Betting on India’s Internet Businesses

Internet service companies never had it so good. Funding circles have been buzzing with news of stupendous deals over the last few weeks. Bigbasket, Ola Cabs, Freecharge and Delhivery have all raised a follow round of about $30 million each from investors looking to grab a piece of India’s burgeoning internet market, a change from the days when a $10 million deal would make headlines. So, the question now is, is $30 million the new funding benchmark? And, what is driving this momentum? What should upcoming entrepreneurs read from all this action?

Here’s what Parag Dhol of Inventus Capital had to say.

Yes, $30million seems to be the new $5-10 million. Indian VC/PE are stepping up. One thing that is common among all of these companies is that they have scaled well and are leaders in their space – or have a very good shot at getting there. Leaders get a premium – we saw this with PolicyBazaar. My hypothesis is that if you are in India’s Top 20 Internet companies, funding is not an issue.

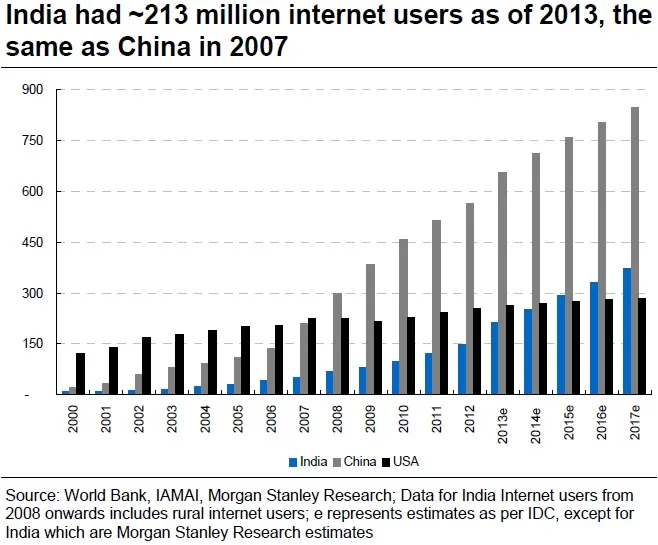

India’s Internet services industry is expected to reach a market size of 29 billion dollars by 2016, from 11.8 billion in 2013, according to a Morgan Stanley research report. The number of internet users in India will rise from 213 million in 2013 to 330 million by 2016, according to the same study.

Currently only 100 million users are daily active users (DAU). By 2016-2017 the DAU will increase to 60-65 %, taking DAUs to 175-200 million. Internet penetration still remains low at 16%, while for China it is close to 49% and for US over 80%. Also our DAU is still low compared to other countries. What this means is that there is a huge scope for increase in the Internet economy, with more market penetration and increase in DAUs.

Online travel is the most mature and the largest segment and e-commerce is snapping at its heels, expected to grow at a CAGR of 45-50% over the next 3-4 years. Not surprisingly, most of the funding is focused in that business.

Indian ecommerce and mobile sectors are delivering 30%+ growth rate – which attracts investors. Also there is the realization that India is particularly well suited to massive growth in eCommerce in second and third tier cities – which still are largely untapped, said Ravi Gururaj, serial entrepreneur and chair of Nasscom Product council.

“Also China & US are seeing deals being done at eye-popping valuations. Alibaba’s IPO heading towards breaking all records, Uber’s funding and aggressive international growth and Amazon’s ability to sustain public market valuations in spite of decades of unprofitability are a few examples. All of these have had a rub-off effect on India deals.”

The whitespaces in US that have received investment and shown traction are getting attention from entrepreneurs and investors alike in India. Of course there are some fundamental differences in business models that are unique to the Indian context. And, it’s certainly not limiting to investment in models that have worked elsewhere that are seeing investment support in India. Anand Lunia of India Quotient says, “It’s good to see bets being taken in areas where even companies in other countries haven’t succeeded.”

Ravi also notes that there is a sense of euphoria coming in.“When Flipkart gets valued at $7B just a few quarters after it was valued at $1B, that type of hockey stick uptick can drive euphoria (“let’s jump in now before valuations go even higher”) and envy (“maybe I can return an entire fund with a single deal”) among investors and even founders, which in turn pushes upwards deal sizes and valuation terms.”

We are also seeing Indian families getting into the funding business at the later rounds. “Narayan Murthy, Premji Invest and Ratan Tata are helping kick off this bandwagon,” says Ravi.

Govind Shivkumar of LGT Ventures believes that there is still a lot of dry powder left. “There are ample amounts left uninvested in, as investors were waiting for elections/political stability, and we should see more deals happening in the country, which is good for the entrepreneurs and growth of Internet economy.”

Rajinder Balaraman from Matrix Partners adds,

Vertical, mobile and social marketplaces are more capital-efficient and solve consumer/supplier friction points in unique ways that horizontals do not.

Examples of this include how Ola and Taxiforsure provide superior point-to-point service vs. OTA’s, or how Stayzilla, LimeRoad, Zomato, Bigbasket and UrbanLadder provide users a differentiated product & service offering vs. their respective horizontal peers.

Each of these marketplaces are scaling very rapidly at low incremental marketing spending and the end-state economics of these business models merit strong valuations.”

Every category has VCs who have picked their horses so to say and once one of the top three in that category gets funded, the next two peers are almost certain to raise funding aggressively as well to stay competitive, says Ravi. Taxi ventures have seen this trend.

More importantly, while the quality of the Indian entrepreneur has improved with each passing year, the number of good investments available is still relatively few and far between. (Companies with good teams + decent early traction + top 2-3 in category + growing segment, for instance) This scarcity also causes investors to be willing to write larger checks.”

Caution

There are naturally also those that sound a voice of caution.

“It’s too early to call who will be successful. Let’s not forget those who raised $40-50M just a few years ago and aren’t around today,” says Anand. ”While great entrepreneurs and great technology have shown that they win, those who think top line growth is a good metric to bet on may find tough waters.”

Ravi also points to the Greater Fool Theory as a likely reason for valuation going sky high at the moment.

The theory states that the price of an object is determined not by its intrinsic value, but rather by irrational beliefs and expectations of market participants. A price can be justified by a rational buyer under the belief that another party is willing to pay an even higher price.

“Current investors are constantly on the search for the next investor (the “greater fool”) to buy in at a higher premium … often times at 2-3x what the valuation was set at just a few quarters ago. The existing investors love this new investor since they enhance their portfolio’s valuation on a market-to-market basis with each new eye-popping valuation. The so-called greater fool is in reality quite a smart investor since they only need to convince themselves that in the worst case their preferential liquidation preference (typically what a strategic would pony up for the entire venture in M&A) will allow them to recover their capital at play. This stacking effect of investors certainly drives up the valuation,” he explains.

The market cap for listed Indian Internet services is currently only at around $3.5-4billion as compared to $300billion and $1trillion in China and US respectively as per Morgan Stanley estimates clearly indicating the vast upside potential in the sector.

Signals for Entrepreneurs

So, while the action is surely heating up in the world’s third largest Internet marketplace, entrepreneurs, current and upcoming, need to think about original businesses. In categories where clear leaders are emerging, it will not make sense to be the 5th or 10th venture in that category. Especially as a large amount of capital is needed to scale up in some of these businesses.

Another new and encouraging trend is the increasing willingness among Indians to trust online — the recent Xiaomi sales through Flipkart is an indicator. Also, businesses that did not work 4-5 years back, might just work now as the marketplace evolves and a strong Internet consumer base is building up.

I remember interacting with Bhavish of Olacabs during the nascent days of e-commerce. He had a vision that time, which many probably did not believe, for he was way too young and thinking way too big, but today Ola is a reality. This holds true for so many other ventures and other experiences online. While it’s time to think rationally and not be a “me too” venture, it’s also a time to seize the white space as the book “Seizing the White Space” suggests.

In 2009, Phanindra Sama of redBus was selected for a TV campaign, Chhota Business Bade Sapne. His was probably the only Internet business among the many ventures that were selected. When he was quizzed at that time, I remember him saying that the idea had stemmed from his own pain and he believed millions would be facing similar problems. At that time, he definitely had a chhota (small) business, but he had bade (big) dreams; and Internet was the way for him. He had an original vision, ideas to make things better not only for himself but for the country. And in 2014, we will agree that he has done that. It’s about looking at the white space.

India is truly emerging as mobile only country. And today’s Indian consumers are hungry for good quality products. Based on the huge consumer opportunity in front of us, there is no reason why the market shouldn’t be bullish. The current valuations of Indian companies in B2C space are just a reflection of this hockey stick growth, says Alok Goel, CEO Freecharge, one of the new entrants into the $30 million club.

India has unique challenges, consumer behavior and requirements, and entrepreneurs must think about what will work, what is needed. It is getting better, with every passing year, to start-up a company.

Suvir Sujan, Co-founder & MD, Nexus Venture Partners

“Capital and Financing valuations are no precursor to success. While the internet story in India is real and real businesses will be created, what is important is that the founders of these companies that are attracting capital continue to maintain their leadership while keeping an eye on business model profitability.”

Ambarish Gupta of Knowlarity concludes it succinctly, “All the action is at least ensuring one thing, ‘it is becoming cool to do a startup in India.”