The first-mover dilemma

At a recent speech, Jack Ma, Founder and Executive Chairman of Alibaba Group, had an interesting story to share about Alibaba’s early pitches to VCs,

Fifteen years ago, I was talking with venture capitalists, hoping that I could find somebody to invest in Alibaba. They said: in China don’t even bother talking about e-commerce, you guys don’t have the business infrastructure for it.

In other words, he was told that it was too early for e-commerce and Alibaba.

Many of the same venture capitalists today opine that it is too late for new entrants to the e-commerce space in China and India. Ironically, this opinion is based on the threat a newcomer would face from one or more of Alibaba’s group companies (Taobao, TMall, Juhuasuan, AliExpress, and 1688), one of Alibaba’s investments (Snapdeal, PayTM), or an investment made by one of Alibaba’s investors (Amazon, FlipKart, ShopClues).

Today, at the beginning of 2016 , we will talk about perhaps the least understandable of all factors that affect a startup’s success: timing.

Bill Gross, Co-Founder of Idealab, a startup incubator, analysed the outcomes of many companies and concluded that timing is the single biggest reason why startups succeed.

If only it were even remotely easy to recognise the right time for a new business. In my first article, I had referenced a post by Tod Francis of Shasta Ventures, which summarised that:

There are large companies to be built by offering new, innovative and superior customer experiences to large markets, regardless of how competitive the sector already is or how successful the founders have been before.

Many entrepreneurs have since referenced my reference to Tod Francis’ post as a valid defense for their pitch being perfectly timed, forcing me to dig deeper into a startup’s timing.

Reid Hoffman, Co-Founder & Executive Chairman of LinkedIn, started a company named SocialNet.com in 1997. It was a social network designed to match up people with similar interests.

As Peter Thiel (an early investor in LinkedIn and Facebook) said, SocialNet.com was “literally an idea before its time. It was a social network seven or eight years before that became a trend.”

A few years later, Reid can lay claim to perhaps being the world’s definitive authority on social networks. After all, he is the Co-Founder of LinkedIn, the first investor in Facebook and also has 21 patents in social networks, making the space almost impenetrable to new entrants.

That is how fast things can go from too early to impossibly late.

But how does one find that Goldilocks timing which is just right, neither too early nor too late?

Image credit: Shutterstock

Let us evaluate the various possibilities around strategic timing:

1. The first-mover advantage

The first-mover advantage is one of the most well-accepted principles of competitive advantage in business, as a way to establish early leadership and create barriers for future entrants.

First movers also appear to attract larger and more frequent rounds of VC funding, thereby creating another barrier in the form of capital.

However, the first-mover advantage is also possibly one of the most misunderstood.

Proponents of the first-mover advantage frequently point to how Coca-Cola, widely recognised as the first mover and pioneer in the cola drinks space, has firmly held on to its leadership in the market since its founding in 1886.

What if I told you that Coca-Cola was, in fact, NOT the first mover in the cola drinks space?

The world’s first soft drink, Tonic water, was offered by the Schweppes Company in 1771, more than a hundred years before Coca-Cola began. And for those of you about to dismiss Schweppes as a historic relic, it still exists today as part of the Pepper Snapple Group, the number three player in the US soft drinks market, with a 16 per cent market share.

2. The second-mover advantage

Does Coca-Cola’s story provide greater credence to the hypothesis of the second-mover advantage?

The idea of the second-mover advantage contends that the first mover inevitably faces the gauntlet of creating and marketing for a new product or idea. The second mover is then able to ride on the work done by the first mover to take the business to the mass market, thereby establishing leadership early enough.

The second-mover advantage is most evident in the case of Amazon.com trumping Book Stacks Unlimited, to become the number one online bookseller. Amazon.com is another commonly and incorrectly used example of a first mover. The first online book retailer was in fact, Books.com or Book Stacks Unlimited.

But how does that explain the success of Google, Facebook and Apple’s iPhone? Market leaders that have emerged after and in spite of many competitors?

3. The last-mover advantage

In his book Zero to One, Peter Thiel talks about the magnitude of the last-mover advantage, going to the extent of saying, “The Last will be First.”

He points to the fact that the likes of Google and Facebook have been able to create their dominant leadership because they came in well after the competition and were able to offer products that were significantly superior, possibly because they had a fair view of what was already out there in the market.

What, then, is the best time for a startup to enter a market ? Should it be a first mover, second mover or last mover — analyzing the merits of timing can be overwhelming.

I would argue that timing is irrelevant, if (and this is a big if) you become and remain The Superior Solution.

What makes something the superior solution?

The superior solution solves the customer’s pain points in a way that is superior and differentiated from its competition.

- While Shweppes had come before, Coca-Cola was the first to harness the power of addiction through soft drinks (combining cocaine from the 'Coca' plant, and the caffeine from the 'Kola' plant, hence the name Coca-Cola).

- Amazon might not have been the first online book retailer, but it was the first to create the inventory-light business model that unlocked the true power of e-commerce for its customers and merchants

- By envisioning the mobile phone as a beautiful touch interface, the iPhone made the cellphone technology more accessible to the less tech-savvy mobile phone user.

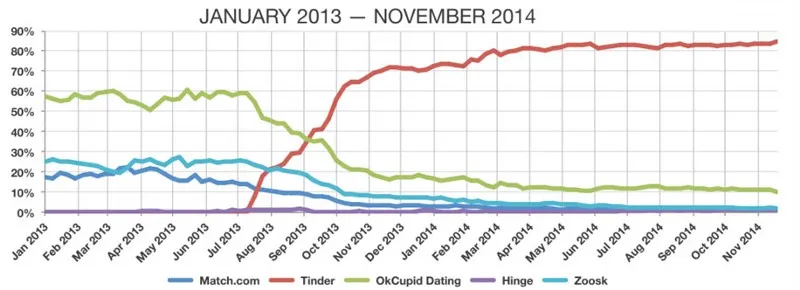

Another great example is Tinder. Take a look at how Tinder’s market share has stacked up against its competition.

Tinder has created a new approach and standard for all match-making businesses. While it is a late mover in that space, its approach has made it the first version of its own kind, creating a new genre of businesses that call themselves ‘Tinder for X’ (yes, we do receive many such pitches). By combining the merits of being the first and last of its kind, Tinder has blanked out its competition.

But the best example of the superior solution superseding timing is, as unlikely as it sounds, Nestlé.

Nestlé — the first, second and last mover

Nestlé is the world’s largest food company. When most people think of Nestlé, they imagine a first mover has since held on to dominant leadership in a large market.

The reality though is that Nestlé has been a leader in multiple categories, as a first mover, second mover, and as a late mover.

- Daniel Peter, the eventual Co-founder of Nestlé, was also the inventor of the milk chocolate process, thereby establishing the first-mover position in the chocolate industry. Nestlé’s beloved brand Maggi (Yes, the one and only!) was the first to bring instant protein-rich legume meals, in the form of soups and sauces, setting the stage for its instant noodles products.

- While Nestlé began as a baby foods company, it was amongst a group of second movers that followed the first infant food in the market, Liebig’s Soluble Food for Babies.

- Nescafé might almost be synonymous with instant coffee today, but it was a late entrant to the market, coming an entire 48 years after the first instant coffee was created, patented and sold as Strang’s Coffee in 1890. Nescafe’s innovation? A superior coffee refining process.

Back in the day, Facebook was rejected by multiple VCs in Boston “because many didn’t grasp its significance”.

Bessemer’s Jeremy Levine (Who by the way has a stellar investing record) told Facebook Co-Founder Eduardo Saverin in 2004,

Kid, haven’t you heard of Friendster? Move on. It’s over!

At a certain point in time, VCs thought Facebook was too early and too late.

Even in the best of times, it is cute that we VCs think we completely understand timing.

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory)

You can connect with the author here on LinkedIn.