How VCs are changing the landscape of MSME financing

While venture capitalists are eyeing profitable family-run enterprises for sustainable growth, the changing landscape offers opportunities for MSMEs, with private investments driving expansion and innovation.

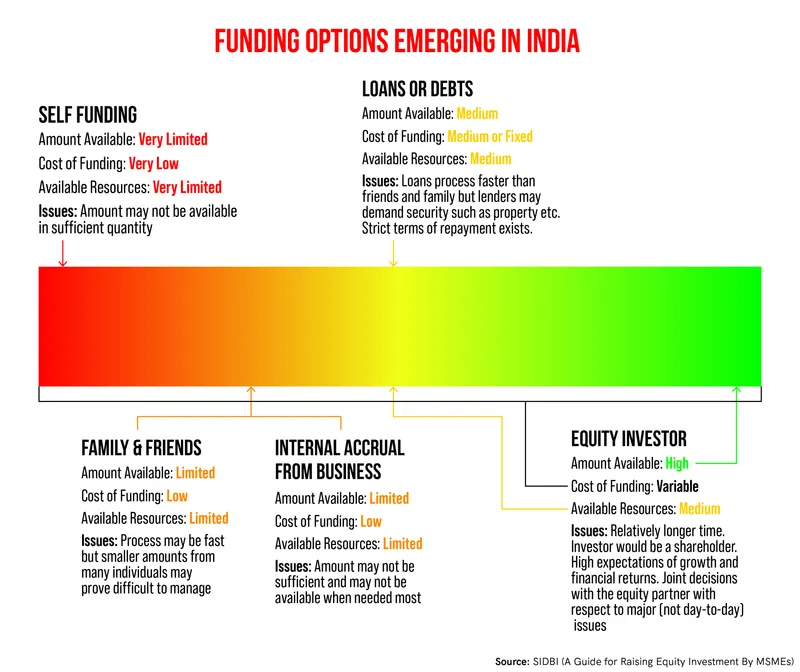

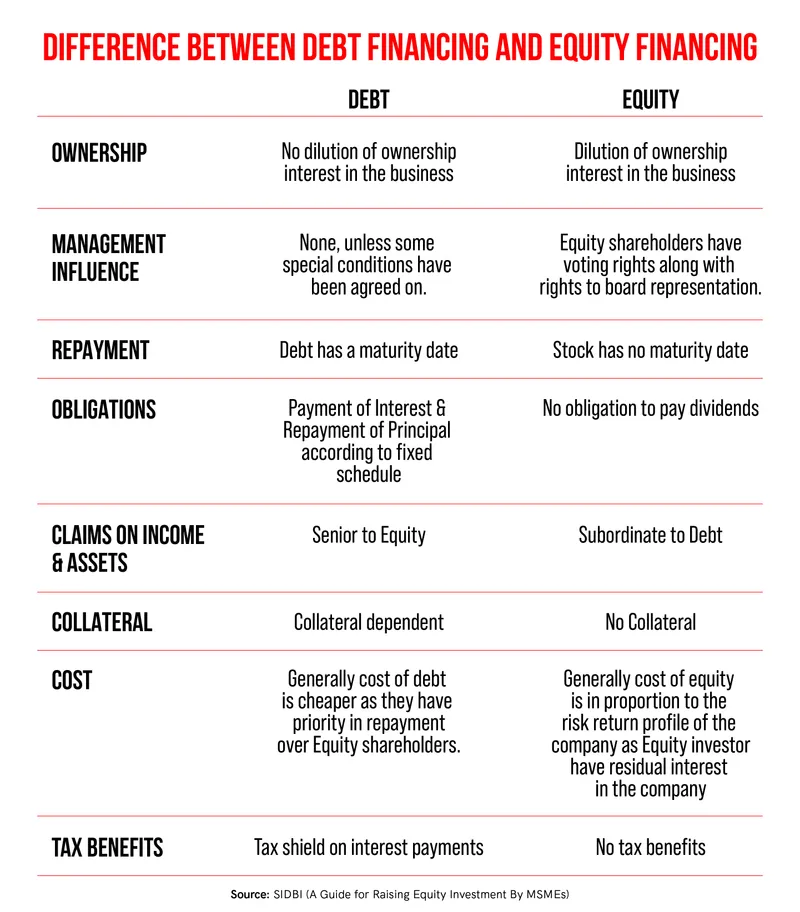

Venture capital is emerging as a significant source of funding for Micro, Small, and Medium Enterprises (MSMEs) in India. These businesses previously depended on banks for funds and credit, with banks often showing reluctance to extend loans due to concerns about Non-Performing Assets (NPAs). Nevertheless, the sector has displayed the capacity to grow steadily, operate profitably, and exhibit the resilience required to thrive in a competitive market.

The MSMEs play an important role in determining the growth and development of the Indian economy. India possesses one of the world’s most extensive MSME sectors, encompassing more than 63 million enterprises. According to government data, the sector contributes a substantial 29% to India’s GDP, and offers employment to over 110 million people.

In this environment, where MSMEs are starved of capital to fulfil their growth ambitions, these businesses are eager to bring in money from venture capitalists (VCs).

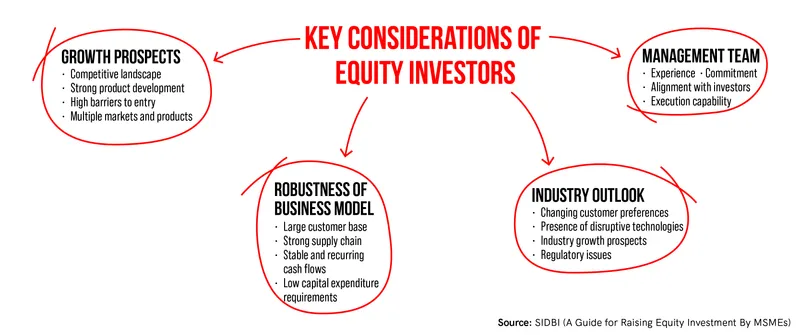

Having played an important role in propelling the growth of startups and contributing to the emergence of over 100 unicorns, VCs like Fireside Ventures, SIDBI Venture Capital, Aavishkaar Capital, Everstone Capital, and others are now actively looking at these small businesses which are profitable, possess a rich legacy and reputation, often being family-run enterprises. These businesses are capturing the imagination of VCs as they seek to further expand their horizons.

The need for external funding

Speaking on how entrepreneurs were running businesses in a protective way, Dipanjan Basu, Co-founder and Partner at Fireside Ventures, says, “Until now, capital served as a protective barrier.” He adds that traditional companies have operated with a rigid approach.

“For these established enterprises, the hallmark of success was running for a decade or two and generating an annual revenue of Rs 100 - Rs 150 crore. However, when startups started achieving these revenue figures in just three to five years, it posed a challenge to these well-established businesses,” he adds.

Basu says long-standing businesses are led by experienced entrepreneurs with innovative ideas, but limited access to capital hinders their ability to expand rapidly, hire top talent, or embrace technological advancements.

Hari Krishnan, Associate Director of Aavishkaar Capital, also highlights similar challenges faced by MSMEs. “Most startups fall within the MSME category, but not every MSME is a startup.” Krishnan explains that MSMEs have a reputation for weathering tough times and operating profitably without excessive spending. However, this resilience can also impede their ability to explore new avenues or adapt to change, hindering their long-term growth.

Bengaluru-headquartered Koskii secured Rs 61 crore in a Series A funding round in June, led by Baring Private Equity Partners India. Transitioning from a traditional family business, Koskii co-founder Umar Akhter, along with his brothers Haroon Rashid, Sameen Eajaz, and sister Ayesha Saubia, is evolving their father’s legacy apparel business into a completely new form after securing funding.

Akhter explains that while they successfully built a profitable venture from ground up, reinvesting every earned rupee into the business has its limitations in terms of scalability.

“To expand nationally would take years at our organic growth pace. Once you’ve mastered the recipe for success, moving fast is crucial to outpace competitors who may quickly learn your strategy and surge ahead. External investment gives us the fuel to propel us into the fast lane, ensuring we stay not just in the race, but lead the pack,” he adds.

Koskii, which has 13 stores across Bengaluru, Chennai, Hyderabad, and Delhi, is now planning to open around 10 more stores by 2024.

Apart from funding, VCs also help entrepreneurs gain access to mentorship from some of the most experienced minds in the industry, says Nishant Sharma, Founder and Managing Partner at Kedaara Capital.

Changing landscape of MSME funding

Legacy businesses, whether they fall under the category of MSMEs or play a role in enabling MSMEs, possess a deep-rooted business expertise. So, building and scaling a manufacturing business is easier compared to a brand, says Ravi Saxena, Founder of kitchenware and cookware brand, Wonderchef.

Wonderchef commenced its operations in 2009, and was self-funded until 2014. Saxena notes that when he approached investment firms for funding in the initial years, they were unresponsive. However, the landscape has undergone a significant transformation since then.

Reflecting on the scenario a few years ago, Saxena says, “Many people had questioned my approach towards business expansion, emphasising cost-effective strategies. However, a pivotal shift occurred with geopolitical tensions and the United States Federal Reserve's decision to raise a key interest rate benchmark. This led to a shift in the availability of easy money, causing the valuation bubble to burst. As a result, the venture capital ecosystem is now leaning more towards stable and sustainable businesses.”

After raising its first round of funding from Mauritius-based investment firm Capvent in 2021, Wonderchef raised Rs 150 crore led by Sixth Sense Ventures, along with the Godrej Family office, Malpani Group, and other high net-worth individuals (HINs) participating in the round.

“Although working capital might not sound glamorous, it’s a significant concern for any small and medium business,” Saxena says.

In its fourth year of operations, Wonderchef reported a revenue of Rs 20 crore. The brand was able to hire top-tier talent after securing funding and gaining access to capital. This, in turn, facilitated the expansion of the business both online and offline, says Saxena.

Today, Wonderchef stands at Rs 700 crore revenue.

VCs rethinking investments

Discussing the current landscape of business investments, Sharma notes that unlike the past, where companies were raising substantial amount of capital, the focus now at Kedaara is on sustainable and profitable businesses. The capital has also dried up, he notes.

Kedaara Capital primarily invests in family-led or traditional businesses, and about half of its investments are in these businesses. Some of its portfolio companies include Vedant Fashions (Manyavar and Mohey), Spandana Sphoorthy, Vijaya Diagnostics, Vishal Megamart, etc.

“There has been a noticeable change in the way traditional businesses are managed. In many cases today, there is either no successor or, even if one exists, they may choose not to be involved in the business. This is where private equity investments come into play, allowing professionals to operate the business,” Sharma explains.

“In some instances, even the new generations seek mentorship as they prefer not to solely continue the family's established practices,” he adds.

Basu also mentions that many traditional businesses are still hesitant to engage in transparent conversations, particularly when it comes to disclosing financial records. There are also concerns about the cap table, with a preference for having relatives in key positions. However, there is a gradual transformation taking place, where these family-run enterprises are looking forward to a corporate culture contributing to the flourishing of these enterprises.

Government funding and loan schemes

While traditional funding methods like government schemes and initiatives offer perks to MSME entrepreneurs, Koskii’s Akhter says that government schemes often fly under the radar, with many entrepreneurs unaware about their existence.

“For those in the know, the journey to access these benefits unfortunately is not seamless. Navigating the bureaucratic maze requires resilience and perseverance. While these schemes do offer a leg up, providing a foundational boost for businesses at a very early stage, they are not structured to support business for rapid growth beyond a certain scale,” says Akhter.

In essence, they're good fringe benefits, but for hyper-growth, you need support beyond what these schemes can offer, Akhter says.

Government has rolled out various credit schemes for MSMEs like Growth Capital and Equity Assistance Scheme (GEMs), Credit Guarantee Fund Scheme for Micro and Small Enterprises (CGTMSE), Pradhan Mantri MUDRA Yojana (PMMY), etc.

Saxena recalls the time he started Wonderchef and was approaching banks for loans. He says there were various schemes that required collateral, but usually MSMEs don’t have that. “I did avail a Rs 1 crore fund under CGTMSE scheme, which really helped me. But that access to credit is limited. Though the government has raised this limit to Rs 5 crore now, not all get its benefits,” he says.

Fireside Ventures, on the other hand, has partnered with Self Reliant India (SRI) Fund, a government funding initiative for MSMEs, where it has catered to around 40 businesses till now. Basu says that besides other investments, Fireside is also focusing on investing in SMBs having a stipulated fund of over Rs 1,800 crore.

In conclusion, the evolving landscape of entrepreneurship is witnessing a changing tide, with even seasoned entrepreneurs overcoming their initial reluctance towards seeking private investments. Saxena's insights suggest that this transformative trend is poised to endure for decades, creating a fertile ground for the growth of truly impactful businesses.

(Graphics and feature image by Nihar Apte)

(The copy was updated to correct the name of Kedaara Capital founder.)