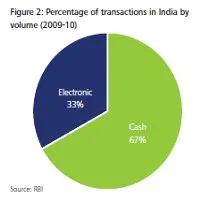

The title intends no pun and is a straight forward question. What are the modes by which an average Indian pays? Cash. The discussion should end over there, one might say. But there are multiple dimensions that can be looked at behind this psyche or perception.Majority of the transactions still happen through cash and people are comfortable with it. In a recent post, it was discussed how the Indians have opened up to paying online but the major revolution has been in the travel sector. So, if we discount this factor, online payment has a different face.

The figures show the numbers before the eCommerce revolution but even today, major chunk of the payment is made through cash. There are many reasons for this, like not having the technical capabilities from the merchant’s point of view or a lack of trust, from the customer’s point of view.

It is only a matter of time while this changes, many would say, but why does this scenario have to change? Why do companies want the customers to pay electronically or why should the circulation of physical cash be thwarted? There are very strong points laid down by Deloitte and ASSOCHAM in one of their reports.

• Fraud – The number of counterfeit notes found in India are around 3 to 6 per million. The actual number of fake notes could be much higher in the country. Such counterfeit currency is used to fund illegal activities, and adds to the ‘black’ money circulating in the economy

• Cost to the economy – The number of notes in circulation in the Indian economy is about 49 billion, increasing at a rate of about 10% per year. Printing notes, distributing notes, destruction of old notes and replacing them with new notes, carries a huge cost to the economy

• Inconvenience of carrying cash – Carrying large amounts of cash is inconvenient and carries the risk of being stolen

• Tendering exact amount of cash – Providing the exact amount of change in any transaction is inconvenient for the consumer and the merchant.

Thus, increasing the percentage of non-cash mode of payment, not only provides a significant opportunity from a business perspective, but also holds significant benefits to the country from economic and social perspectives.

This is what makes the online business so compelling and companies have been trying to revolutionize the system of how a customer pays. We’re not far from when we’d know what clicks in the Indian market and we’d surely be bringing you stories about all these possible enablers in the coming times.

To talk about technology, mobile payments seem like the future and you might want to read an analysis of the kind of technologies that would be enabling this.