Yes, getting VC investment is a big deal, especially in a market like India where venture money is still chasing a few.

Since the past few years the news that has been getting maximum attention in the media in the context of startups is indisputably the news on funding. Nothing wrong in that, it’s just that subconsciously we all have been fed to believe that a company that has raised money has actually arrived. Again, to a certain extent this is true. I look at it more like a marriage; at least you got married compared to some of your single friends who are still hoping to find their life partner. But, as we (those of us who are married for long) know the real challenge begins after the honeymoon is over. So is the case with funding. Acquiring an investor’s money is just the beginning. The real (love) story begins thereafter.

Today, I am going to talk to you about the lesser-known facts about investment (for the lesser-known facts about marriage you can watch the movie from which I got the inspiration for the title of this article).

Some of you must already be privy to stories of post-funding calamities. It’s tragic that after all the fanfare of getting funded, things fall apart. There are many reasons why things don’t work and there cannot be one single answer or point of view.

Alok Patnia, founder of Taxmantra.com, has come a long way since he left KPMG and started his own venture in 2010. He was offered a seed investment in the early days (and he really needed capital when he was just starting up) but the ‘draconian’ clauses that came along with the 10 to 15 lakhs of cash being offered deterred him from taking the money. “There were too many clauses and the discussion with the prospective investors was taking forever. Also I evaluated and found that for the amount I was raising the restrictions were humongous and I decided not to go for it,” says Alok. Maybe his prior background of working in KPMG and Ernst and Young helped him understand the finer points that come in the form of a term-sheet.

Today, Alok actively works with a lot of entrepreneurs; last year his firm filed 15,000 returns, a significant number of which were for entrepreneur-led ventures. He sees how entrepreneurs continue to ignore to read the fine print in agreement clauses.

“Recently, a founder was asked to leave his firm. One fine day he came to office and his email id was blocked and he was given 24 hours notice to leave. This founder had not taken salary for six months as he was completely invested in growing his venture. The disagreement between him and the investors plus his other co-founders happened over the selling of the company. While the investors saw a good return and wanted to go for a quick sellout, this founder wanted to stay put in the game -- build more value in time and then look at options. He did not know that one day he will be thrown out of his own company," observes Alok.

Read the term-sheet carefully; you need to ask as many questions to a VC as many as he asks you. “Most entrepreneurs are only interested in how much money is coming to them and how much are they diluting, but a lot lies in between that,” remarks Alok.

Aman Narang, co-founder of the erstwhile startup, Giftology, has lived first-hand the whole experience of building on an idea, raising funds and after all that, shutting shop. “Funding can be a slow poison. You have to decide who you will take money from. We had an NRI investor who put in half a million dollars in our venture. But he did not understand how it is to operate a business out of India and run on ground. Having a 30,000 feet view on what works and what does not work for a startup is easy to have, but as an investor it is important to understand the entrepreneurs you invest in and also the local nuances and challenges of the business. Our investor compared us with the market in the West. In India, the market we were addressing still remains fragmented and the approach had to be different from the one adopted in the West. Our investor unfortunately did not get it.”

Aman advises caution. “Think through before making any commitment. My whole experience has taught me one thing, don’t raise money until and unless it’s an absolute must; better still, go figure it out on your own, get customers on your own, bootstrap and once you make it happen with the right basics in place, you will see how investors will come after you,” adds Aman.

BK Birla, co-founder of ZopNow seconds this view and says,"don't raise money until and unless you really need it."

Paul Graham had once said, “competitors punch you in the jaw, but investors have you by the balls,” while it’s a debatable point, let’s simplify some of the debatable funding clauses.

Liquidation preference to investors: This clause basically refers to when the company is sold or shuts down, the investors get the first cut of the pie which is typically their invested capital plus 50% to 100% returns on top of it. The remaining pie (if anything remains) is then split between all the shareholders (including yes, the investors) in proportion to their shareholding. Simply put, in case your company is sold, you might end up making a lot less than the investors irrespective of who holds what percent of shares.Anti-dilution clause: This clause says that should you raise capital in subsequent rounds at a lesser valuation than the current round, investors get free shares so that their effective investment price is also reduced to the new valuation. For example, say I put Rs 100 in your venture at a price of Rs. 20 per share and you go and raise further money at Rs. 10 in your next round, then in the next round my investment cost becomes Rs. 10 per share and I get 5 free shares. Essentially, the additional free shares I get are at the cost of the founders.

Affirmative rights: The investors will be party to some of the key decision making in the company. Among other approvals that you need to take from the investors, you need to have their approval before raising another round, which is ok, but this clause comes into play when your investor and you do not agree on the valuation or the investor wants an exit which the new investor is not willing to provide. Many a deals have been lost because the investor wanted a higher valuation despite the entrepreneur being ok with the offer. So net result, you lose out to the wishes of your investor. Sometimes, the list of the key decision-making items may extend beyond strategic matters to operational matters.

Escrowing founder shares: Earlier, VCs used to give additional ESOPs to incentivize the founders to out-perform, now they have moved from a carrot to a stick policy. So what it means is that the founders escrow their existing share holding, which is then released back to them over time. Essentially, you start with zero shareholding in your own company and earn back your shares over time. If you are removed you lose your unreleased shares and mind you, you can be removed for non-performance.

Drag along right: Even though the investors may own less than majority shareholding in the company, they can force the other shareholders, including founders, to sell their shares when they are selling their own.

Tag along right: A perfectly normal clause, it states that should the founders sell their shareholding, the investors will also get an exit. However, the reverse does not apply, i.e. should the investors sell, there is no exit provision for the founders. This can be dangerous especially when the investors own a majority of the company. There have been instances where the majority investor sold their shareholding to a large corporate leaving the founders high and dry, the acquiring corporates felt no need to acquire the minority shareholding of the founders. Yes, it has happened.

Shanti Mohan, Founder of LetsVenture, had co-founded a product venture, Ionic Microsystems, in 1998 out of Bangalore and exited it in 2003. She raised her seed and series A money at that point of time from Global Technology Venture and WestBridge Capital. She has gone through the whole process of raising money and is now actively working with startups to enable them to raise money.

"I personally think that when the entrepreneur gets a bad deal it is not the VC to blame. A VC never forces you to sign a deal and agree to something which you do not want to agree to. Whenever VC bashing happens entrepreneurs forget to talk about their own compulsions and decisions. I believe if you do a startup, the buck stops at you as an entrepreneur. As you are accountable for all the good that happens in your venture, so you should be accountable for all the wrongs. Someone I knew bought an expensive car as soon as he raised money and eventually the company shut down. So you cannot generalize the experience a particular entrepreneur has with a VC. Many entrepreneurs trivialize the whole process of signing the term-sheet, the mindset being, I am a tech expert and I don’t feel kicked about the business side of it," says Shanti.

Advising entrepreneurs to think through their decision to raise money, Shanti says, “Today, there is so much hype around funding... is that one of the reasons you are getting pressurised? Think deeply.”

Having said that, Shanti shares an example about an entrepreneur, who after the fund-raising was over, was asked to build traction by his investors, and then within six months, the same investors flipped and started asking for revenue numbers. The company started feeling the heat from the investors.

In a market where a large traction leads to revenue, a demand for quick revenue generation is like hanging an albatross around the entrepreneur’s neck. The company shut down.

Here are some important things to consider before getting into a marriage with a VC:

- Are you doing it for the right reason? Do you really need to raise money?

- Are you raising it from someone who is right for you? Two people can be brilliant individually but they may not be compatible together.

- Are you reading the fine print? Have you understood every aspect of the deal?

- Are you seeing the VC as a partner or someone external? Have you made any effort from your side to make this partnership work well?

What has been your experience? Waiting to hear your point of view.

(Note: This article is based on my conversation with various entrepreneurs, many of whom did not wish to be quoted.)

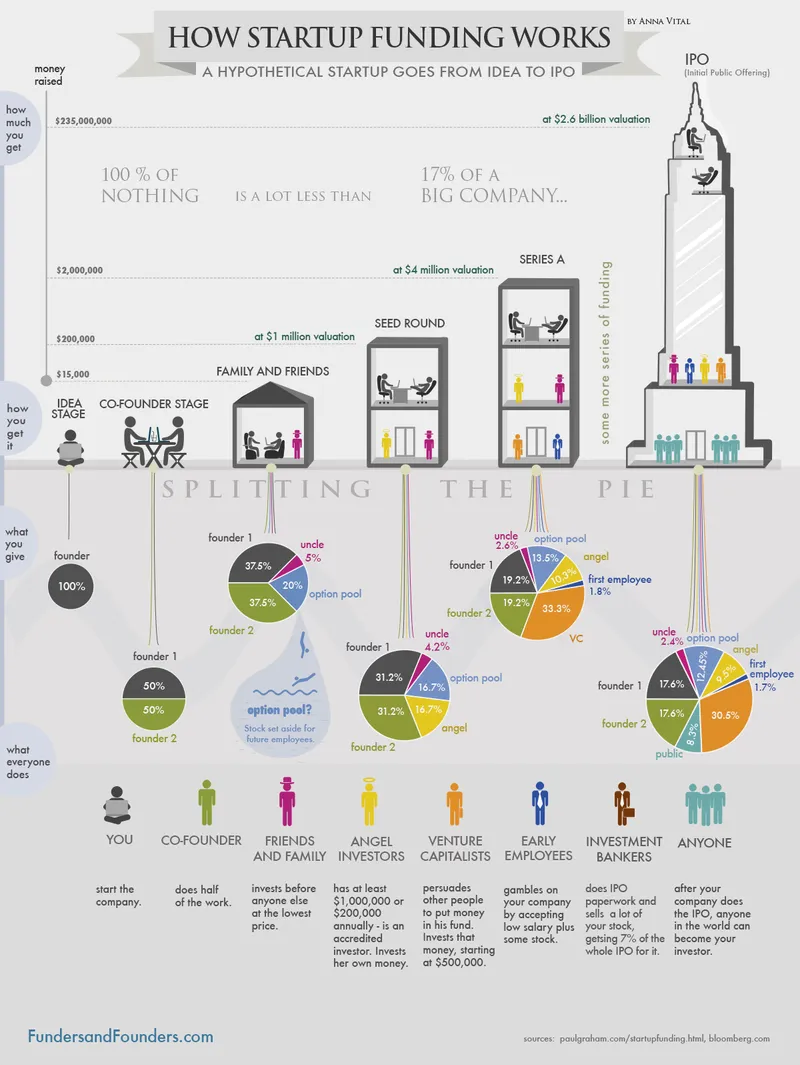

Check out this detailed infographic from Funders and Founders to find out "How Startup Funding works "