Decoding the Value Chain in Online Real Estate Services

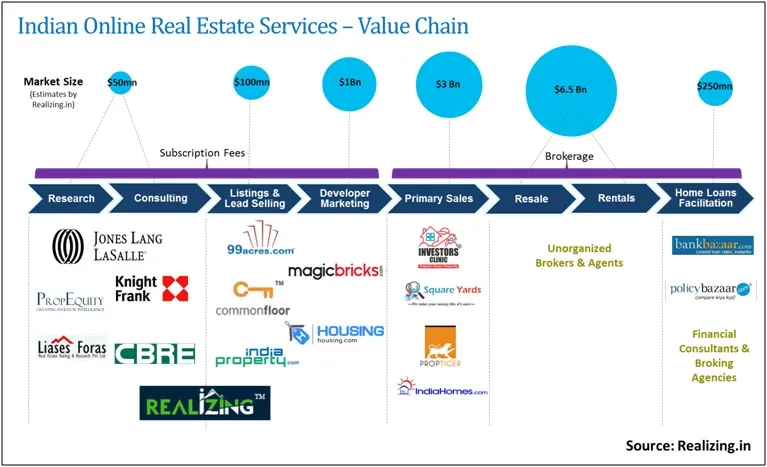

Millions of dollars have been invested into online real estate in India in the last few quarters from the likes of Softbank, News Corp, Google Capital, and Tiger Global. But the sector came into limelight after the latest controversy surrounding a young CEO. Now questions are being raised on fundamentals, monetisation aspects, and the viability of various business models. Therefore we(at Realizing) - as a stakeholderthought it would be prudent to explain the online real estate value chain to the readers andshed some light on the different business models, competitive intensity and gaps in each segment of the value chain.

First things first – Online real estate is a pretty large market and will remain so till mankind and the Internet exist. Of course, there will be slow times like today – based on temporary imbalances in the demand and supply scenario. But by and large, the overall market of online real estate –search, discovery, and transactions will continue to be strong in the years to come.

Now let’s take a look at the individual segments in the value chain:

- Research and consulting work is mostly dominated by international property consultants like JLL and Knight Frank. There have been a few forays into the data sciences by some Indian players but most of this research is B2B and available only to Institutions. There is a no structured data product for the consumers. A property transaction is the most expensive transaction that most of us would ever make in our lifetime. It often involves your whole life’s savings and encumbering yourself with a lifelong burden of EMIs. For such a vital and expensive decision fraught with risks, consumers do not get the research they deserve. And there lies a big value opportunity for someone like us to tap into.

- Listings and lead Selling is the most overheated space at the moment. Long-term incumbents like 99acres and Magicbricks are being challenged by the likes of Housing and Commonfloor for controlling the supply. Even general free classified sites like OLX and Quikr want to play the real estate game. A marketing warfare is being launched to attract end consumers –expensive OOH and PPC campaigns, full page ads in newspapers, and a blitz of TV commercials. But the truth of the matter is that this is essentially a broker’s market from a monetisation perspective. Even today, more than 95 per cent of the listings on all major classified portals are uploaded by brokers and not end consumers. The gap really exists on what value a broker gets after paying for listings. Is anyone helping these brokers close more business or make their day more productive?Unfortunately, the answer is: no one.

- Developer marketing is an emerging big market that everyone is trying to capture as there is a significant shift in the developer’s marketing budget from print/OOH to online. Most online players are focusing on virtual reality-type innovations – 3D glasses, drone views, virtual walk-throughs, slice These are helpful to an extent but also slightly overrated when it comes to helping a developer close an actual property transaction with a potential customer. What developers need is smart content telling a different story from run-of-the-mill glossy brochure text; something that positions their product as more superior to the competition.

- Primary Sales is a transaction where an individual buys a property directly from the developer rather than from another individual as in a resale. Developers offer a sales commission to the channel partner ranging from 2 to 5 per cent on primary sales. These commissions can be as high as 10 per cent, especially in some pockets of North India. Primary sale is the most lucrative market and that’s why we see competition between the likes of Investors Clinic, Square Yards, Prop Tiger, and Indiahomes. The flip side here is that account receivable cycles are very long – ranging from 3 months to 12 months and the key is to manage the cash flows. In this space, there are gaps in the realm of aftermarket services like resale assistance and portfolio management that can become a big differentiator, if tapped by the incumbents.

- Resale and rentals is the biggest market and its monetisation is still the unsolved puzzle of this story that no organised player has been able to crack successfully. It is still dominated by brokers and there is no disruption in sight from any online player. This is partly due to two reasons – the inability to control the supply side and the involvement of coloured components in RE transactions in the form of cash. As the markets get more regulated and transactions get digitized, this space will become ripe for a big disruption, possibly by a self-regulating C2C digital marketplace or a ‘dealroom’ kind of solution.

In conclusion, – online real estate is a multi-billion market and there are sub-markets within mega markets. In spite of the hype and hoopla, no one is able to capture a paying customer’s mind share – forget the share of the wallet. And it’s definitely not a ‘winner-takes-all’ market. There is enough room for everyone to coexist and compete with each other. There are far greater problems to be solved and larger battles to be won.

About the author:

Vivek Agarwal is the founder & CEO of Realizing , an independent and transparent real estate search and discovery platform for builder projects in India. Founded in 2014, the company offers deep research, data driven insights and decision tools that help consumers take an informed property decision. Currently, it's operating in 7 cities and has listed around 20000 properties with a 10-member team.