In the last two weeks Rocket Internet had a blast – the valuation spiked up by $1 billion

Hate ‘em but can’t ignore ‘em – Rocket Internet continues to build on the shoulder of the giants.

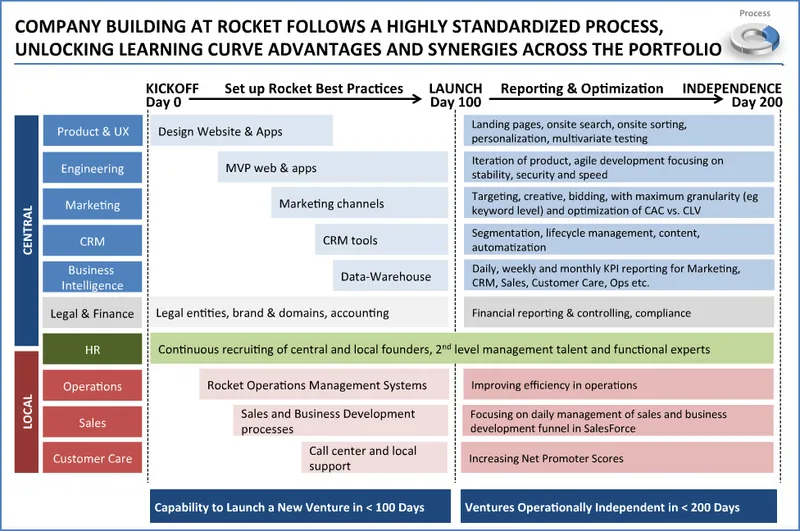

Centralized execution prowess and ruthlessly cloning successful US Internet companies is synonymous with Rocket Internet, but also innovating to adopt locally.

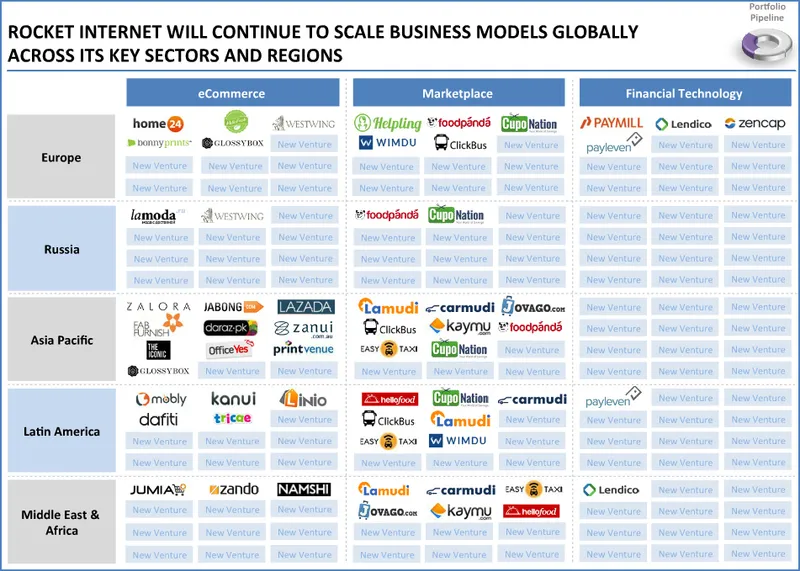

Berlin-based Rocket Internet was founded in 2007 by trio brother-entrepreneurs, Oliver Samwer and his siblings Marc and Alexander. The company has incubated startups that mimic successful internet business models from the U.S. Since the late 90s, the Samwer brothers’ core strength is built on transplanting successful concepts from established markets to emerging markets. “Rocket is focused on online business models that satisfy basic consumer needs across three sectors: e-commerce, marketplaces and fintec.”

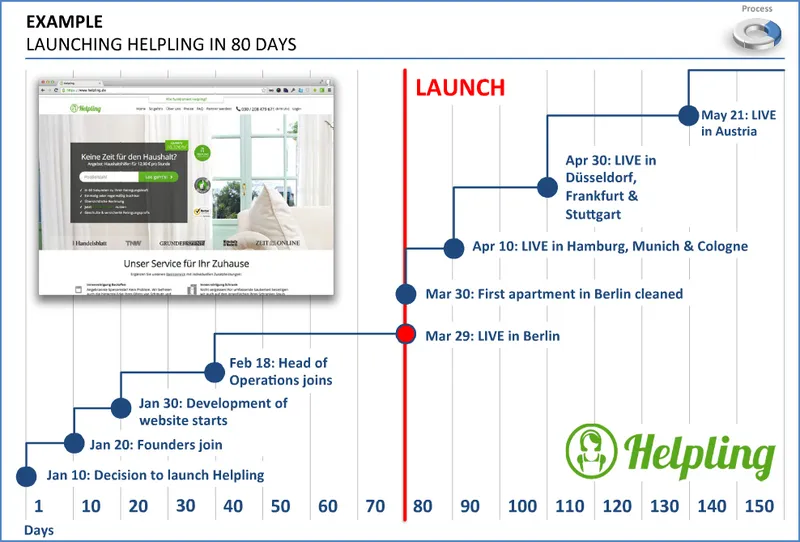

Oliver said, “We want Rocket Internet to be the biggest consumer internet group outside the US and China.” Currently, the Rocket Internet portfolio companies employ more than 25,000 employees across 100 countries, and has more than a billion dollar aggregated revenue in its 75 firms – in five regions of Europe, Russia, Asia-Pacific, Latin America, Middle East & Africa. The company is well positioned to capture increasing consumer spending emerging market – currently Rocket Internet reaches covers over 1 billion Internet users and 3 billion mobile users. Rocket Internet has been launching a website in at least 5 new countries per month, the highest they have done so far is launch 16 new country websites in a single month.

As per the calendar, the company is gunning to open another 100 startups in the coming 18 months.

New Round of Funding from PLDT

Last week, Rocket Internet took a massive investment from PLDT valuing the company around $4.45B. Through $445 million investment Philippines-based telecom company PLDT bought a 10% of Rocket Internet and supervisory board seat.

Wait that is not all, another round of funding from United

The German-based ISP United Internet AG has recently injected $582 million funding in Rocket Internet for a 10.7% stake. This investment put the valuation of Rocket Internet at 4.3 billion Euros post-money. “United Internet's investment will be in newly issued shares by Rocket, of the same class and bearing the same rights as shares held by current Rocket investors,” said the statement.

How it all started?

Back in 1998 when the Samwer brothers were studying in San Francisco, they fell in love with the hot emerging startup culture in Silicon Valley. In 1999, Oliver co-published a book about his fascination titled, America’s Most Successful Startups. That year when they returned to this homeland Germany, they started their first startup called Alando, cloned after eBay’s businesses model. Later, they agreed to sell it to eBay Cofounder Pierre Omidyar for $43 million. They have also exited Jambal to VeriSign and CityDeal to Groupon.

What are the new investments for?

The company said in a press release that was sent to YourStory last week, “Concurrent with the investment, PLDT and Rocket will jointly develop mobile and online payment technologies and services in emerging markets. The partnership will leverage PLDT's experience and intellectual property in mobile payments and remittance platforms together with Rocket's global technology platform to provide products and services for the ‘unbanked, uncarded and unconnected’ population in emerging markets.”

Last year, PLDT subsidiary Smart Communications had handled $4.5 billion in payments, and has been working with big ecosystem players like MasterCard, Citibank and Visa. Its mobile banking platform is currently employed by the top three banks of the Philippines.

Regarding last week’s investment, Founder and CEO of Rocket Internet Oliver Samwer said, “Strategic partnerships are a core part of Rocket's strategy to provide great services to consumers and rapidly roll out new Internet-based business models across diverse geographies. Financial technology is a key focus sector for Rocket and this partnership will allow us to build on PLDT’s world-class innovations in mobile money and micro-payments and accelerate the delivery of those solutions around the world.”

And commenting on yesterday’s funding, Ralph Dommermuth, Founder and CEO of United Internet, said: “We’ve partnered with Oliver Samwer for several years and jointly made a number of highly successful early stage investments in consumer internet and technology businesses in Germany and internationally. I have been very impressed by the quality and scale of Rocket and its network of companies and we are excited to support the further development of the group with additional growth capital. Our investment is strategic and long-term in nature and we look forward to working with the Rocket team and the other shareholders going forward.”

Who shrinked & by how much in Pre-IPO minute dilution

Last week as the PLDT joined Kinnevik and Access Industries as the third external investor, let’s see who has diluted and how much.

Before the new round of funding, Rocket Internet had three major investors – Swedish Kinnevik used to hold a 24% stake, while Len Blavatnik’s Access Industries used to own 11% and the Samwer brothers’ investment company Global Founders used to maintain a cool 65% stake.

After the fresh injection of investment by Asian PLDT in the European Rocket Internet, previous share holders have diluted their holding as the following.

Just last week, principal investor Kinnevik owned a 21.5% stake in Rocket Internet diluted from 24%. Philippine Long Distance investment (PLDT) owns 10%. Access Industries is down from a 65.2% ownership stake to a 58.7% stake owns a 9.8% stake. The Samwer bros equity stake in Rocket Internet has declined to roughly 59% from 66%.

According to Reuters, “Friday's deal makes United Internet Rocket Internet's fifth shareholder. Following the deal, Swedish investment firm Kinnevik will hold an 18.5 percent stake in Rocket, Access Industries 8.5 percent, PLDT 8.6 percent and the Samwer brothers' investment vehicle, Global Founders Fund 53.7 percent.”

Copying in a style?

Existing business model in a new market is much more successful than new business model in existing market. – Oliver Samware

Imitation, they say is a sincerest form of flattery. But with Rocket Internet all of Silicon Valley’s fraternity doesn’t seem to be flattered by it. That’s the reason tech media lash out at the trio calling them clone factory, the shameless clone-ubator, and a low-class thief. But one thing is for sure obvious here. Maybe the Samwars didn’t present our world a startup wonder, but they showed us operational execution wonder by moving fast and breaking things (and assumptions about emerging market). Their unparalleled experience in scaling world-class internet business across geographies was impressive. Rocket is still misunderstood entity by many.

Could it be said that what Amazon has done in the early days of Internet – delivering items to people that brick and mortars can’t/won’t… Is Rocket re-delivering startups to emerging markets that Silicon Valley won’t/can’t reach? Because for US companies, going global is seen mostly as an afterthought.

It’s fair to argue cloning stifles innovation. But taking innovating to newer market could be noble. And in the end it’s good for the consumers in the new markets as it gives them more options.

Rocket Internet also serves as a chip on the shoulder for local entrepreneurs. Competing aggressively, lest startups know what they are made of. If rocket can, so can us! So the moral of the story is you can do what rocket does in your market even if you don’t have the resources that Rocket has. You just have to figure out the Achilles’ Heels of Rocket and innovate.

![[TechSparks 2020] Rural India is a harbinger of growth, says 1Bridge’s Madan Padaki](https://images.yourstory.com/cs/2/803961002d6d11e9aa979329348d4c3e/Madan1-1603807611907.png)