Google: Mission Total World Domination (Part 2 - Beyond Online)

In part 1 of this series yesterday, we analyzed how Google has created a well-integrated suite of online products that are designed to garner and retain online traffic. But the problem is that online traffic and hence advertising revenues are saturating and slowing down. More importantly, they have huge cash reserves that need to be utilized with a long term view if they have to remain relevant as technology changes rapidly. History is littered with organizations that ruled the roost, only to be caught unawares when technological advances or user behaviour changed drastically in a short period of time – Kodak andBlackberry are just some of the examples.

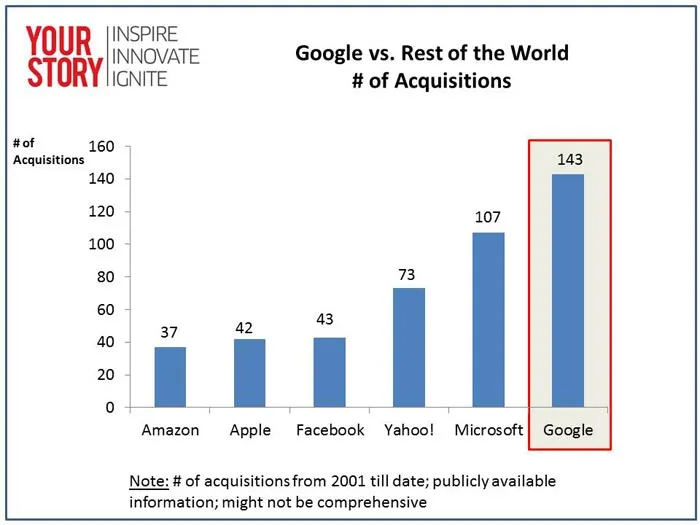

One route that the Mountain View, California-headquartered Google has taken to remain relevant and ahead of the wave is the inorganic approach of acquiring companies for IP, talent and user base. Google has perfected the art of acquisitions and post-acquisition integration over the years. To be specific, they have integrated about 143 companies over the past 14 years.

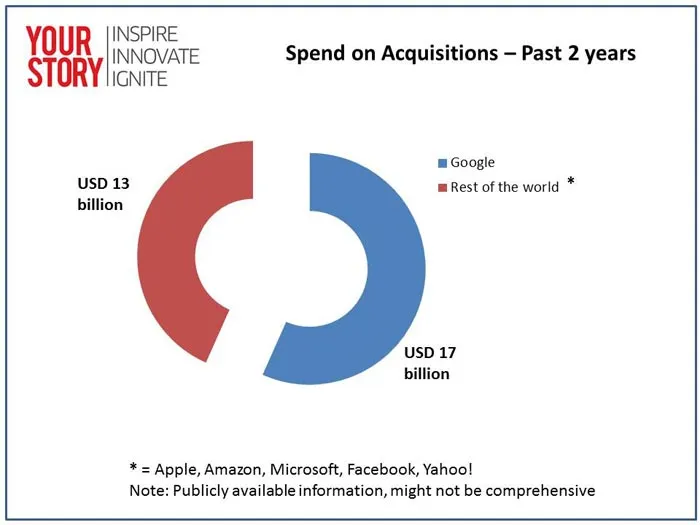

Google is way ahead of its competitors not just in the number of acquisitions, but even in terms of money spent on those acquisitions. The chart below shows the money spent on acquisitions by Google in comparison with the same five companies, over the past two years. Arguably, this two- year period is an exception rather than the rule since there were two big ticket acquisitions - $12.5 billion spent on Motorola Mobility and $3.2 billion on Nest Labs. But even considering that, Google has outspent the top five competitors put together by a wide margin!

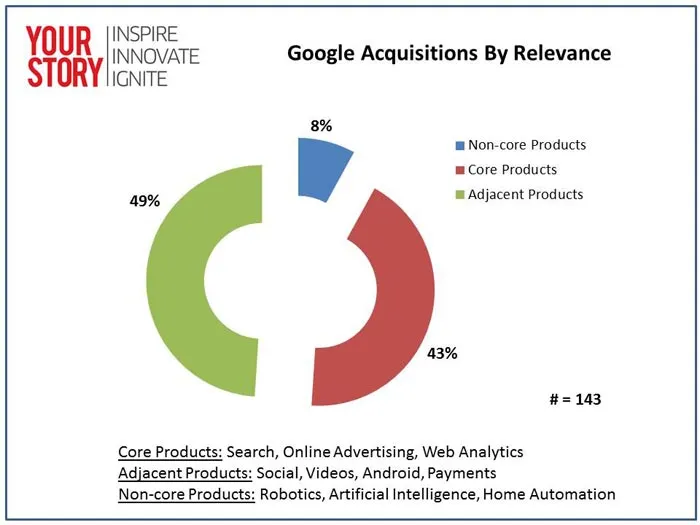

But where is all this money going? Before the Nest Labs deal could be assimilated by the market, they acquired a little known artificial intelligence company called DeepMind Technologies for an estimated $ 400 million. About six months ago they purchased the mobile mapping software company Waze for nearly $ 1 billion. These are as diverse as can be imagined. An analysis of the known 143 acquisitions from 2001 till date shows three trends:

- About 43% of all these acquisitions were related to their core search, advertising and analytics products; further, most of these happened in the first few years and then slowed down

- About 49% of all acquisitions were related to their second wave of products –social features, mobile platform Android and so on; these started about six-seven years ago

- About 8% of all acquisitions are seemingly unrelated to their business by any stretch of the imagination and most of these have happened in the past three-four years

So what is a search engine and online advertising company doing with all of these acquisitions?

- Some of these acquisitions are going into “Google X”, housed in a non-descript building a few miles from the headquarters. Google X is the code name for the super-secret facility that runs projects that have a longer gestation period and have the potential to improve technologies by a factor of 10.

- Some of these acquisitions, like Nest, have got to do with taking a gamble on how the future will pan out. It is a trend over the past decade that hardware products feature set and manufacturing have become increasingly commoditized. Design (how well designed is the product?), software (what additional features is the software providing that only hardware can never provide?) and data (what is the company doing with the gold mine of usage data?) have emerged as the new age differentiators.

With Google’s deep expertise in analytics and software integration, is the day far behind when we will be able to track our home’s power usage on our Google Drive in a daily report, calibrate the thermostat from our Android device and share the complete home security and automation update with our significant other via a private Google+ update?

Home automation and security were traditionally the fiefdom of hardware product manufacturers such as Honeywell, Siemens and the GEs of the world. But with software truly eating the world and Google leading the way, there is every cause for concern for the old guard in any industry where software and data will be the differentiators. Are they listening?

Last part of the series ‘Part 3 – Google Ventures’ coming up tomorrow!