One hell of a ride: More than $100 million poured into India’s auto classifieds space

Late in 2013, GM started a campaign Shop-Click-Drive with 100 dealers across the US via which customers could buy cars online. In the pilot, 900 cars were sold and over the next one year, GM had sold 13,000 new vehicles online. The service is currently available in all 50 states in the US with over 1,600 dealers covered. And this is a trend which is expected to spread across the globe over the next decade.

In India, we're still far from it but advances are being made in that direction. In the last few weeks, there have been many announcements about investors backing various players in India. There are four major players in the segment right now and here is how they stack against each other:

(image credit: Shutter Stock)1. CarDekho: A product from Jaipur-based GirnarSoft, CarDekho is an auto platform catering to aspiring car buyers, car owners, fans and car dealers across India. CarDekho was started by brothers Amit Jain and Anurag Jain way back in 2008 and it raised $15 million in funding from Sequoia Capital. Recently, CarDekho joined hands with Ratan Tata and further raised a $50 million round of funding led by Chinese firms Hillhouse Capital and Tybourne Capital. The company has about 1,800 used car dealers and has tied up with about eight auto manufacturers. It claims to get 11 million visits per month (7.5 million unique visitors).

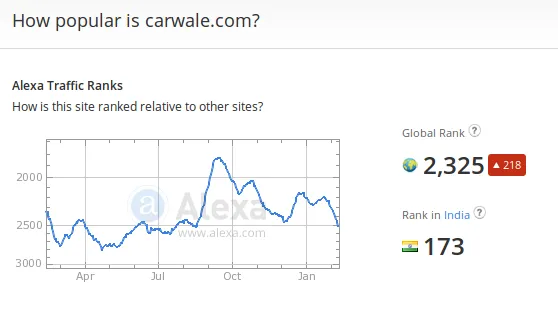

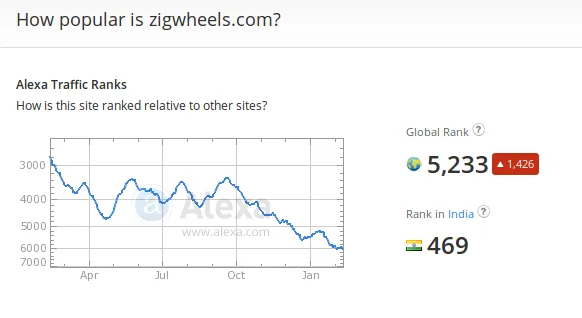

2. CarWale: CarWale calls itself an auto media vehicle and was founded in 2005 by Mohit Dubey, Arun Sahlam, Gaurav Verma and Tufail Khan with the backing of Seedfund. It is a platform where car buyers and owners can research, buy, sell and come together to discuss and talk about their cars. In 2008, CarWale completed a Series A round of funding with Sierra Ventures. By 2010, it was getting over 1.3 million visitors and 17 million page views a month. At this point, they were acquired by Axel Springer AG and their Indian partners the India Today Group. The portal recorded 13.2 million visits in January 2015.

3. Gaadi: Founded in 2008 by Ankur Warikoo, Vivek Pahwa, and Umang Kumar, Gaadi lets users buy and sell new and pre-owned cars along with providing them with reviews, comparisons and other related content. Gaadi was acquired for $2 million in 2011 by Ibibo which later sold it off to CarDekho for $11 million. Gaadi.com still operates separately with a healthy traffic which is managed by the team at Girnaar Soft. Accentium Web, the company that owned Gaadi initially, has started up 99cars.com in the same sector.

4. ZigWheels: A property of Times Internet, ZigWheels started in 2007 with Vijesh Sharma handling product and consumer experience. Now headed by Akshay Chaturvedi, Zigwheels remains a key property of Times Internet. From their website ranking, traffic can be estimated to be about 5.5 million monthly unique visitors. (ZigWheels follows ComScore numbers which are appended after the list)

5. Cartrade.com: MotorExchange was founded by Vinay Sanghi and Rajan Mehra in 2009 and it owns cartrade.com. The company raised a Series A in December 2009 from Canaan Partners and other investors and then In October 2014, it raised $30 million from Warburg Pincus, Tiger Global and Canaan Partners. More recently, ex-auto trader CEO Chip Perry has topped the funding round. The company claims to have listings of more than 100,000 used cars in India and traffic of more than four million unique visitors every month.

6. There are others in the space like India.com's Oncars.in and MotorTrends.in which was initially Carazoo.com. SAIF Partners recently invested $1 million in Zoomo which is a used cars marketplace with a mobile first approach. Classifieds sites like OLX and Quikr are also competition as they have an auto section.

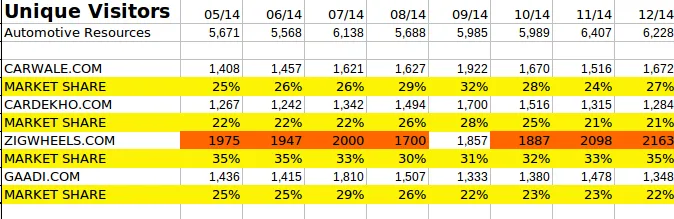

Alexa has been used as a tool above for comparing but like any tool, there are always concerns about measurement methods. TimesInternet follows ComScore numbers from which Akshay shared the data with us. Their claim is that ZigWheels has been doing better in terms of unique visitors every month, here is a screen shot from the sheet for the last 6 months of 2014:

The sector has suddenly become visible and one wonders why. Vinod Murali, MD of Silicon Valley Bank, India was part of the deal that had provided venture debt to Carwale and they exited along with the acquisition by Axel Springer/India Today Group. He tells us, “This is a sector which is currently going through its second wind. Along with online travel, the used car classifieds segment was seen to be highly promising a few years back but saw a lull in investor interest till fairly recently.” With one investment going through, others followed. For every new car sold in India last year, a used car was also sold, according to consultancy and market research firm Frost & Sullivan. Reports suggest that 2.5 million new cars were sold in India last year while 3 million used cars were sold. In developed markets, the ratio of new passenger vehicle sales to used passenger vehicle sales is 1:3. This is where India is heading.

All the companies in the fray started during the middle or second half of the last decade and had their own reasons. “We are a bunch of car enthusiasts and back in the time when internet had hardly penetrated India, we knew that the power of technology could be used to make the car buying experience a better one,” Mohit of CarWale told YourStory over a phone conversation. Auto Classifieds is suddenly in the news because of the funding but Mohit says they are unperturbed and will keep marching closer to their goal of making the car buying process easier. They are also confident because of the leg work they've done to maintain relationships with dealers. For GirnarSoft, CarDekho quickly became their flagship product with PriceDekho and BikeDekho playing the supporting role. Cardekho.com had close to 3,00,000 used cars listed on the website during 2014, up by 110 per cent from last year’s data and about half of the traffic came via mobile.

Smartphone penetration will play a key role in going ahead and so we took a look at where the numbers stand currently:

CarWale: 36,937 ratings with 4.3, 500k downloads. CarWale's homescreen straight away asks me to choose used cars or new cars. Other options come in at a later point.

CarTrade: 2,914 ratings with 4, 100k downloads. CarTrade takes the tile approach on the home screen making four things prominent: used cars, new cars, prices and sell my car'.

CarDekho: 2,076 ratings with 4.2, 500k downloads. CarDekho has a sleek UI with a wheel menu which stresses on research about cars and has clear buttons to check and compare old and new cars along with finance options. (Gaadi.com has 1512 ratings with 4, 50k downloads)

ZigWheels: 4546 ratings with 3.9, 100k downloads. The app takes an open approach with options to research new and old vehicles, read news, compare, view pictures and more on the home screen. It also has information for both cars and bikes, as opposed to others who have only cars.

In terms of usability, CarDekho and CarWale do have a better interface and experience (as the ratings would suggest) but all of them are completely functional. If I landed on either of them by chance, I wouldn't really go looking out for another app and hence from a company's point of view, discoverability will play a key role. As far as revenues are concerned, all the sites depend on: advertisements, premium listings, lead generation and other intelligence for car dealers and manufacturers.

Investors have made their bets and the market also looks prepared. Globally, there are many multi-billion dollar companies in USA, China, Australia etc that work as auto classified web portals. The According to a KPMG report, BRIC markets will dominate the global car market in 2020. But consolidation has to be on the cards. Vinod says, “I don’t think it is a sector which will have multiple strong players and is likely to end up with two strong players and maybe a third. I think the focus will substantially be in the used car segment rather than first hand purchases which do not have similar economics, have established offline dealer competition and could also depend a lot on broader auto segment performance which can be volatile.” He suggests that companies will need to invest in contemporary and relevant research, building smart rather than pretty interfaces and brand building. “More effort also needs to go into category development because I still hear the same concerns which were prevalent in 2010. Mostly regarding the discomfort of Indian customers towards used car purchases vs. the developed markets where it is a substantial part of the overall auto market. This could be covered through investment into quality assurances and certification which need to be a focus area and can generate service revenues as well,” he says.

In terms of recent events, here is a timeline which is not exhaustive:

2005: CarWale starts

2007: Times Internet starts Zigwheels

2008: GirnarSoft starts CarDekho, Gaadi.com starts, CarWale raises series A

2009: CarTrade starts

2010- CarWale gets acquired by Axel Springer AG/India Today Group

2011: Ibibo acquires Gaadi

2013: GirnarSoft raises $15 million

2014: CarDekho acquires Ibibo-owned Gaadi, Gaadi founder starts 99cars, CarTrade raises $30 million

2015: CarTrade raises from AutoTrade CEO, CarDekho joins hands with Ratan Tata and raises $50 million more, SAIF invests in Zoomo

This has been one hell of a ride for the companies involved and although the Indian consumer market is in the second phase now, we're pretty far from maturing as a market. This is why more companies are focusing on certification, auto guides, auto news, and in turn building trust with respect to online. With all the companies flush with cash, the engines are revving up to go full throttle!