The Barbell Strategy, or how you can have your cake and eat it too

One of the tenets that stock market investors live by is diversification. As their advice goes - if you invest in several (uncorrelated) stocks, you reduce the risk of one stock failing damaging your income significantly. An extension of this argument is that traders should have a mix of low-risk and high-risk assets in their portfolio; even if the risk materializes and your high-risk assets blow up, you still have some income from the lower-risk assets. This is called the 'barbell strategy'.

This is a very useful concept in stock investing. But can we take advantage of this in other businesses?

Before we try and answer this question, let's understand the 'barbell' concept a little bit better.

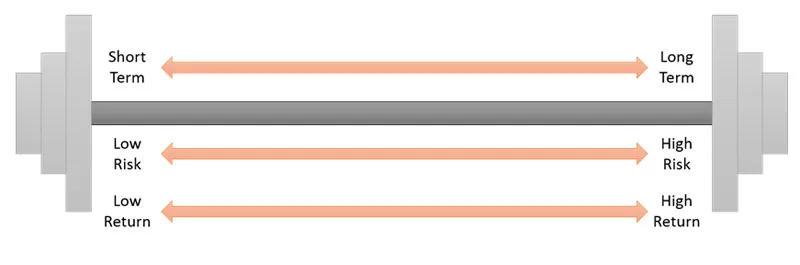

The reason this investment strategy is called a 'barbell' is that all your investment goes to the two extremes of low risk-low return and high risk-high return, much like the weight of a barbell is concentrated at its ends.

Thus, you deliberately plant your feet at both ends - low risk and high risk; low payoff and high payoff; short-term and long term.

Sounds like a great investing idea - limit your potential losses, even while pursuing high-risk investments. But, you may ask, how does this help those of us not in the financial sector? If you're not a trader, how can you take advantage of diversification in general, much less specifically the barbell strategy?

There are several different avenues of business where a barbell approach can help cover downsides, and allow you to test new channels of growth.

1) Startup Marketing: There are several different channels through which you can market your product (Traction, an excellent book on the subject, lists 19!). But not all of them are equal – channels like TV advertising, SEO, and viral growth have a high ceiling on saturation (i.e., you can acquire millions of users through these channels), while others (PR, social media, community emailing, etc.) are far less scalable. But there's a flipside – the former 'moonshots' are also more expensive, far more risky, and take longer to optimize.

When you're selling a new product, you should definitely explore some of the moonshots – if any of them work, they can make your company's destiny. But at the same time, you should also invest in the more near-term, less-scalable channels, to 'keep the wheels turning' with a small flow of users. This also gives you time to perfect your product and plug the leaks in your user acquisition funnel, so that when one of your moonshot experiments suddenly delivers a deluge of users, you are able to effectively retain them.

Andrew Chen has written an excellent article on this. And Paul Graham refers to a similar concept when he says, "Do things that don't scale."

2) Short vs. long-term value propositions: Sometimes, startups also need to bet on a combination of short and long term opportunities. Your product vision may be very ambitious, but you often can't offer that proposition from day one. In fact, the more ambitious your vision, the longer it will take to start delivering it. So, if you want to survive long enough to achieve your dream, you need to sell something else till that happens.

A great example of this is Zomato - they started as a pure-play information source on restaurants around you. Gradually, as the user base grew, they began overlaying restaurant promotions. Now, they've just started an even more lucrative food delivery service. And I bet they’ll add other services soon – allowing you to book a table, pay for your meal through the app, etc. (I predicted this in an early March blog post, maybe 10-15 days before they started the food delivery service).

3) Multiple product lines: More mature businesses also employ the barbell strategy. They often have one-two cash cow product lines, which they can milk till the cows come home (I had to take the metaphor to its conclusion, didn’t I?). This gives them the freedom to invest in potential breakthrough products - many of these will fail, but a few will succeed and make up for all the losses and more.

Think of skincare brands - they all have a couple of stable products like fairness creams and face washes, and periodically introduce more cutting edge products (e.g., anti-aging elixirs) to test the market.

4) Your own entrepreneurial career: The above examples are at a company level. But even individuals can employ a barbell strategy. For example, I have a startup, and have been working on a couple of products for 2 years now. At the same time, I also do some freelance consulting, and am about to run a taxi on Uber / Ola. Not only does this small but steady income give me the staying power to explore more opportunities at my startup, it also gives me a reserve to tap into, should any of my experiments work and I want to step on the gas. You may say I'm hedging. I don’t disagree, but I've found this safety net invaluable - I can apply myself to my venture in the best frame of mind, without worrying about a fast-falling bank balance.

This is similar to the entrepreneurial system that Scott Adams talks about in his excellent book. And James Altucher has often spoken about how rich people have 7-10 different income sources.

Thus, you can employ the barbell strategy in several different situations, to reduce your risk even as you take on high-risk opportunities. And that, ladies and gentlemen, is how you can have your cake and eat it too!

![[Funding alert] Venture Catalysts invests in wellness startup Green Cure](https://images.yourstory.com/cs/2/70651a302d6d11e9aa979329348d4c3e/Imagey8ho-1594190613192.jpg)