Instructions: How to File ITR-4 SUGAM Return Form

Given here are the basic instructions which has to be followed while filing the ITR-4 SUGAM form for all the individuals having income based on salary, house property or from other sources.

General Instructions:

These instructions are directions to the taxpayers for how to file Income-tax Return Form-4 (ITR-4) considering each and every detail for the Assessment Year 2019-20 or the Financial Year 2018-19. For any query, taxpayer can once check the relevant provisions of the Income-tax Act, 1961 and the Income-tax Rules, 1962.

1. Applicability of this Return Form for the Assessment Year

An individual can file this Return Form for the Assessment Year 2019-20, i.e, for the income earned in the FY 2018-19.

2. Eligibility to use this Return Form

One who is a resident other than not ordinarily resident, is liable to file this Return Form if his/her total income for the AY 2019-20 does not exceed INR 50 lakh and whose income falls under the following heads:

(a) Income from Salary/ Pension

(b) Income from One House Property

(c) Income from Other Sources

(d) Income from Profession where such income is calculated on presumptive basis u/s44AD (i.e. Gross receipt up-to Rs. 2 crore) or section 44AE (income earned from goods carriage upto ten vehicles)

(e) Income from business where such income is computed on presumptive basis u/s 44ADA (i.e. Gross receipt upto Rs. 50 lakh)

Note: 1 The income estimated on presumptive basis u/s 44AD or 44AE or 44ADA shall be presumed after reducing every loss, allowance, depreciation or deduction under the income-tax Act.

Note: 2 Further, in case if the income of other family members like spouse, minor child, etc is added to the income of the assesses and the combined income falls into the above mentioned categories then an individual can file for this Return Form.

3. Ineligible Candidate to file this Return Form

A. An individual cannot use this Return Form who-

- Is a Director in a company

- Kept any unlisted equity shares at any time during the last year

- Possess any asset (including financial interest in any entity) vested outside India

- Has signing authority in any account established outside India; or

- Earn income from any other source outside the country

B. Any individual who have earned income last year from any of the below mentioned ways, would also not be eligible to file this Return Form

- Profits and gains from business and industry

- Capital gains

- Income from more than one house property

- Income from other sources given below

- winning from lottery

- from owning and maintaining race horses

- Income taxable at particular rates u/s 115BBDA or section 115BBE

- Earned income in accordance with provisions of section 5A; or

- if earned income from agriculture excess INR 5,000

C. Further, those who have any claims of loss/deductions/relief/tax credit etc of the following nature, also cannot fill this Return form

- Any brought forward loss or loss to be carried forward under any head of income

- Deprivation under the head ‘Income from other sources‘;

- Any claim of exemption u/s 90 and/or section 91;

- Any claim of deduction u/s 57, other than deduction under clause (iia) thereof (relating to family pension); or

- Any claim of credit of tax deducted at source (TDS) in the hands of any other person.

4. SUGAM Form is not Obligatory

ITR-4 (Sugam)Form is an optional, simplified return form which can be used by the taxpayer, if he can declare profits and gains from business and profession on presumptive basis u/s 44AD, 44ADA or 44AE. Even if, the assesses keeps and maintains all books of accounts and documents refereed in section 44AA, and also his accounts audited and gets audit report as per section 44AB, there is no requirement of filing Form ITR-4 (SUGAM). In such situation other available forms like ITR-3 or ITR-5, as applicable to be filled instead of this form.

5. Annexure-less Return Form

While filing this Return Form there is no need of attaching any document including TDS certificate with it. If any enclosed with this Return form will be detached and returned to the person filing the return.

6. Different Ways to file this Return Form

One can file this ITR-1 form with the Income-tax Department by following any of the given below method Electronically through the Income-tax Department web portal (www.incometaxindiaefilling.gov.in) and verified it via any of the following manner-

- Digitally signing the verification part, or

- Authenticating by way of electronic verification code (EVC), or

- By sending duly signed paper Form ITR-V (Acknowledgement) by post to CPC at the following

Address- 'Post Bag No. 1, Electronic City Office,

Bengaluru-560500, Karnataka'

The time limit for sending the Form ITR-V at the given address is 120 day from the date of e-filing of the return.

(B) This method of filing from paper form, at the designated offices of IT department, along with duly signed Form ITR-V, is acceptable only in the case of super senior citizens (i.e. an individual of the age of 80 years or more at any time during the previous year)

7. Filling out the Acknowledgement

Fundamentally, there is need of filing only one copy of this Return Form. in case one opt for paper form of filing, the acknowledgement/ ITR-V should also be duly filled.

8. Assignment to file Return

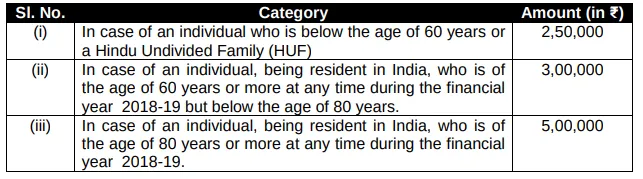

If the cumulative sum of income of any taxpayer before allocating deductions u/s Chapter VI-A of the Income-tax Act, surpasses maximum amount threshold which is not accountable to income-tax is liable to provide his return of income. Also, the deductions claimed are required to report in Part C of this Return Form. For any query, please go through the relevant provisions of the Income-tax Act. The threshold value under which the Income tax would not be deducted for Assessment Year 2019-2020, considering different categories of individuals is as under.