What exactly does filing of Income Tax Return mean

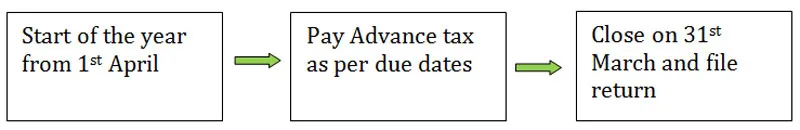

The months of July, August and September in India are the busiest months for chartered accountants, such as myself, with the filing of Income Tax Returns.

I have a lot of clients who, when asked, to complete their filing of income tax return, tell me that they have completed all their timely advance tax payments for the previous year in March. They say they have made advance tax payment for this quarter too also as they have completed one quarter of the next year. They are confused by this request.

IS FILING OF INCOME TAX RETURN AN ADDITIONAL COMPLIANCE PUT ON TAXPAYERS BY OUR GOVERNMENT OF INDIA?

No. It is a statement of your earnings from various sources of income, tax liability thereon, details of tax paid and any refunds that have to be given by the government. And hence the deadline kept to furnish these details is after four months from end of the financial year so that taxpayers have sufficient time to aggregate the data for the whole year and report accurately and in time to the government.

WHAT ARE THE REPERCUSSIONS IF ALL TAXES ARE PAID AND BOOKS ARE PROPERLY CLOSED BUT NO INCOME TAX RETURN FILED?

Non-filing of Income Tax Return attracts interest, penalty, prosecution and scrutiny from the Income Tax Department. There are some myths associated with filing; a common fear is that the taxman comes knocking at the door if the tax returns is filed.

However, the benefits lost on non-filing of returns are more than the penal provisions imposed for non-filing. Following are the benefits of filing of the income tax returns:

- For Accidental Claims in Third Party Insurance: This is one of the rare benefits of filing the ITR every year. It is immaterial if the income barely touches or crosses the taxable limit. You may file ITR for yourself or your spouse, thinking your CA is pushing you so that he can earn his budgeted revenue from his July-September season, but it can help you in the future in case of accidental death of any one member(s) during a road accident. At a court trial, insurance companies need the proof of income to arrive at the amount of accidental claim, and if any return is missing for the previous three years, this could lower the claim amount or even can become no claim because the court takes only ITR as evidence. No wealth record, fixed deposits, business etc is given that much importance as compared to ITR in the eyes of law. The formula for claim is by multiplying the yearly income in ITR with years of expected life of deceased.

- For eligibility in all loan applications from Banks: Income tax returns of last three years are the basic need for all loan cases like housing, business or personal loan, and is a declaration of your income. Before granting the loan, banks want to know your financial capacity and your income details as shown by you in income tax returns.

- For immigration profile obtaining visa outside India: The High Commissions of various countries or VFS centres across India have records of fabricated documents, including income tax returns of visa applicants. They want to know if you are financially sound before they issue you a visa and for this purpose they will rely on your ITR. Every assessee should file genuine returns, especially if one intends to go abroad in the future. Use it to show your genuine source of incomes, because immigration officers give due weightage to your annual income. Absence of returns of any single year can decrease your chances of foreign visa under visitor, investor or work permits category.

- For obtaining government tenders, registration on panels: The value of business profiles of various corporate agencies, contractors, professional service providers or individuals is dependent on the yearly income tax returns. Sometime contractors have very good history of procuring heavy projects in their line, be it a service or works contract, but they lack the knowledge of the benefits of filing returns on time or the importance of filing on factual provisions. Contractors need these returns to not only be filed on time , but also in an accurate manner, audited (if required) ,and signed with necessary documents. This is important, as in tender approval meetings or for finalising professional panels, the selection body has ample options to mature the tender in favor of the fittest. Sometimes, this work is checked by the tender scrutiny committee and ITRs for five to seven years are considered to see whether the applicant has done work for that amount earlier. So if one wants to expand one’s business and obtain tenders from government or private bodies, one needs to file regular returns every year.

- For appointment in Judicial & Class one Jobs: In judicial jobs or where a candidate is a chartered accountant or lawyer and needs to demonstrate annual professional income for the judicial/judge’s, senior auditors post income tax return is presented. No client data or record of similar work done previously shall matter to the selection body; it is only the last five to seven years’ income tax returns (in judicial interview, seven years’ ITR records are checked) that show the candidate’s credibility.

- For obtaining LIC/GIC agency: Insurance corporations, before allotting an agency, check the financial health and habits of the agents. Previous three years’ returns are called for before allotting any agency.

- For Startup Funding: Many a time, seed, angel or VC investors include income tax returns filed till date in their statistical analysis. From returns they not only want to know your profitability but also your scalability, various cost parameters, and validity of the data produced from the auditor’s report.

So you now know how important it is to filing your income tax return, the next time you get a call from your chartered accountant.