly infrastructure management company to a well-diversified IT services firm. We think HCLT's diversified service capabilities are still underappreciated, especially its progress in cloud computing.”

It also added that HCLTech's revenue growth guidance looks conservative, but it remains confident of broad-based growth recovery by the IT company.

Edited by Jyoti Narayan